CoinDesk Indices

Ah, What Folly Unfolds:

Pray, attend to this tale of woe and wonder, dear reader, in our weekly missive, Crypto Long & Short. ‘Tis a newsletter of insights, news, and analysis for the discerning investor. Subscribe forthwith to receive it each Wednesday, lest ye be left in ignorance.

Welcome, oh noble souls, to our institutional epistle, Crypto Long & Short. This week, we present:

- Haider Rafique of OKX doth share a study most profound on the generational whims of crypto investing.

- Top headlines that institutions should heed, penned by the wise Francisco Rodrigues.

- Sky defieth the 2026 downturn in our Chart of the Week, a marvel to behold.

-Alexandra Levis, thy humble scribe

Expert Insights, or So They Claim

Gen Z Trusts Code Over Bank Promises, Forsooth!

By Haider Rafique, global managing partner, OKX

’Tis no secret that the banking industry doth tremble at the specter of crypto disruption. After months of fervent lobbying, the Senate Banking Committee hath postponed its markup of market structure legislation, owing in part to the banks’ lamentations over stablecoin yield.

Yet, mark my words, ’tis but a minor skirmish. The true crisis faceth the banks: they are utterly forsaken by the younger generation, who trusteth not their hollow promises.

Behold, the behaviors observed on the OKX app across the globe have prompted us to conduct a study, to fathom the generational perspectives in this ever-evolving industry.

