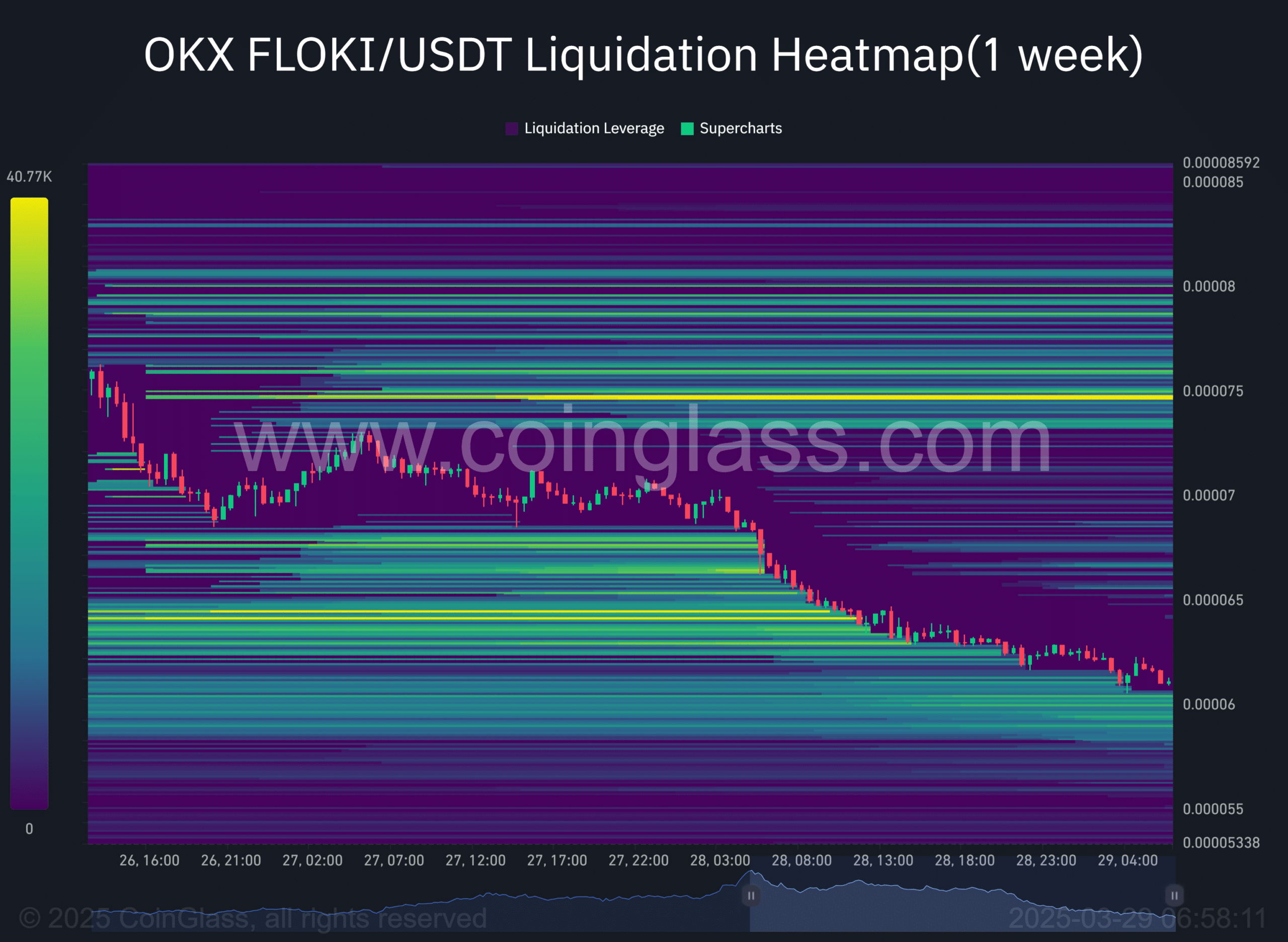

- In the dim light of the liquidation chart, it became clear that FLOKI was clinging to liquidity clusters like a drowning man to a life raft.

- Spot traders, those relentless harbingers of doom, have been on a three-week selling spree, adding weight to the already sinking ship.

Ah, FLOKI, the once-mighty contender, now finds itself among the market’s greatest losers, having shed over 11.43% of its value in just 24 hours. At this very moment, its weekly losses stand at a staggering 23%. Talk about a rough week!

But wait, there’s more! The analysis from AMBCrypto suggests that this selling frenzy could escalate, as volumes are dwindling faster than a politician’s promises. The bears, both derivative and spot traders, are stepping in like they own the place.

Liquidity clusters and derivative traders ignite drop

Upon closer inspection of the FLOKI/USDT liquidation heatmap, it was revealed that several liquidity clusters lurked below the press time price of $0.00006075, like shadows in a dark alley.

These liquidity clusters are akin to unexecuted orders in the derivative market, acting as a magnet, pulling the price down into the abyss.

Further digging showed these clusters extend to $0.000058147—a level so devoid of liquidity it might as well be a ghost town. This price point could be where FLOKI finds its footing, or at least tries to make a grand exit.

AMBCrypto’s findings indicate that the impending market decline will be driven by derivative traders, as the selling volume has overshadowed buying activity. The long-to-short ratio is a telling sign of this grim reality.

