As an experienced analyst with a deep understanding of the Bitcoin market, I’ve closely monitored its recent price action and have identified two key factors contributing to its current bearish momentum.

As a crypto investor, I’ve noticed that Bitcoin has faced some challenges lately, despite the increasing demand for spot Bitcoin Exchange-Traded Funds (ETFs). According to my analysis, there are several reasons behind Bitcoin’s current struggle:

Bitcoin Has Been Seeing A Rise In “Paper BTC” Recently

In a fresh discussion on platform X, financial analyst Willy Woo explains the reason behind Bitcoin’s recent bearish trend, despite the purchasing power exerted by spot Bitcoin Exchange-Traded Funds (ETFs) and prominent institutional investors.

Initially, the analyst discussed a reason for frequent spot transactions: the long-term investors (LTIs). These LTIs are individuals in the market who typically hold onto their cryptocurrencies for extended durations.

The investing behavior of these individuals is characterized by scarcity as they seldom dispose of their holdings. Their participation in selling seems to adhere to a consistent historical pattern, which can be observed through the following chart illustrating the Coin Days Destroyed (CDD) metric data.

As a crypto investor, I closely monitor the daily coin transactions recorded by the Coin Days Destroyed (CDD) metric. The CDD tallies up the number of coins moved on the blockchain each day and compares it to the age of those coins. When the CDD experiences a significant increase, it’s an indicator that many previously dormant coins have recently been activated.

In the graph, you can see that the Bitcoin CDD experienced a significant surge earlier in the year, coinciding with the asset reaching a new record price (all-time high or ATH). This implies that long-term holders may have sold a substantial amount during this price increase.

The chart shows that there were comparable peaks in the indicator during the mid-points of the 2017 and 2021 bull markets. Consequently, this recent selling wave by the long-term holders doesn’t represent an unusual occurrence based on historical trends.

As a crypto investor, I’ve noticed that one potential reason for the recent deceleration in my asset’s growth could be attributed to “paper Bitcoin.” This term signifies derivatives products in which investors don’t actually hold the physical Bitcoins themselves. Instead, they are betting on the price movements or own contracts representing those assets. These derivatives can impact the market and influence the price trend of Bitcoin, potentially slowing down its growth for those holding real tokens.

As the analyst notes:

In the past, Bitcoin (BTC) experienced exponential growth due to limited selling from early adopters (OGs) and minimal additional supply from miners’ newly minted coins. However, today’s focus should be on the influence of paper Bitcoins.

