In a twist of economic fate, President Trump’s new tariffs may just knock the US off its Bitcoin mining throne. The dream of being the global Bitcoin king could fade as tariffs make mining harder and more expensive. Who saw that coming? Oh right, everyone. 😏

On April 2, the Trump administration announced new tariffs that will raise the cost of essential mining equipment. And guess what? This could make the US a less competitive contender in the Bitcoin mining race. Not exactly a victory lap, is it?

Trump’s Tariffs: The Perfect Recipe for a Bitcoin Mining Snafu

Jaran Mellerud, CEO of Hashlabs Mining, explains that these new tariffs would hike the cost of importing mining machines to the US by at least 24%. Meanwhile, those countries like Finland—living the tariff-free dream—will keep on sailing smoothly. 🌊

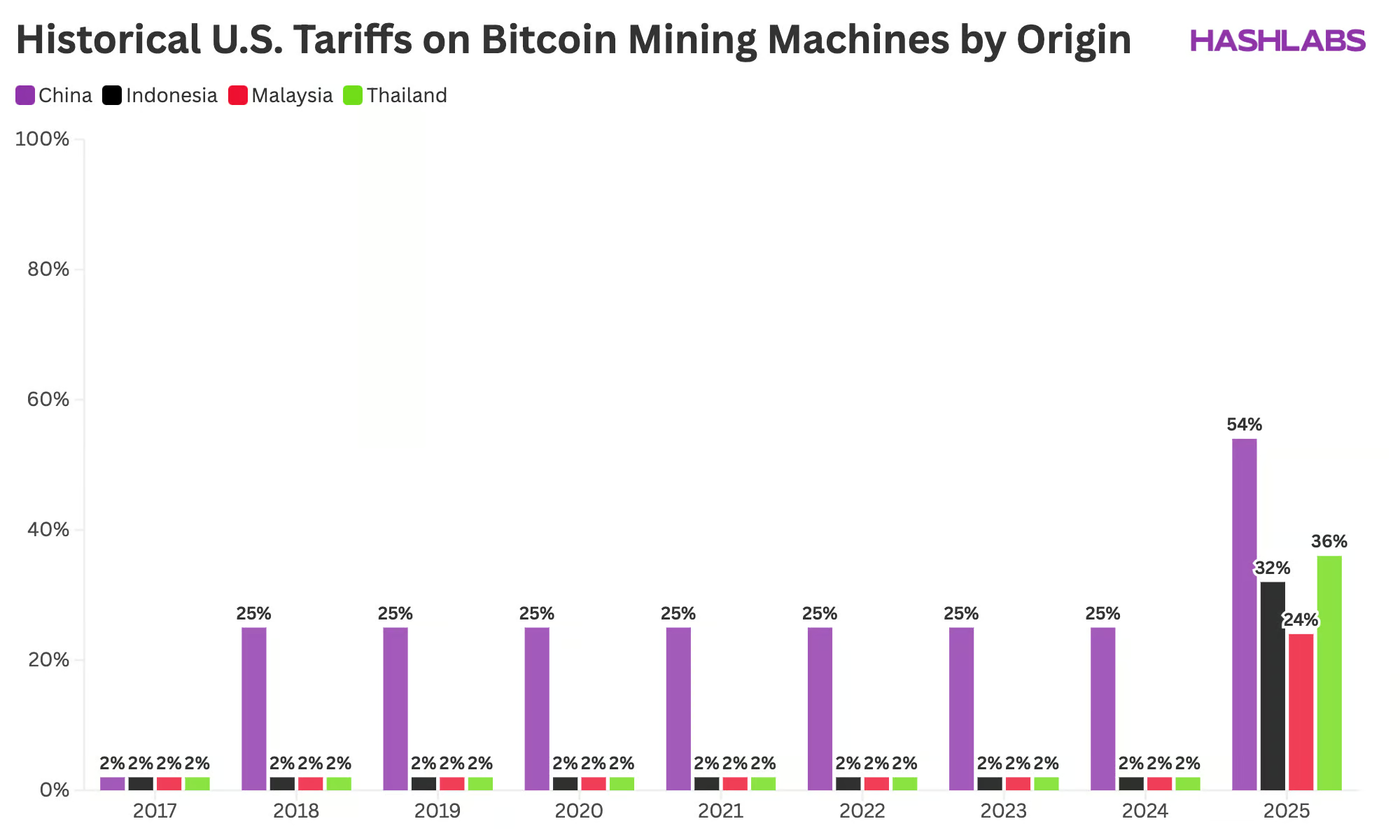

It turns out the US relies heavily on mining hardware made in Southeast Asia, primarily by giants like Bitmain, MicroBT, and Canaan. Sure, a 25% tariff on Chinese-made machines has been in play for years, but manufacturers cleverly sidestepped it by moving production to Southeast Asia. Sneaky, right? 😏

“This strategy worked well until earlier this month when Trump decided to raise tariffs on goods imported from Indonesia, Malaysia, and Thailand to 32%, 24%, and 36%, respectively,” said Mellerud. Oh, what a party pooper.

With tariffs cranked up, manufacturers are now trapped in a corner. The demand for mining machines may shrink, and they could be left with a pile of unsold equipment. Who wants to buy used mining rigs? They might have to lower prices to attract buyers from other regions, just to clear inventory. Talk about a fire sale. 🔥

“While it’s tough to say exactly how much prices will drop—since mining profits also matter—we can bet that, based on good ol’ supply-and-demand economics, a drop in demand will lead to falling prices,” Mellerud wisely stated. Oh, the joys of economic principles!

The Ripple Effect: Bitcoin Hashrate Redistribution

But wait, there’s more! It’s not just about the price of mining rigs. The US, which currently controls about 36% of global Bitcoin mining, might soon see its reign come to an end. As mining costs rise, the US could become less appealing to miners looking to expand. So, who’s ready to swoop in and take over? 😈

