Listen up, folks:

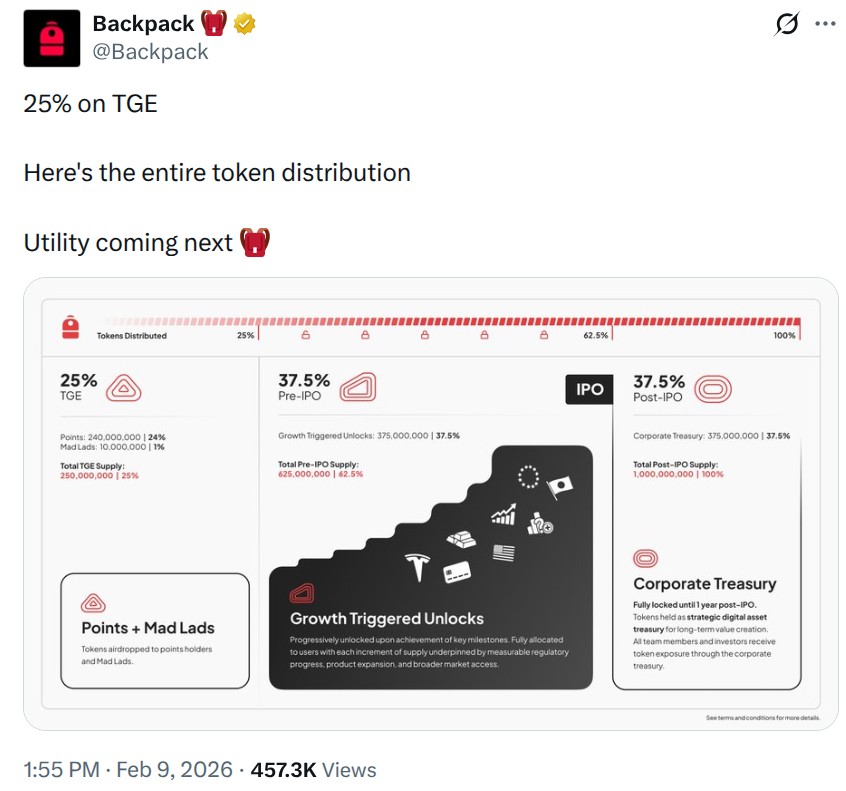

- Backpack is throwing caution to the wind with a double whammy: a native token launch and possibly an IPO – all while juggling regulatory compliance like a circus clown.

- The industry is shifting gears, moving from manual chaos to a cozy, unified execution environment – because who doesn’t love a good abstraction?

- LiquidChain steps in with a Layer 3 solution that promises to mix Bitcoin, Ethereum, and Solana liquidity like a trendy cocktail, waving goodbye to wrapped asset woes.

- The early birds in the $LIQUID ecosystem are already chirping, raising over $533K as they hunt for interoperability like it’s the last slice of pizza at a party.

Ah, the crypto exchange landscape! Once a wild west of ‘move fast and break things,’ we’re now tiptoeing toward regulatory compliance, navigating the minefield laid out by our friends at the SEC. Enter Backpack, the brainchild of Armani Ferrante, who has decided that launching a native token and eyeing a public listing is the way to go.

It’s almost cute how Backpack mirrors the giants like Coinbase, but with a twist – keeping the sprightliness of a Web3-native community. Because why not?

Exchange tokens are getting a makeover, evolving from mere discount coupons into something resembling actual utility. With sights set on an IPO, Backpack is waving its flag to institutional investors, declaring it’s ready to play by the rules while minting a shiny new asset to bootstrap liquidity.

But why should you care? It’s simple: this creates a bridge between the chaotic innovation of DeFi and the rigid structure of traditional finance. But let’s not kid ourselves; execution is the real dealbreaker. The road to issuing a token while dodging SEC scrutiny is littered with the remains of countless fallen projects.

While Backpack polishes its front end, a more profound issue lurks beneath: liquidity fragmentation. Sure, users can admire their assets on a sleek interface, but transferring value between Bitcoin, Ethereum, and Solana is about as smooth as a bumpy dirt road.

As exchanges beautify the user experience, new infrastructure protocols are working hard to unify the backend. That’s where LiquidChain ($LIQUID), a Layer 3 (L3) infrastructure provider, prances in to save the day.

LiquidChain: Merging Fragmented Ecosystems with Layer 3 Magic

Cross-chain interaction is currently a chaotic mess. Moving your precious capital from Ethereum to Solana? You might as well be trying to solve a Rubik’s Cube blindfolded. LiquidChain swoops in, deploying a Layer 3 protocol designed specifically to ease cross-chain liquidity woes.

Picture this: LiquidChain’s architecture acts as a single execution environment, harmonizing liquidity from Bitcoin, Ethereum, and Solana, all while avoiding the pitfalls of those pesky wrapping mechanisms. It introduces a Verifiable Settlement system that allows for single-step execution – because who has time for complexity?

For developers, it’s a dream come true: the ‘Deploy-Once’ architecture means a dApp built on LiquidChain can tap into users and capital from all connected chains without needing a separate smart contract for each ecosystem. It’s like having your cake and eating it too!

This tech hints at a seismic shift in how value flits around on-chain. By simplifying the messy business of cross-chain hops, the protocol positions itself as the fuel for the next generation of DeFi apps. The ultimate goal? Pure capital efficiency, allowing assets to flow freely to where yields are golden without the friction of traditional bridges.

CHECK OUT THE UNIFIED LIQUIDITY LAYER WITH LIQUIDCHAIN

Early Investments Pour into Interoperability Infrastructure

The savvy money is gravitating towards infrastructure plays that tackle the age-old ‘usability vs. security’ conundrum. While the broader market fancies memecoins and consumer apps, the foundational layer needed to make those apps tick is seeing steady inflows. LiquidChain is ready to cash in during its presale phase, offering a sneak peek into infrastructure investing before the public listing.

So far, $LIQUID has raked in over $533K. Early adopters are flocking in, recognizing the necessity of cross-chain VMs like moths to a flame. With tokens priced at a humble $0.0136, it’s like finding a bargain in a digital thrift store.

And let’s not forget the tokenomics model that fuels this growth by incentivizing liquidity staking – rewarding users who provide that essential capital for the cross-chain execution environment. If you’re considering liquidity and ease of use, $LIQUID could be one of the best altcoins to buy.

The market dynamics back this trend. As major ecosystems like Solana and Ethereum grow apart technically, the demand for ‘glue’ protocols-middleware connecting these isolated islands-skyrockets. LiquidChain’s ability to fuse these liquidity pools into a single interface offers a delightful hedge against ecosystem maximalism. It’s a gamble on a future where users interact with apps, not chains.

GRAB YOUR $LIQUID FROM ITS OFFICIAL PRESALE PAGE

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Sony Shuts Down PlayStation Stars Loyalty Program

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2026-02-10 15:06