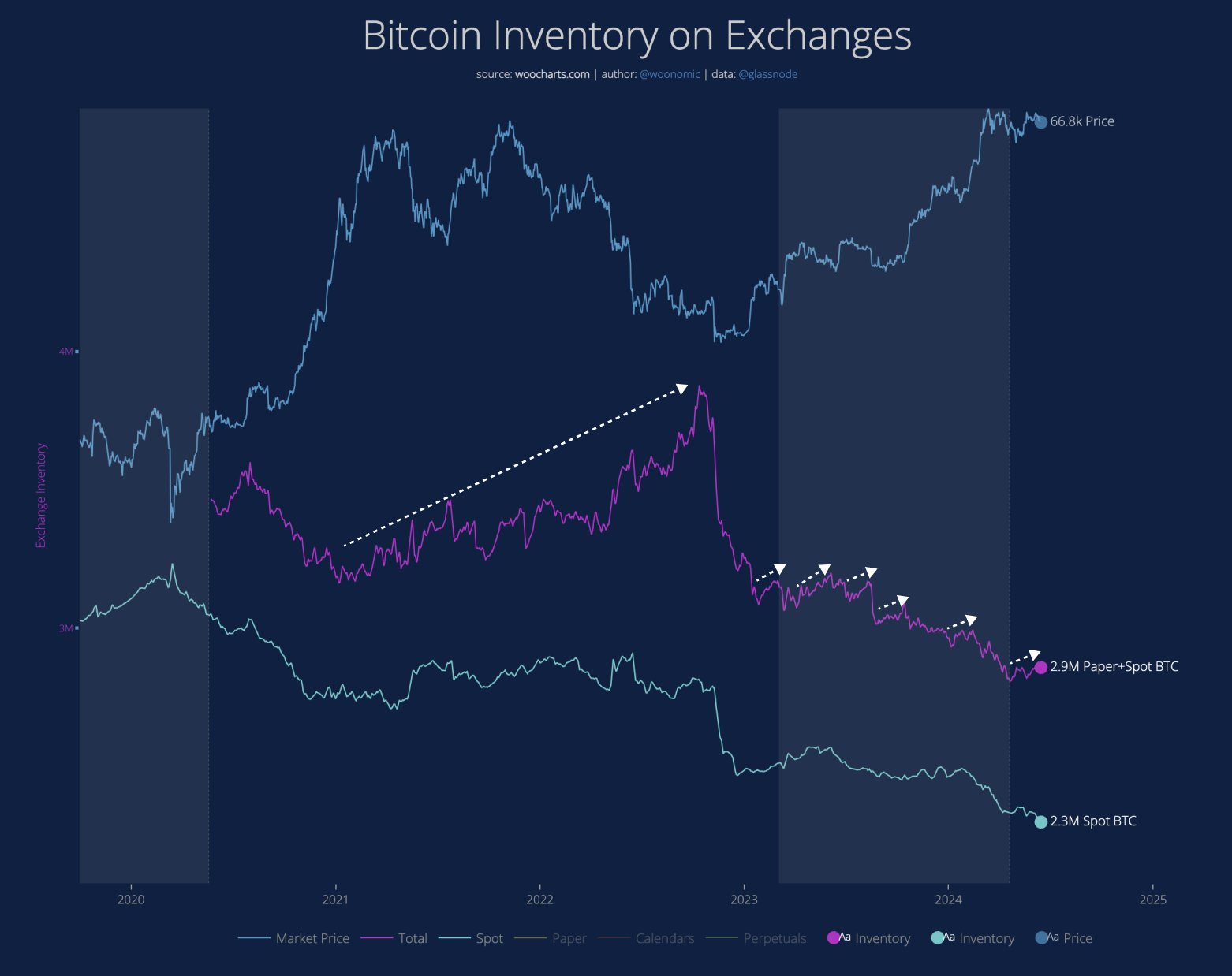

The chart below shows the Bitcoin inventory sitting on exchanges in recent years.

Based on the chart presented, the asset’s spot inventory has displayed predominantly decreasing and flat patterns over the past few years, indicating a lack of substantial net deposits to exchanges.

During the 2022 bear market, there was a rise in the combined amount of Bitcoin held as spot inventory and on paper. This growth indicates that a large volume of paper Bitcoin was being created swiftly, with the actual Bitcoin inventory remaining relatively stable during this time. Woo points out that this trend implies that paper Bitcoin may have influenced the market downturn.

As a crypto investor observing the current bull market, I’ve noticed an intriguing pattern in the graph. Each time the price of paper Bitcoin (BTC) has surged upward, it appears that the rally has subsequently lost some momentum.

As an analyst, I’ve noticed that the inventory of paper Bitcoins has been growing once more in recent times. This could potentially be a reason why Bitcoin has failed to gather enough steam and create a bullish trend.

BTC Price

Over the weekend, Bitcoin regained ground and surpassed the $66,000 threshold. However, its momentum faltered, and the cryptocurrency now hovers around $65,300 as of today.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- USD COP PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- SHI PREDICTION. SHI cryptocurrency

- IQ PREDICTION. IQ cryptocurrency

- TROY PREDICTION. TROY cryptocurrency

- PRIME PREDICTION. PRIME cryptocurrency

2024-06-18 06:12