When the long-to-short ratio dips below 1—the neutral threshold—it signals that selling is the name of the game. As of now, FLOKI’s ratio sits at a dismal 0.7828, suggesting that traders are more interested in selling than buying. Who could blame them?

Open Interest has also taken a nosedive, with just $14.76 million worth of unsettled contracts left in the market. This drop is largely due to long positions being closed faster than a door on a bad date.

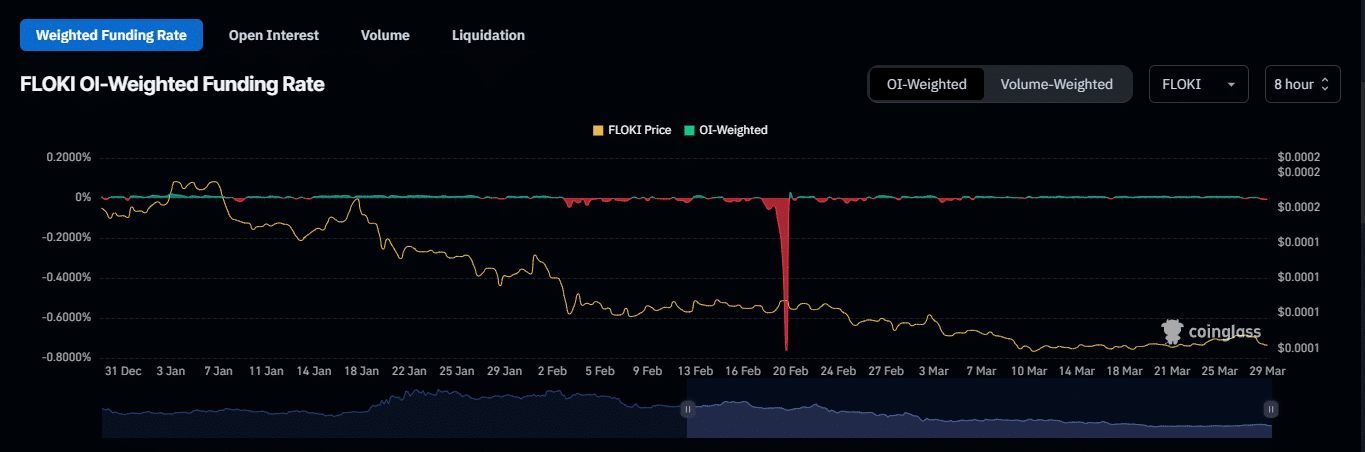

The OI-weighted funding rate paints a bleak picture for derivative traders, showing a reading of -0.0143%. This is the most bearish the market has been since March 4th, a date that will live in infamy.

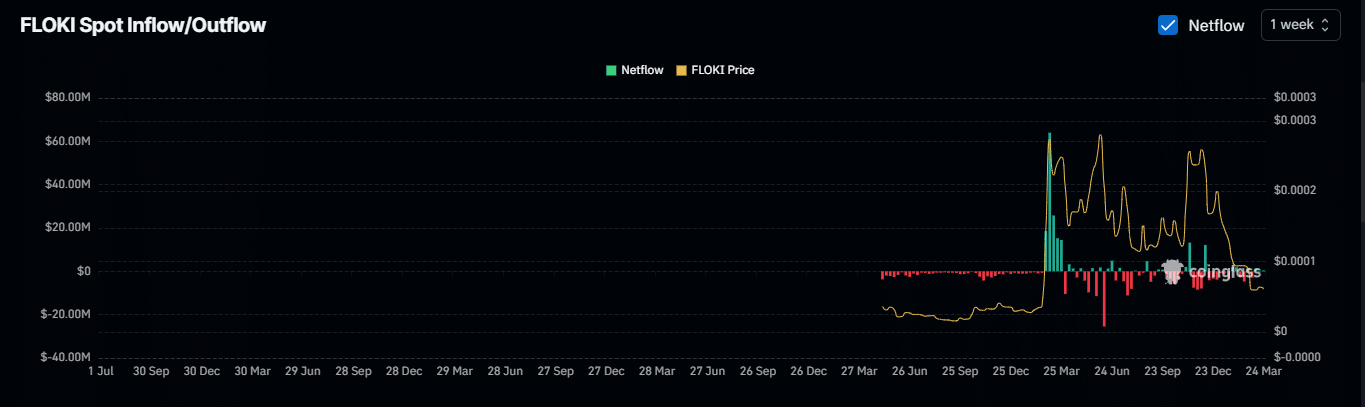

Spot traders are not helping either, maintaining a week-over-week bearish stance, as if they were all in on a joke that the rest of us missed.

Three-week outflows from spot traders

In the spot market, traders have been selling like there’s no tomorrow—a trend that kicked off on March 10th. According to Coinglass, a staggering $1.75 million has been sold during this period. Ouch!

If these spot trader outflows continue alongside the derivative market’s selling wave, FLOKI’s decline could pick up speed faster than a rumor in a small town. Despite the fluctuations in key metrics, this memecoin remains firmly in the bearish zone, like a ship lost at sea.

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- USD ILS PREDICTION

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nine Sols: 6 Best Jin Farming Methods

- Slormancer Huntress: God-Tier Builds REVEALED!

- AI16Z PREDICTION. AI16Z cryptocurrency

- REPO’s Cart Cannon: Prepare for Mayhem!

- Invincible’s Strongest Female Characters

2025-03-29 18:19