As a seasoned researcher with a keen interest in both politics and cryptocurrencies, I find myself intrigued by the prospect of the United States establishing strategic Bitcoin reserves. Having closely followed the crypto space for well over a decade, I can attest to the remarkable growth and potential of this digital asset.

In the year 2024, the U.S. election stood out as a significant milestone within the cryptocurrency sphere. Notably, the re-election of Donald Trump sparked renewed interest in Bitcoin and the broader crypto market, following a lackluster performance during the second and third quarters.

During his campaign for presidency, one of President-elect Trump’s proposed plans involved establishing a strategic Bitcoin reserve. Since then, many discussions about cryptocurrency have centered around this Bitcoin reserve and its possible influence on the U.S. economy and the overall crypto market.

Why Should The US Establish Strategic Bitcoin Reserves?

As a researcher delving into the realm of digital currencies, I’ve recently come across an intriguing perspective shared by Ki Young Ju, CEO and founder of CryptoQuant. In a discussion on the X platform, he posits that employing Bitcoin, the world’s largest cryptocurrency, as a strategic tool to mitigate U.S. debt could be a viable solution worth considering.

The CryptoQuant CEO mentioned:

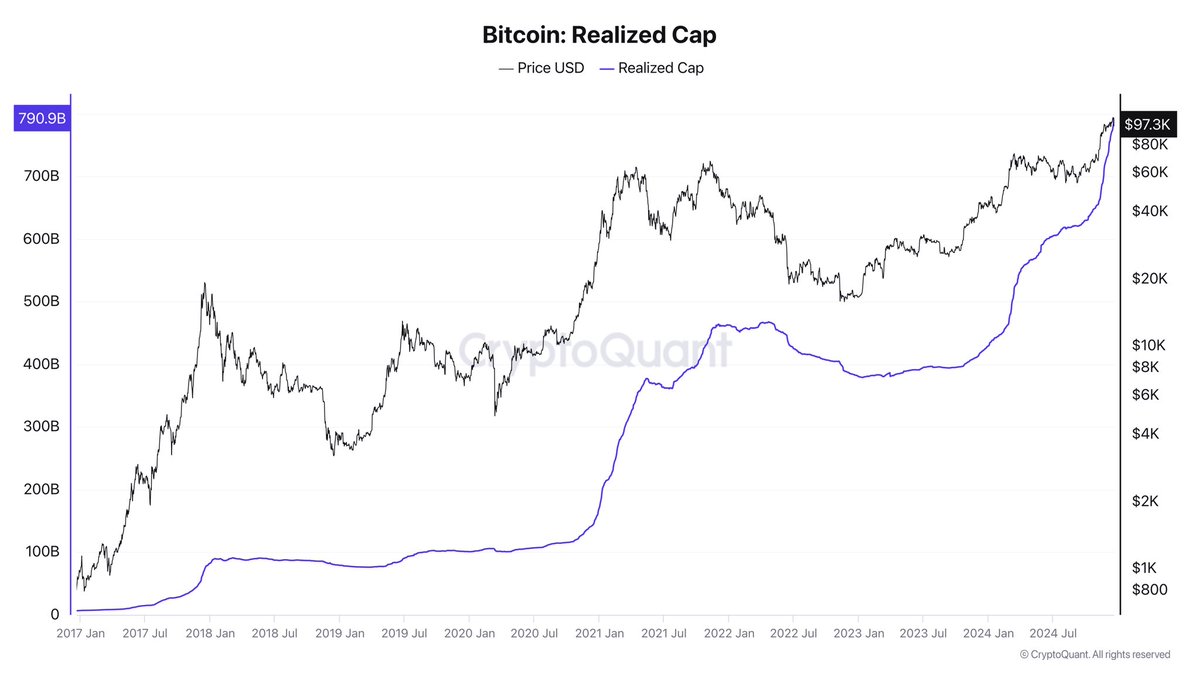

Over the last fifteen years, a staggering inflow of approximately $790 billion has catapulted Bitcoin’s market capitalization to an astounding $2 trillion. In this very year alone, an impressive $352 billion in inflows have contributed significantly to an additional $1 trillion in its market value. As an analyst, I find these figures truly remarkable.

If the U.S. government were to purchase 1 million Bitcoins by 2050 and classify it as a strategic asset, they could potentially reduce their domestic debt (representing about 70% of the total) by approximately 36%. Although foreign entities holding the remaining 30% of U.S. debt might find this strategy resistant, it’s important to note that the plan does not necessitate paying off all debt with Bitcoin, thus keeping the approach feasible according to the founder of CryptoQuant.

Ju Young posits that employing a “pumpable asset” such as Bitcoin for settling dollar-based debts might encounter issues regarding creditor acceptance. Conversely, if the United States were to establish a strategic reserve of Bitcoin, it could be viewed as an initial significant move towards globally legitimizing the leading cryptocurrency – similar to the recognition accorded to assets like gold over time.

In a recent post about X, the CEO of CryptoQuant pointed out a potential risk associated with building a strategic Bitcoin reserve: old whales selling their BTC in retaliation against the US government. Yet, if governments persistently buy Bitcoin up until 2050 and its value continues to increase, it’s unlikely that they would ever decide to sell it off, according to Young Ju.

BTC Price At A Glance

Currently, Bitcoin’s price stands approximately at $97,000, showing a minor decrease of 0.4% over the past day. Data from CoinGecko indicates that in the last week, Bitcoin has experienced a drop of 3.6%.

Read More

- REPO: All Guns & How To Get Them

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Top 5 Swords in Kingdom Come Deliverance 2

- LUNC PREDICTION. LUNC cryptocurrency

- REPO: How To Play Online With Friends

- BTC PREDICTION. BTC cryptocurrency

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- How to Reach 80,000M in Dead Rails

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

2024-12-22 12:42