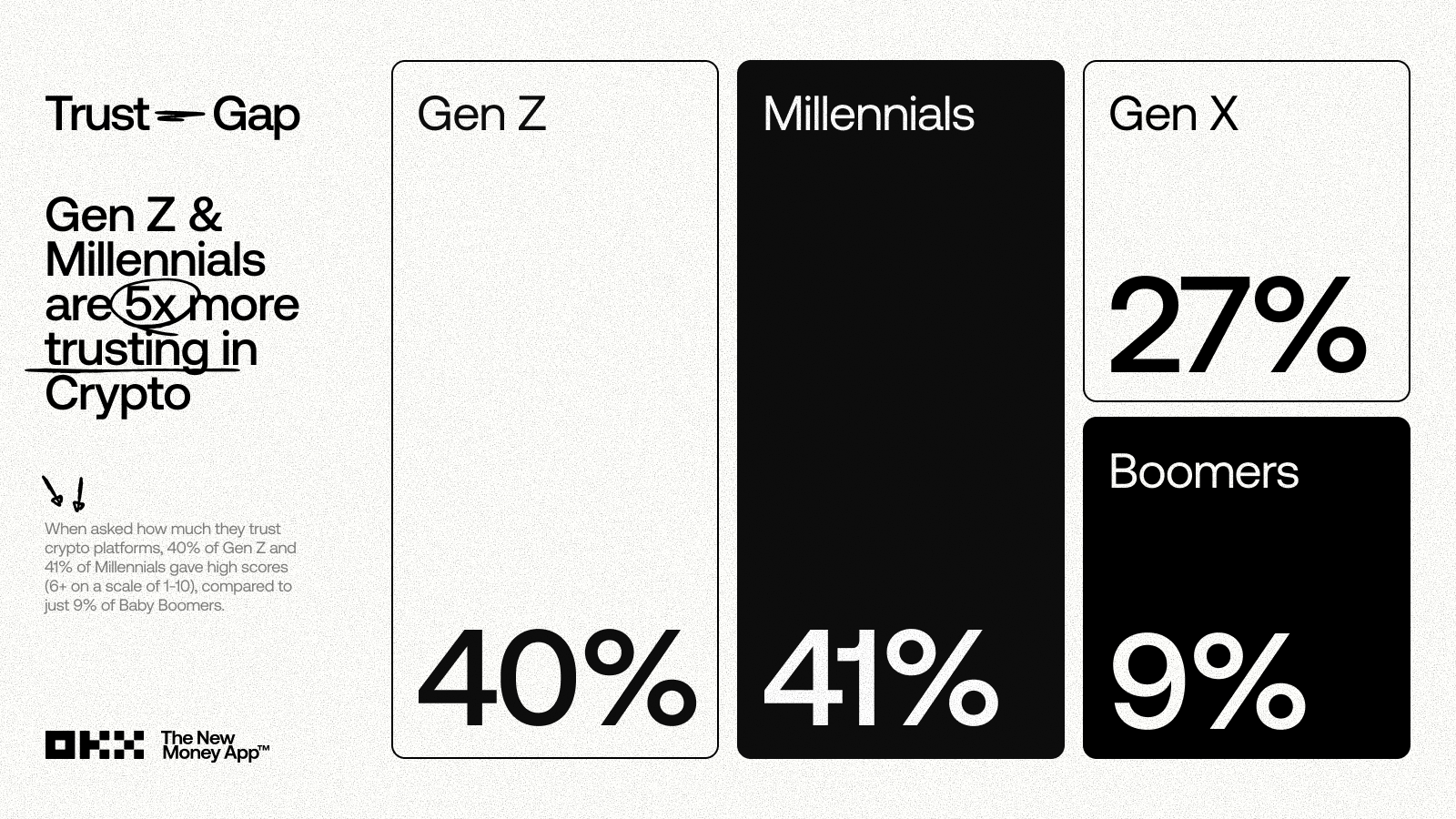

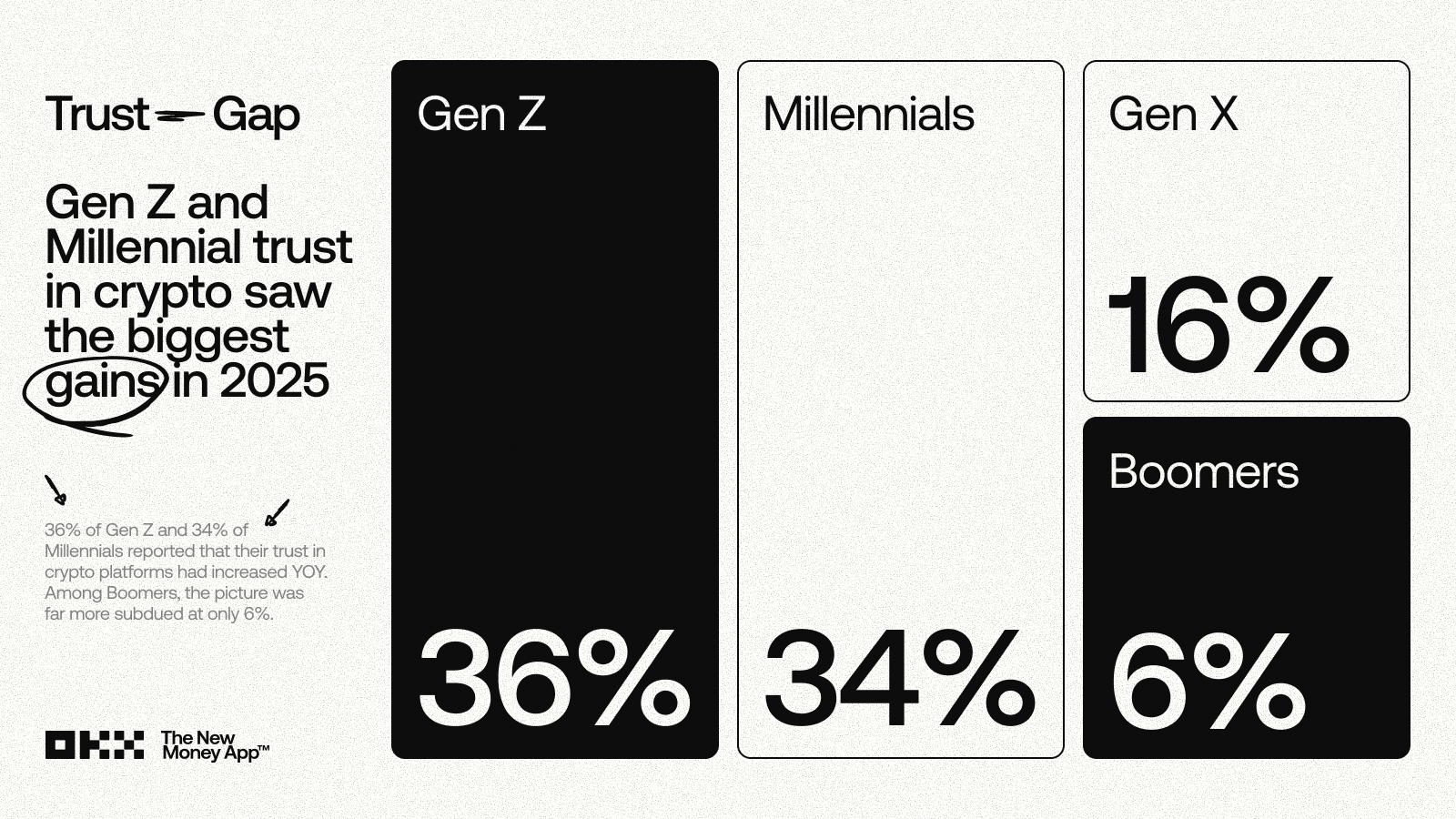

The revelations are most telling: Gen Z and millennial consumers are nigh fivefold more trusting of crypto than their boomer counterparts. Moreover, one in five of these young scoundrels proclaimeth low trust in traditional financial institutions, while nearly three quarters (74%) of baby boomers cling to their faith in the ancient system.

