It seems the world of finance has been turned quite topsy-turvy, what with Bitcoin losing its grip on several critical levels and gold, like a sprightly old gent at a garden party, soaring to new heights. Most traders, I suspect, were caught rather off guard by this unexpected turn of events. One can almost hear them muttering, “Good heavens, whatever next?” as they watch gold seemingly steal the limelight from our beloved digital currency. 🌟

Bitcoin: Still Secure in Its Digital Fortress

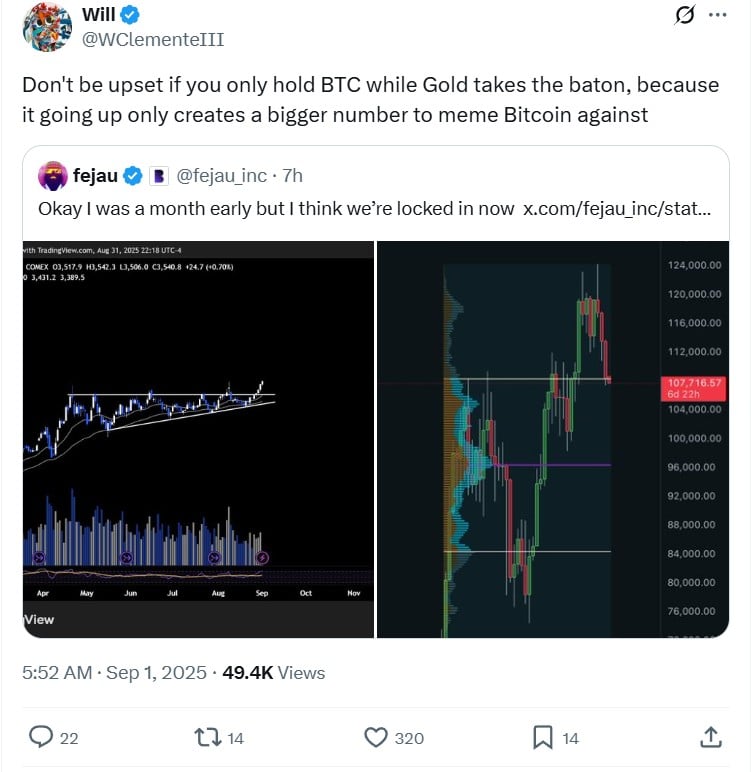

Now, don’t go thinking that just because the charts might suggest otherwise, Bitcoin is about to throw in the towel. Far from it! The recent rally in gold, one might argue, actually bolsters Bitcoin’s long-term case. After all, with gold futures breaking above the $3,500 resistance level, completing a multi-month consolidation breakout with all the flair of a matador at a bullfight, and backed by strong volume, it’s a sign that the market is on the move. 📈

Historically, you see, the demand for gold has been fueled by the trifecta of inflation, geopolitical unpredictability, and a general sense that fiat currencies are about as reliable as a politician’s promise. Investors, bless their hearts, are trying to protect themselves, and poor Bitcoin has found it a tad challenging to keep up in such a competitive environment. After failing to hold the $120,000 zone, Bitcoin has taken a bit of a tumble, falling to $107,000 and dipping below its 50-day EMA. 🤷♂️

At first glance, this might look like a zero-sum game where Bitcoin is the unfortunate loser as capital shifts to the golden goddess. However, the correlation isn’t as dire as it first appears. In fact, the strength of gold only serves to reinforce the broader anti-fiat narrative that both assets share. It’s like saying the sun and the moon are at odds when really, they’re just different parts of the same celestial dance. 🌞🌙

Why Bitcoin Has a Soft Spot for Gold

Bitcoin, you see, thrives on the narrative that hard assets are outperforming fiat currencies, a narrative that gets a nice little boost every time gold hits a new high. Despite the temptation for Bitcoin holders to view gold’s breakout as a threat, it actually makes Bitcoin more vulnerable to those delightful internet memes. If gold can firmly establish itself at $3,600 or higher, Bitcoin proponents will be quick to point out that BTC still has a much greater upside potential compared to the, shall we say, slightly older asset. 💪

The argument that Bitcoin’s eventual run could outpace gold’s measured gains is strengthened by the fact that the comparison gap widens as gold prices rise. So, does gold kill Bitcoin? Perhaps in the short term, but the breakout momentum of gold is undeniable, while the Bitcoin charts look a bit like a toddler’s scribbles. 🖋️

But fear not, dear Bitcoin owners! The race is far from over, even if the baton has momentarily shifted to gold. This peculiar correlation is simply another chapter in the ongoing saga of fiat money versus hard assets. So, sit back, relax, and enjoy the show. After all, it’s not every day you get to witness such a splendid spectacle. 🎉

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- TRX PREDICTION. TRX cryptocurrency

- How to Unlock & Upgrade Hobbies in Heartopia

- Xbox Game Pass September Wave 1 Revealed

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2025-09-01 15:28