Countries unaffected by tariffs will be sitting pretty, gaining a competitive edge in this newly competitive market. The US may still be a player, but its dominance? Not so much. Prepare for a globally-distributed Bitcoin hashrate—no longer the domain of one power-hungry nation.

“In the grand scheme of things, this may give rise to a more geographically diverse Bitcoin mining landscape. The US will still matter, but its dominance will slowly fade,” said Mellerud, because, you know, capitalism is fickle.

Meanwhile, the global growth rate of Bitcoin mining could hit a speed bump. With the US slowing down, the global hashrate growth could be a lot slower than anticipated in the next 1-2 years. Oh well, global dominance was never that easy, was it?

“A 36% drop in global hashrate growth is a theoretical upper limit. In reality, the impact will likely be less severe,” said Mellerud, reassuring us that the worst-case scenario is still on the table. 🙄

In the long run, if US mining cools down, other countries might step in and pick up the slack. Miners never rest—unless they’re exhausted from all this tariff-induced drama.

Even if Trump reconsiders and reverses the tariffs, Mellerud points out that the damage to investor confidence is already done. Investors are skittish, and the sudden changes have made it harder for them to sink money into US-based mining operations. In an industry that thrives on long-term investments, this unpredictability is about as appealing as a Monday morning without coffee. 😩

“In a capital-intensive industry like Bitcoin mining, stability is key—and right now, we’re fresh out of that,” Mellerud concluded, presumably after sipping some strong coffee.

As if that weren’t enough, Trump’s tariff dance has caused a larger meltdown in both the stock and cryptocurrency markets. When the 104% tariff on Chinese imports hit, Bitcoin briefly plummeted below $75,000. The horror! 😱

Overall, the global cryptocurrency market capitalization took a 6.0% dive in just a day, proving that Trump’s policy moves really know how to shake things up. Let’s just hope they don’t break anything, too. 🤦♂️

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-04-09 09:19