The “why” of this matter runneth deeper than viral trends and memecoins. ’Tis a generation reared on open-source code and real-time dashboards, who now demand the same transparency from TradFi.

And lo, as the world moveth on-chain and all things are tokenized, ’tis clear that the young see the digital economy as their stock market.

TradFi is not theirs. ’Tis the domain of their parents and grandparents, may they rest in financial peace.

A Generation Shaped by Institutional Folly

A recent FINRA and CFA Institute report doth suggest that a sizable share of Gen Z investors now lean heavily into crypto relative to other assets – a behavioral signal that younger Americans are willing to seek solace beyond traditional channels when they perceive a lack of transparency or competitive returns. According to this study, nearly 20% of Gen Z investors only hold crypto.

For banks, this should be a wake-up call, though I fear they slumber still. Trust is no longer a declaration but a demonstration they must earn.

Boomers built their financial lives in an era when institutions were the safest haven. Regulation meant protection, and trust was granted first, questioned later.

Gen Z hath lived through the opposite. They came of age in the aftermath of the 2008 financial crisis, entered adulthood burdened by student debt, and now face a housing market bereft of millions of units, alongside relentless inflation.

They’ve also endured years of policy whiplash on student loans, shifting repayment rules, and weakened borrower protections. These reversals have taught them a simple lesson: institutional promises are as fleeting as a summer breeze. When trust is repeatedly tested, skepticism becomes rational.

Banks are not losing Gen Z to crypto; they are losing them to their own failures.

Control Over Promises, or So They Dream

This skepticism is reshaping what influenceth trust for the younger generation. For boomers, security meaneth regulatory oversight and the perceived stability of legacy institutions.

Contrarily, Gen Z consistently ranketh platform security above regulation as the top driver of trust. For them, security is more personal and technical, with direct ownership of assets, the ability to verify how systems work, and the freedom to move value without intermediaries.

