As an experienced financial analyst, I’ve followed the FTX bankruptcy case closely and have observed the recent developments with great interest. The latest news regarding the sale of the remaining shares in Anthropic, an AI startup, is noteworthy. The FTX estate has sold these shares for $452 million, bringing the total proceeds from the selloff to over $1.3 billion. This represents a significant profit for FTX, considering they originally paid only $500 million for the 8% stake in Anthropic back in 2021.

The FTX bankruptcy estate has been actively liquidating assets over the past year in order to fully compensate previous customers of the defunct exchange. In a recent turn of events, the estate has disposed of its remaining stakes in the AI company Anthropic as part of this process.

FTX Rakes In $800 Million From Anthropic Shares Sale

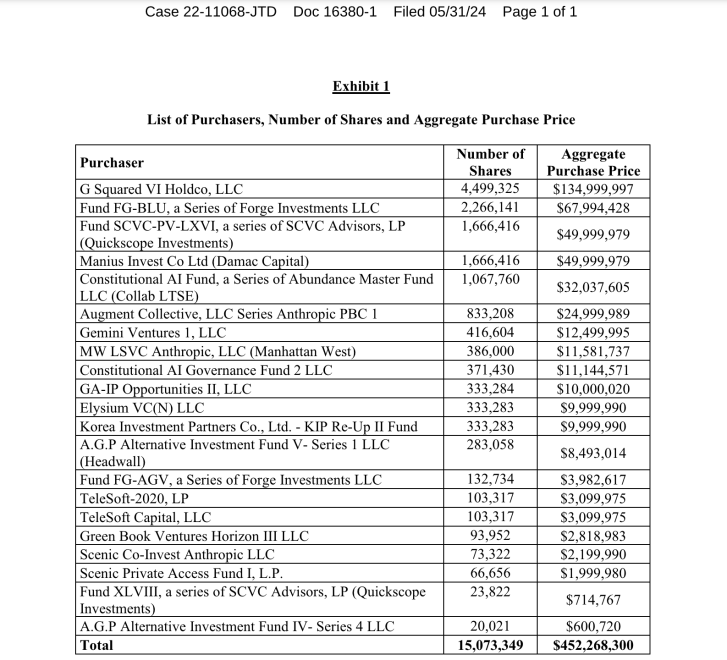

As an analyst examining recent bankruptcy filings, I’ve discovered that the FTX estate has successfully sold its remaining 15 million shares in Anthropic, the AI company behind Claude chatbot. The shares were offloaded at a price of $30 each, generating over $452 million in total proceeds for the estate.

G Squared, a venture capital firm, is the leading purchaser in this sale, acquiring approximately one-third (4.5 million) of the remaining shares for about $135 million. Other buyers include Fund FG-BLU and over a dozen other hedge funds and investment companies.

Noteworthy is that the recent sale transpired approximately two months following the exchange’s disposal of most of their Anthropic shares at $30 each, generating approximately $900 million in profits. The aggregate earnings from selling FTX’s Anthropic stocks now reach around $1.3 billion.

As a crypto investor, I originally invested $500 million with FTX and Alameda for an 8% stake in Anthropic back in 2021. However, the unexpected boom in the AI industry significantly increased the value of those shares, resulting in profits exceeding $800 million for the exchange.

I’ve mentioned before that it’s not just Anthropic shares that have been offloaded in recent times. More recently, the individuals managing FTX’s assets announced their intention to sell real estate properties that FTX had obtained prior to filing for bankruptcy.

FTX Bankruptcy Fees Surpass $700 Million

As a bankruptcy analyst, I’ve reviewed the latest findings from an industry expert on the subject. The expenses related to FTX’s insolvency proceedings have surpassed $700 million. This amount encompasses the legal and administrative costs incurred since the exchange’s unfortunate demise.

In the given report, it is revealed that Alvarez & Marsal, a consulting firm, tops the list with an impressive earnings of $212 million from FTX’s estate. Sullivan & Cromwell, acting as FTX’s legal advisors, follows closely behind with a bill amounting to $202 million.

One notable cost highlighted in the report is the $5.6 million fee billed by FTX CEO John Ray since the commencement of the bankruptcy proceedings at an hourly rate of $1,300.

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- EUR CLP PREDICTION

- USD COP PREDICTION

- HYDRA PREDICTION. HYDRA cryptocurrency

2024-06-02 12:41