Ah, the eternal dance of gold and its inflation-adjusted glory-now pirouetting above $3,610 per ounce, a feat not seen since the days when neon leg warmers were a sensible fashion choice. The venerable Kobeissi Letter decreed on the eleventh day of September, 2025, that rising inflation combined with looming interest rate cuts compose what one might call “gold’s dream setup.” Picture gold itself donning a crown, sipping tea, and chuckling knowingly. Bitcoin, that mischievous digital nephew, waits in the wings, hoping the economic script grants it a similar standing ovation.

There it is:

Inflation adjusted gold prices have officially hit a new record high for the first time since the 1980s.

Inflation + rate cuts = gold’s dream setup.

– The Kobeissi Letter (@KobeissiLetter) September 11, 2025

Now, for those who snoozed through Econ 101, the inflation-adjusted gold price is basically a math trick: take gold’s dusty old nominal prices and sprinkle them liberally with the ratio of today’s US Consumer Price Index to the one from back when mullets were in vogue. Voila, you get all figures speaking the same dollar language-ideal for long-term bragging rights.

Just yesterday, the august August CPI numbers rolled out, revealing inflation at a spunky 2.9%, up from July’s modest 2.7%. This unexpected jump pushed the adjustment meter further in gold’s favor. Meanwhile, Core CPI stands firm at 3.1%, stubborn as a mule, keeping inflation whispers alive in less shouty price categories.

On the flipside, the US Producer Price Index (PPI) for August arrived fashionably late with a shy 2.9%, below the expected 3.3%. Since PPI is the economic equivalent of a fortune teller’s crystal ball, it suggests inflation might be cooling its heels soon. Naturally, the Fed’s wizards are toying with the idea of slicing interest rates by 50 basis points on September 17. Coinspeaker, ever the town crier, shouted this news to the masses yesterday.

Bitcoin and Gold: The Odd Couple’s Financial Tango

2025’s gold demand surged, driven not by golden ambitions alone but by a cocktail of world tensions: trade squabbles, political soap operas, US elections starring all-too-familiar characters, Middle Eastern skirmishes, and tariffs that make phone calls cost less than imports. In times like these, gold dons its patented “safe haven” cape and flies-if only metaphorically-above the storm.

Meanwhile, central banks in China, India, Russia, and Turkey hoard their shiny treasures like secret agents guarding top-secret dossiers, casting wary glances at the US dollar’s wobbling stature and sanctions’ slapstick. As the US Dollar Index stumbles, foreign buyers cheer, buying gold with glee and reinforcing their faith in a metal more reliable than political promises.

Lower interest rates make gold about as attractive as a party with free booze-no yield, no problem, because who cares about “opportunity cost” when you’re dancing with a shimmering relic? Curiously, Bitcoin and its cryptocurrency kin nod in agreement from their pixelated thrones, often dubbed “digital gold” by enthusiasts who believe in magic, or at least in cryptographic spells.

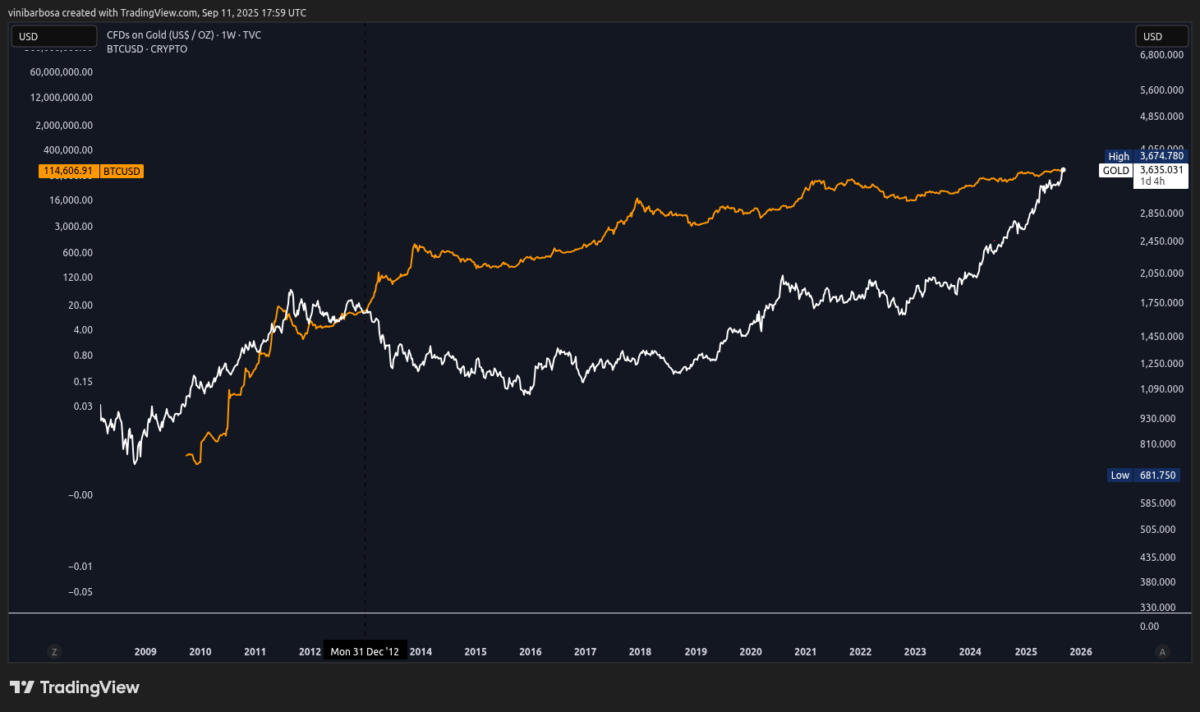

When last we checked the ledger, Bitcoin was bartering around $114,600 per coin, while gold shimmered majestically at $3,635 per ounce. Historically, these comrades waltzed in step until December 2012, when Bitcoin slipped away to outpace its metallic cousin. Yet, come September 2025, TradingView’s charts whisper of renewed equilibrium-a rare moment when the old world and new world nod sagely to each other.

Gold vs. Bitcoin weekly (1W) price chart | Source: TradingView

This détente signals a curious maturing of the cryptocurrency beast, tempering its wild fluctuations and slowing its sprint while eyeing gold’s venerable stance. However, the shadowy market whispers of Tether minting 2 billion USDT-the largest conjuring act since December 2024-hinting at a possible crypto renaissance, a sequel no one expected but everyone secretly hopes for. Yet, for now, gold retains the throne, waving its crown with a knowing smirk, seasoned by the trials of time and the folly of men. 💰🐾

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Who Is the Information Broker in The Sims 4?

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-09-12 01:27