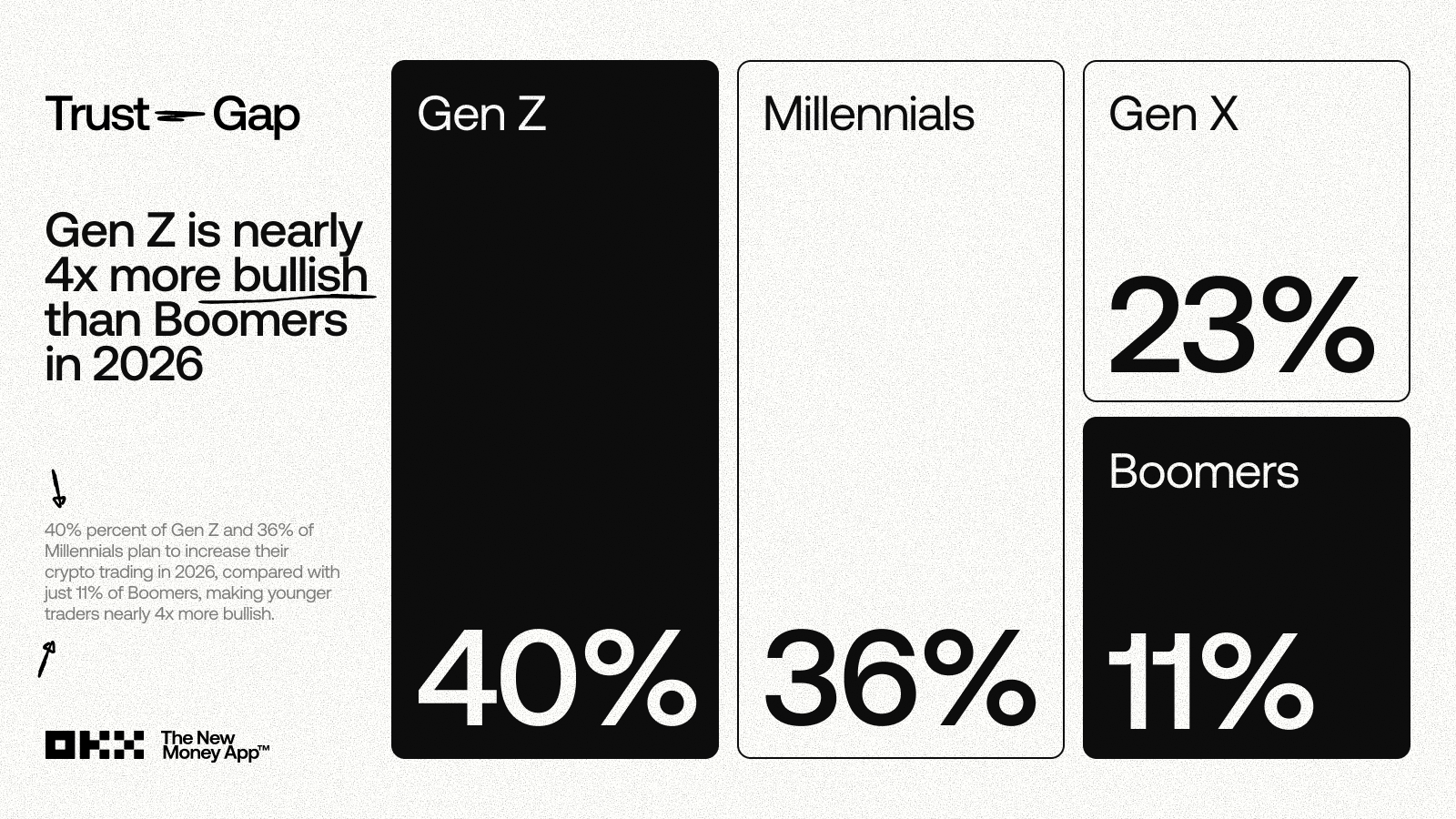

’Tis why both Gen Z and millennials are fourfold more bullish on crypto in 2026 compared to boomers. They can see transactions on-chain, self-custody, audit protocols, and understand the rules without awaiting a quarterly statement or a regulator’s update.

Transparency is central to this shift. Boomers tend to equate trust with regulatory approval, but Gen Z equateth trust with visibility. They desire to understand how decisions are made, how risks are managed, and how incentives are aligned. They crave clarity on fees, yields, and conflicts of interest, and systems that are open by default.

Traditional banks have historically struggled here. Their value proposition was built in an era when limited transparency was oft treated as a feature. And now, when a generation is accustomed to real-time dashboards and proof of reserves, the idea of waiting for a monthly statement seemeth absurd. Transparency hath become a baseline requirement for credibility.

The Future of Finance, or So They Say

Banks should ask themselves: why do younger customers trust transparency more than tradition? Younger Americans desire the stability of regulated finance paired with the transparency and control of digital assets, and they seek products that reflect how they already interact with technology and money. The institutions that understand this shift and build for it shall define the future of finance. The ones that don’t shall continue to watch as younger Americans look elsewhere.

Headlines of the Week, a Farce Unfolds

Francisco Rodrigues

Markets stumbled this past week, and miner capitulation intensified. This led to the steepest decline for Bitcoin’s mining difficulty since 2021, while corporate accumulation of cryptocurrencies and other assets continued, and Russia moved closer to formalize crypto-backed lending.

- Bitcoin mining difficulty drops by most since 2021 as miners capitulate: Bitcoin’s mining difficulty saw its largest decline since China’s 2021 crackdown on the mining industry. The drop cometh over severe winter storms in the U.S., plummeting prices, and miners pivoting to AI workloads.

- Here’s how market makers likely accelerated bitcoin’s brutal crash to $60,000: The price of bitcoin dropped more than 8% in the past week. The selloff was exacerbated by macro pressures and options market makers that were heavily short gamma, forcing them to sell BTC in spot and futures markets.

- Tether’s gold stash tops $23 billion as buying outpaces nation states, Jefferies says: Leading stablecoin issuer Tether bought an estimated 32 tonnes of physical gold in late 2025 and early 2026. That outpaced the buying of most central banks and trailed only Brazil and Poland.

- Russia’s largest bank, Sberbank, prepares to issue crypto-backed loans: The financial institution is moving to offer loans secured by cryptocurrency and says it’s ready to work with the central bank on a regulatory framework. The model was piloted last month.

- Here’s why the quantum threat for bitcoin may be smaller than people fear: CoinShares hath argued in a new report that fears of an imminent quantum computing threat for bitcoin are overstated, as realistically only a small portion of the supply is at risk of disrupting markets.

