A successful breakout could trigger a 40-45% rally toward $0.28, while failure to hold support may lead to a sharp correction. One might say the market is playing a particularly spirited game of charades with the coin, and the audience is betting on whether it will “break out” or “crash and burn.” 🤡

Analysts Track Bullish Setup

According to the ever-dashing analyst World of Charts, Hedera Hashgraph is showing early signs of a bullish formation that may precede a strong breakout. The chart indicates that Hedera has been consolidating just below a descending trendline, which has been a rather chatty wall of resistance since mid-year. The analyst noted that if the token manages to break and successfully retest the resistance area near $0.21, the move could trigger a rally in the range of 40-45%. A feat that would make even the most stoic investor’s heart flutter like a hummingbird on espresso. 🐦☕

The analysis suggests a buildup of buying pressure under a key resistance area. The market appears to be entering a phase of accumulation before potentially breaking higher toward the $0.26-$0.28 zone. This projection aligns with the series of higher lows recorded since the October bottom near $0.15, which may indicate improving sentiment among traders. A confirmed breakout above the descending trendline could transform previous resistance into new support, strengthening the bullish case as the market heads into November. One might call it a “bullish Cinderella story,” complete with a glass slipper made of chart patterns. 👠📈

Key Support Levels Hold Market Attention

The analyst further pointed out that maintaining price stability above $0.20 will be crucial for sustaining the bullish pattern. Failure to hold this level may weaken the technical structure and delay upward continuation. Market participants are closely observing whether HBAR can preserve its recent momentum as the coin tests the upper boundary of its multi-month downtrend channel. It’s a bit like watching a penguin try to climb a ladder-delightfully awkward but oddly endearing. 🐧😅

At present, price movements suggest buyers are attempting to defend the $0.194-$0.196 area, which has acted as an intraday base for recent trading sessions. If this support range holds, it may create favorable conditions for buyers to challenge higher resistance levels. The broader setup signals potential for trend reversal, though confirmation will depend on the strength of future volume and the ability to sustain levels above the channel’s upper line. All in all, a performance that would make a Shakespearean actor weep with envy. 🎭💧

Alternative Viewpoints Suggest Near-Term Pressure

A contrasting outlook from analyst Jack describes the asset as being positioned at a decisive point within a descending channel that has guided price action since July. According to his chart, the token has faced repeated rejections along the upper boundary of the channel, suggesting ongoing control by sellers. HBAR is currently testing the $0.188 support zone, which Jack identified as a “make-or-break” level. A phrase that sounds suspiciously like a tuxedo fitting for a coin. 🧥📉

If this level fails to hold, the analyst expects a potential decline toward the $0.14 support area, reflecting intensified selling momentum. The analysis also noted persistent bearish pressure following multiple failed breakout attempts. A loss of the $0.188 zone could open the path to a 20% or more decline, reinforcing the bearish control that has defined recent months. One might say the bears are hosting a particularly raucous tea party at the moment. 🐻🍵

Market Activity and Short-Term Outlook

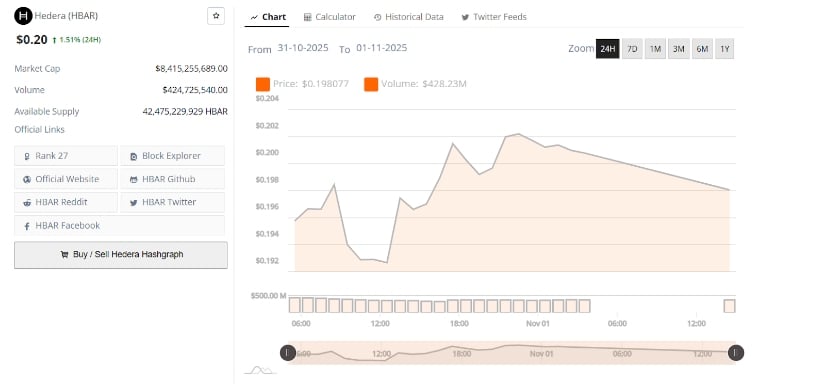

Over the past 24 hours, Hedera traded near $0.20, marking a 1.51% daily increase. Price data shows the coin opened around $0.194, dipped slightly to $0.192, and later rebounded to $0.198. Trading activity rose sharply during this rebound, with volume peaking near $428 million, suggesting renewed buying participation. The momentum briefly pushed the asset above $0.20 before mild profit-taking occurred. Despite the cooling, the coin managed to retain most of its intraday gains. If buying strength continues above $0.198, the next upside target may be $0.204, while a failure to maintain $0.194 could lead to short-term consolidation near $0.19. The market remains at a decisive juncture, where sustaining current levels could validate the bullish setups outlined by analysts tracking potential breakout momentum. In short, a financial drama more thrilling than a raccoon in a chess match. 🐾♟️

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-11-01 23:05