As an analyst with extensive experience in the crypto space, I’m deeply saddened by the fall from grace of Sam Bankman-Fried (SBF) and the subsequent legal proceedings against his former FTX executives, Nishad Singh and Gary Wang. The ongoing court cases are a stark reminder of the destructive power of fraud and deception in the industry.

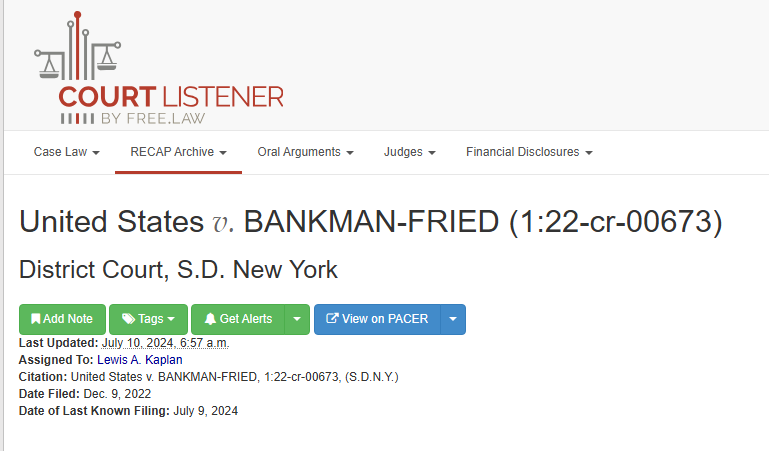

The breathtaking collapse of Sam Bankman-Fried’s (SBF) formidable FTX exchange, which occurred in November 2022, continues to wreak chaos in the crypto world. Over two years later, the judicial consequences for ex-FTX executives Nishad Singh and Gary Wang are imminent as they prepare to be held accountable for their roles in the massive fraud worth multiple billions of dollars.

Cooperation Might Get Lighter Penalties

Based on the latest court records, Singh and Wang are scheduled to be sentenced on the 30th of October and 20th of November respectively. Both executives opted for plea deals, confessing to their involvement in various offenses such as wire fraud and conspiracy. By cooperating with prosecutors against SBF, they may receive leniency in sentencing. Nevertheless, the crypto industry’s reputation takes a hit due to their legal troubles.

Singh’s account painted a grim picture of a business barely holding on. He expressed concerns over SBF’s extravagant expenditures and the lack of oversight into Alameda Research, FTX’s supposed sister company, which was rumored to have an unfair and eventually dishonest trading edge.

The evidence presented by Wang underscored these claims by proving that no “Backstop Liquidity Fund” as advertised by FTX truly existed, thereby shedding light on another tool used to manipulate market conditions.

From FTX Wunderkind To Felon: The Web Of Lies

As a cryptocurrency market analyst, I would describe FTX’s prominent position within the crypto community during its peak as follows: With a valuation surpassing $32 billion, FTX shone brightly among its peers. The charismatic and innovative founder, SBF, was widely regarded as a visionary figurehead in this burgeoning industry. His ability to forge connections with influential politicians and business figures further solidified his reputation as a brilliant strategist and thought leader.

The illusion was shattered in November 2022 when a leaked financial statement revealed that FTX had been inflating the value of its own illiquid token, FTT, through artificial means. The discovery led to widespread panic, and within a week, the entire structure came crashing down.

As an analyst, I’ve unraveled a complex web of deception uncovered by prosecutors. Funds from customers were funneled towards Alameda Research, the now-defunct trading firm led by SBF. Disguised as “normal corporate expenses,” their extravagant spending was shocking. The charismatic figurehead we once trusted turned out to be a fraudster, now serving a 25-year prison sentence.

The Unraveling

As a crypto investor, I’ve felt the ripple effects of FTX’s collapse on the bitcoin market. The unexpected jolt left me and many other investors feeling less confident, emphasizing the need for stricter regulations in the industry. While the penalties imposed on Singh and Wang are a step towards resolution, the fallout from the exchange continues to unfold in complex ways. The sector is grappling with rebuilding the shattered trust, and we investors are left dealing with the significant losses on our own.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- NAKA PREDICTION. NAKA cryptocurrency

2024-07-10 23:41