Ah, the Bitcoin! Precious and perplexing, it dances delicately like a ballerina teetering on the edge of a precipice, consistently tangoing within the $85,000 and $88,000 hall of mirrors! As the greatest crypto of them all performs this farcical dance, the ardent crowd of crypto enthusiasts finds themselves mirroring the sentiment of a stage full of confused actors. Little do they know, the supply of this glorious digital gold is dwindling faster than a politician’s promises on election night.

In this whimsical tale, dear reader, we will cast our cautious gaze upon the pitiable plight of short-term traders, poised at the edge of their seats like the inhabitants of a Gogolian village, watching their piggy banks deflate. Let us delve!

The Hilarious Tragedy of Short-term Holders! 🎭

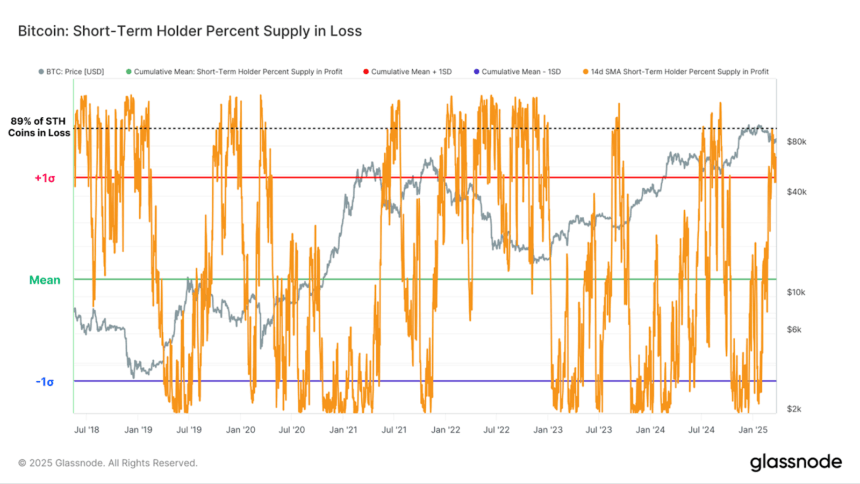

Lo and behold! Over 90% of short-term holders find themselves entangled in the webs of loss, as supply percentage lurches beyond a fateful +1SD band—who knew statistics could be as terrifying as a shadowy ghost in the night? With the type of sheer dramatic irony worthy of a Russian novel, the potential for liquidation looms large over Bitcoin, threatening to break even like a particularly stubborn mule refusing to budge from its spot.

Surely, such losses could rival the worst plays ever performed, for only on two occasions prior has this tragedy befallen the bullish caricature we call the market! New investors, beware! Beware! The pressure mounts, exerting a comedic gravity that would make even the tragicomic Gogol chuckle and sigh.

Moreover, we find that the noble actors—those active addresses on the Bitcoin Network—have been slowly waltzing away, dwindling from 23.75 million in January to a disheartening 20.81 million in February. Alas, is it not like checking your pantry and finding it void of potatoes in a Russian winter?

March, too, seems poised to join this pantomime, with the views shrinking to a mere 19.76 million. How tragic that the influx of joyous new investors and wallet creators appears to have been swallowed by the very maw of apathy!

While over 40% of the market rejoices in splendid profits, we must pity the poor short-term souls, with their 3.4 million BTC weighed down by loss, like a hapless villager buried in debt! Such a record of despair has not been seen since the high tide of 2018, that grand peak of the fabled bull market!

The Ironic Conclusion:

As Bitcoin adopts its leisurely, sideways trend, profits flutter away like autumn leaves, whilst losses accumulate like the dust on forgotten tomes. Demand ebbs, and the result is a delightful side-sell pressure; the irony is as rich as a Dostoevsky novel!

Yet while the short-term holders clutch their proverbial pearls, the long-term whales wade into this melodrama, accumulating Bitcoin as one might gather fallen apples in a deserted orchard! What a comic opera indeed! 🎭💸

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- How to Unlock the Mines in Cookie Run: Kingdom

- Nine Sols: 6 Best Jin Farming Methods

- Top 8 UFC 5 Perks Every Fighter Should Use

- Slormancer Huntress: God-Tier Builds REVEALED!

- USD ILS PREDICTION

- REPO’s Cart Cannon: Prepare for Mayhem!

- AI16Z PREDICTION. AI16Z cryptocurrency

- Invincible’s Strongest Female Characters

2025-03-27 20:05