Miners have responded to the completion of Bitcoin‘s fourth halving by adjusting their total hashrate accordingly.

Bitcoin 7-Day Average Hashrate Hit New All-Time High Recently

Every so often, Bitcoin undergoes a process called halving, where the rewards given to miners for successfully adding new blocks to the network are reduced by half.

Approximately every four years, this occurrence transpires, with the most recent edition wrapping up not long ago. This marks the fourth time Bitcoin’s reward for new blocks has been reduced, bringing it down to 3.125 BTC from its previous 6.25 BTC level.

Bitcoins miners derive their income from two primary sources: rewards for adding new blocks to the blockchain and transaction fees paid by users. Historically, block rewards have made up the larger share of miner revenue due to consistently low transaction fee rates.

Miners closely monitor Halving events due to significant impact on reward sizes. A good method to gauge miner response is by observing hashrate adjustments.

The “hashrate” represents the total computational power linked to the Bitcoin network by miners. Fluctuations in this figure may mirror the attitudes or behaviors of these miners.

An increase in the indicator signifies that miners find the blockchain rewarding to mine on at this moment. Conversely, a decrease might suggest that certain miners are no longer profited by mining Bitcoin and have left the network.

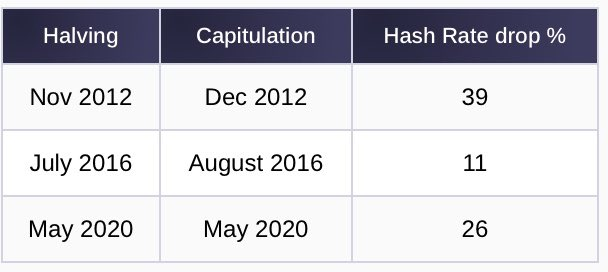

According to analyst James Van Straten’s post on X, the Bitcoin mining hashrate tends to decrease after Halving events.

Instead of asking “But what about this time? Are miners capitulating?”, you could ask “What’s happening now with miner capitulation? Let me show you a chart displaying the development of the 7-day average Bitcoin mining hashrate over the past year.”

The graph indicates that Bitcoin’s 7-day average hashrate reached an unprecedented high of 650 EH/s during the Halving event. This might suggest that miners weren’t concerned about the Halving or seized the opportunity to maximize their profits by mining more blocks before the rewards decreased.

Since the occurrence, the metric has dropped, indicating that some miners may have disconnected. Nevertheless, the indicator remains stable at approximately 629 EH/s, implying a modest drawdown and suggesting that the hashrate remains near all-time highs.

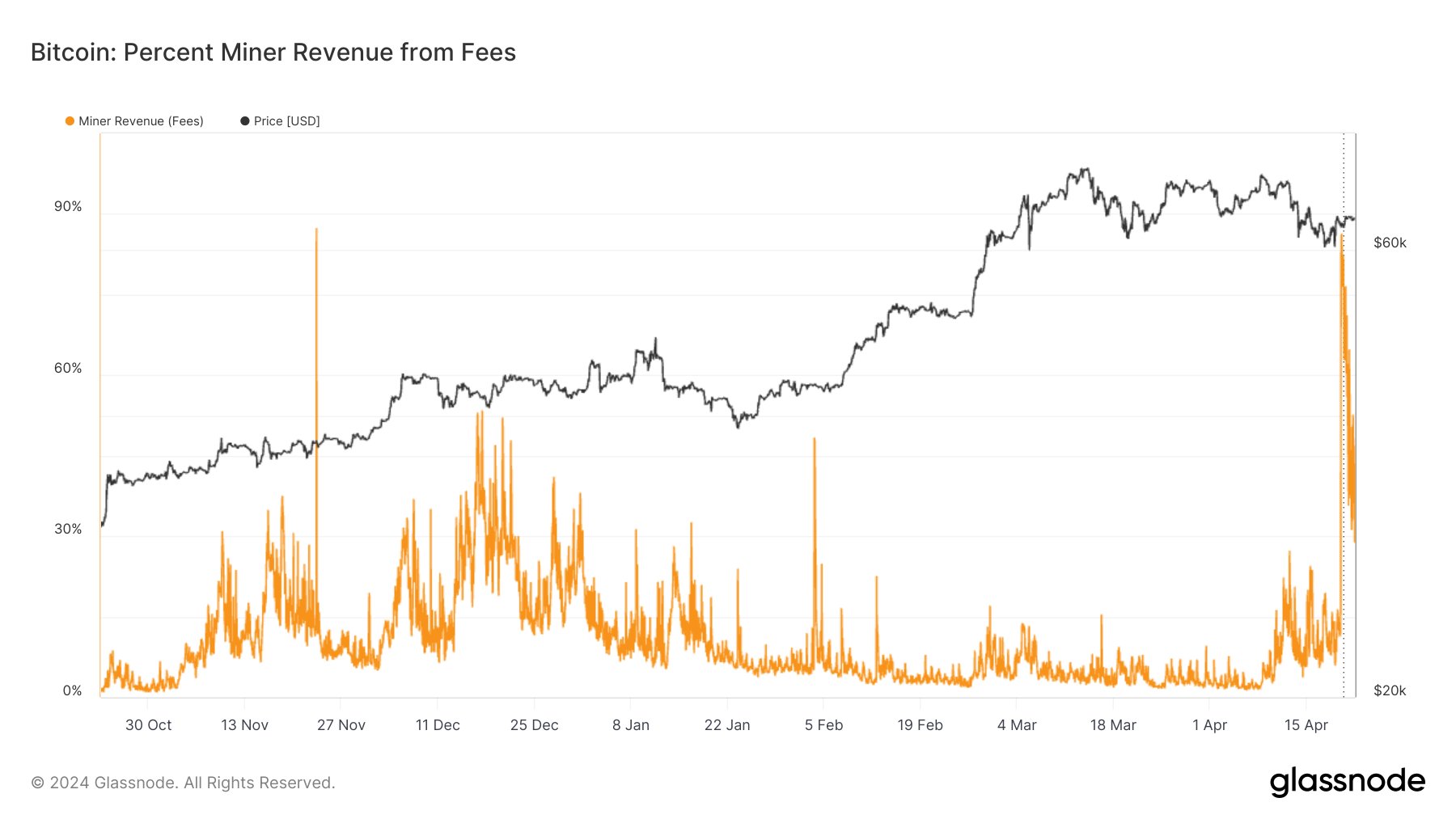

Thus, only a few miners have been shaken out so far. However, this still doesn’t necessarily mean that miners are more persistent this time. As Straten has discussed in another X post, the miner revenue from the fees has been quite extraordinary since the Halving.

Due to the introduction of Runes, a fresh protocol for creating fungible tokens on the Bitcoin network, we’re experiencing an increase in transaction fees.

Although the excitement has decreased a bit, with fees making up approximately 30% of miner earnings compared to over 75% previously, the significance of these fees remains substantial in comparison to historical levels. This could explain why miners continue to operate after the halving event.

BTC Price

At the time of writing, Bitcoin is trading at around $66,100, up more than 3% over the past week.

Read More

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- BRISE PREDICTION. BRISE cryptocurrency

2024-04-23 07:11