In the grand circus of finance, where the clowns wear suits and the lions roar in screens, Bitcoin ETFs somehow managed to gather $47 million—probably convinced that noise makes the crowd love them. Thanks to Blackrock and Bitwise, the crypto market spun a tale of stubborn optimism amidst the chaos.

Bitcoin and Ether ETFs: A Tale of Persistence and Slight Humor 📈😂

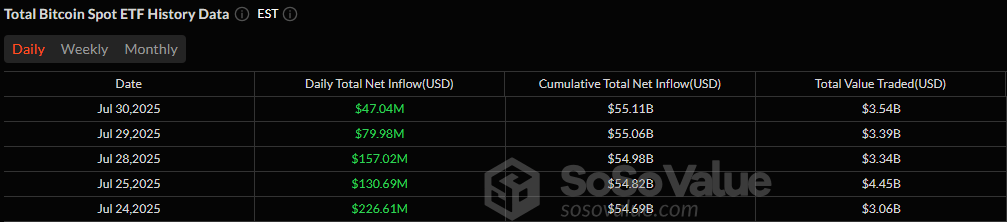

On Wednesday, July 30, the crypto ETF market played a game of contrasts. Bitcoin ETFs hauled in a hefty $47.04 million—like a dog with a bone—mostly because Blackrock and Bitwise decided to put their best foot forward.

Blackrock’s IBIT took a major slice with $34.37 million, while Bitwise’s BITB joined in with $12.66 million—like old friends sharing snacks, not fighting for attention. Remarkably, no money rushed out the door, a rare sunny day in recent weeks. Trading saw $3.54 billion dance across screens, holding the total assets at $151.36 billion—because why not keep the numbers steady as a rock?

Meanwhile, Ether ETFs lingered in the green—just barely—adding $5.79 million, marking their 19th day of positive flow. Blackrock’s ETHA dropped in with $20.27 million, Grayscale’s ETHE chipped in $7.77 million, but Fidelity’s FETH decided to blow the gains—exiting $22.27 million. Because why not keep life interesting?

Trading $1.49 billion worth of ether, the ETF’s net assets surged to $21.43 billion—proof that even in chaos, interest flickers like a stubborn candle in the wind.

The tale: Bitcoin’s inflows keep steady, clinging to institutional anchors, while ETH fights to stay relevant—like a rock star aging gracefully but with a few more wrinkles. Volatility? Yes. But who needs consistency when you can have drama in the financial soap opera?

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- TRX PREDICTION. TRX cryptocurrency

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Xbox Game Pass September Wave 1 Revealed

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- INR RUB PREDICTION

2025-07-31 20:02