Chart of the Week, a Marvel to Behold

Sky Defies 2026 Downturn, a Triumph of Folly

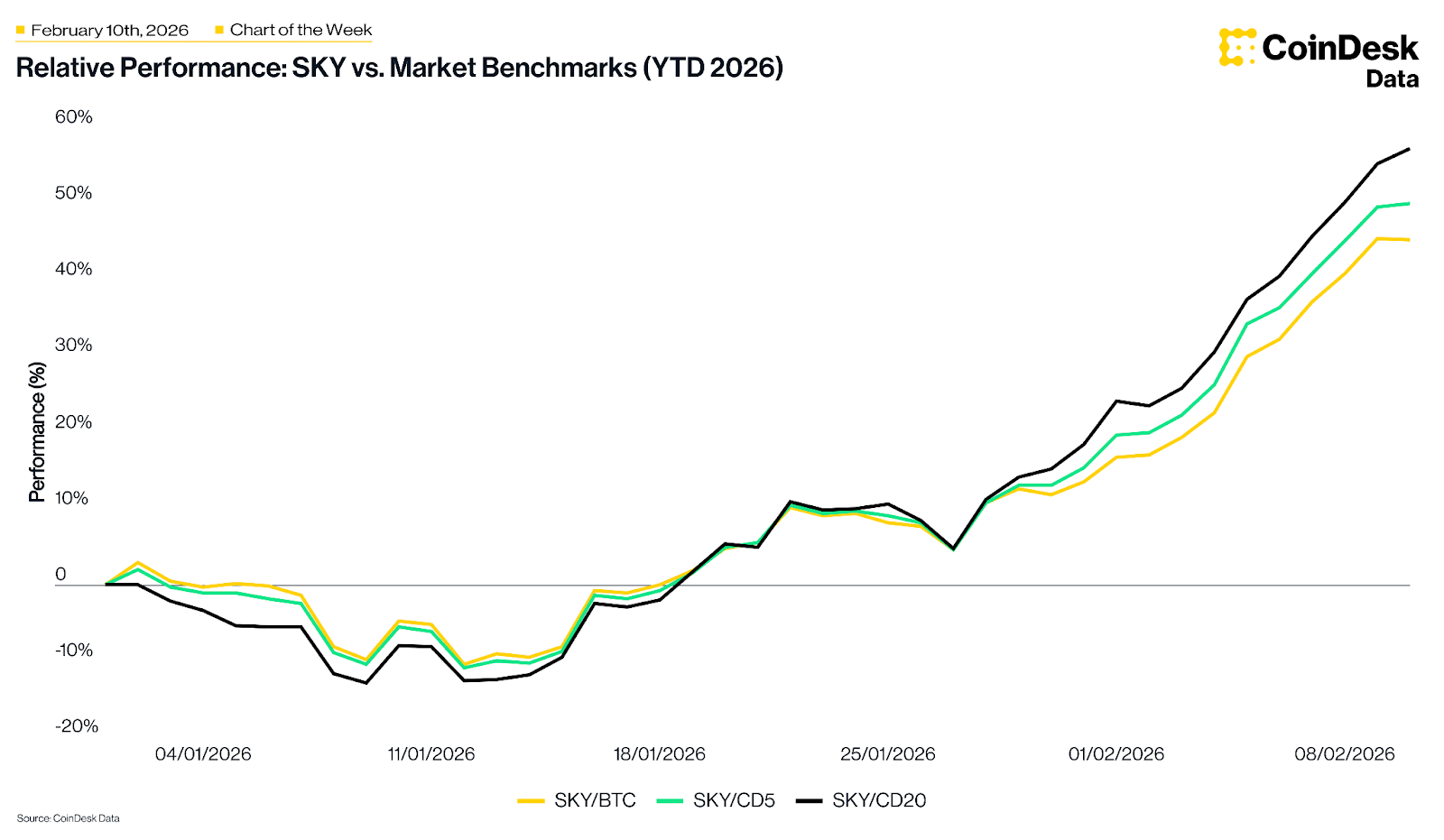

Sky hath decoupled from the 2026 market downturn, outperforming BTC, CD5, and the CD20 index by 45%, 50%, and 57% respectively YTD. This resilience is anchored by a consistent business model: January revenue surged 1.5x YoY to $19 million, fueling $10.4 million in YTD buybacks ($8.5 million in Jan; $1.9 million last week) and driving a flight to quality that pushed the USDS (Sky’s stablecoin) market cap from $5.8 billion to $6.5 billion.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- INR RUB PREDICTION

2026-02-11 20:49