As a seasoned researcher who has closely observed the crypto market’s ebb and flow for several years now, I find it intriguing to see Bitcoin once again leading the charge. The recent inflow surge is reminiscent of the bull runs we witnessed in 2017 and 2021, albeit on a smaller scale this time around.

Over the past weeks, there’s been a notable resurgence in the worldwide market for digital asset investments, signaling a robust comeback for crypto-focused funds. As reported by CoinShares, these cryptocurrency investment products attracted approximately $321 million in new investments last week.

After two consecutive weeks of withdrawals, it suggests that investors are changing their perspective, with significant economic factors like the latest US Federal Reserve’s rate cut having a substantial impact on the trajectory of the cryptocurrency market.

Bitcoin And Solana Lead The Inflow Surge

According to a recent report by CoinShares, Bitcoin-focused investment products have been leading the market, taking the majority of inflows observed during the past week.

According to CoinShares, there was an inflow of approximately $284 million into Bitcoin-focused products, indicating a significant change in momentum for the top cryptocurrency. This trend underscores Bitcoin’s consistent strength in drawing institutional investments compared to other digital assets.

It’s worth noting that even though Bitcoin’s price dropped, certain short-term investment products related to Bitcoin attracted inflows of approximately $5.1 million. This indicates that some investors are being prudent and are taking steps to safeguard themselves from potential market fluctuations by hedging their investments.

In my recent investigations, Solana-based funds have been shining quite brightly. As reported by CoinShares, this asset attracted approximately $3.2 million in net inflows just last week.

On the other hand, Bitcoin and Solana experienced a surge, but investments in Ethereum-related products recorded another round of withdrawals last week.

The latest CoinShares report indicates that Ethereum investment products experienced an outflow of approximately $29 million last week, marking the fifth consecutive week they have seen losses. Over this timeframe, a total of $187.7 million has been withdrawn from Ethereum-focused funds.

What About Regional Flows?

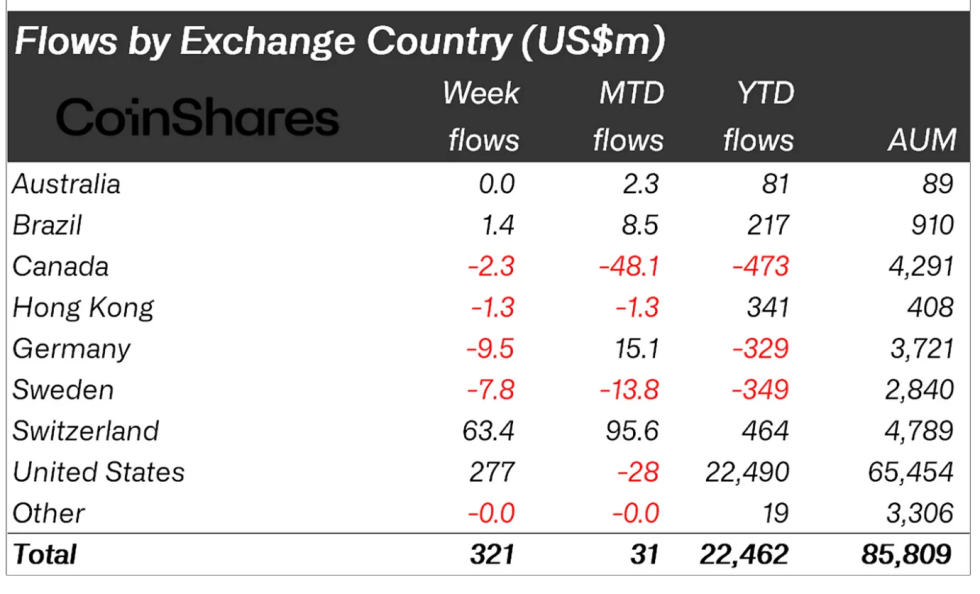

Globally, it’s the United States that leads the pack in crypto investment, as American investment funds accumulated approximately $277 million in net inflows.

In simple terms, Switzerland experienced an inflow of approximately $63 million in cryptocurrency investments last week, making it the second-highest weekly intake. On the other hand, countries such as Germany, Sweden, and Canada saw net outflows, indicating a diverse global trend in crypto investment.

Significantly, the resurgence observed in Bitcoin and Solana, as highlighted by James Butterfill, Head of Research at CoinShares, was primarily fueled by a change in the US monetary policy, particularly the Federal Open Market Committee’s (FOMC) adoption of a more accommodating stance and their 50-basis-point interest rate reduction.

As a researcher, I’ve observed that the monetary relaxation has created an advantageous context, fostering growth in riskier assets such as cryptocurrencies. This positive environment has led to a surge in global investments flowing into digital asset products.

To this point, the increase in Bitcoin’s favorable investments has been mirrored in its market behavior, as it currently surpasses the symbolic $60,000 price point once more. At present, Bitcoin is being transacted at $62,775, experiencing a minor decrease of 1.1% over the past day.

The surge in price efficiency has, in addition, elevated the market value of Bitcoin to surpass $1.25 trillion, having been just under $1.15 trillion a week ago.

Featured image created with DALL-E, Chart from TradingView

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- SEILOR PREDICTION. SEILOR cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- USD PHP PREDICTION

- FJO PREDICTION. FJO cryptocurrency

2024-09-24 05:42