Bitcoin’s recent dance on the financial floor has left analysts clutching their proverbial pearls. Some whisper of a catastrophic waltz toward ruin, while others merely suggest it’s doing a jittery jig that might already be coming to an end-probably just in time for tea.

Traditional Wisdom or Panic? The Old Guard Gets Dramatic

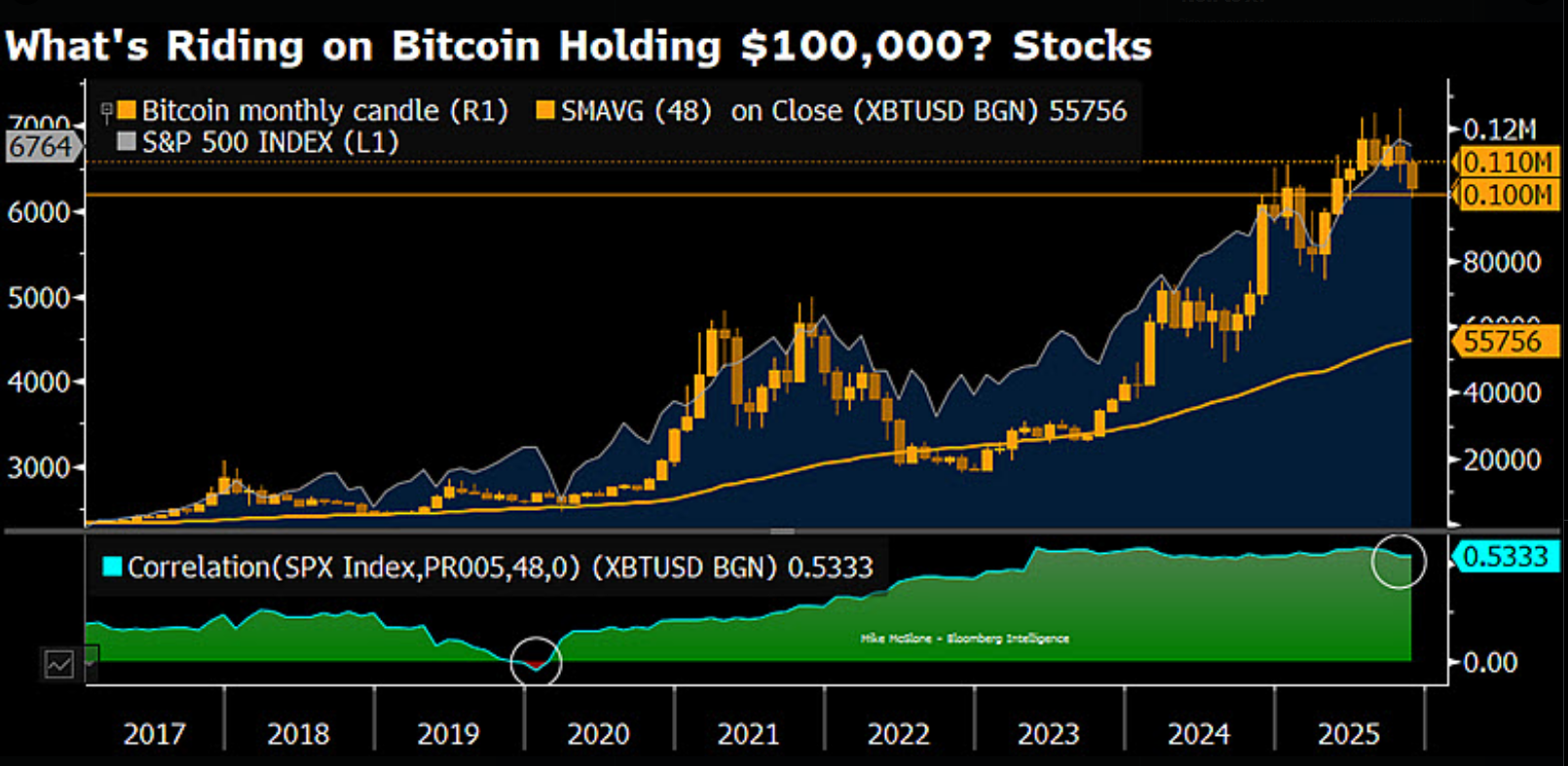

According to the wise and slightly caffeine-deprived Bloomberg sage Mike McGlone, Bitcoin might be on a bumpy road to somewhere around $56,000, which he charmingly dubs a “Speed Bump Toward $56,000.” Apparently, past rallies have the habit of reverting to their 48-month average-because why not?-and this could mean a graceful fall of almost 50% if the downward trend insists on playing hard to get. The market’s favorite drama critics are waving their arms wildly, warning of impending doom with the enthusiasm of a soap opera star.

Onchain Signals: The Crypto Mood Ring Is Slightly Less Dramatic

Meanwhile, the unsung heroes of crypto analysis-glass soot from the blockchain, if you will-show that Bitcoin dipped below the “psychological” $100,000 on November 4th, the first time in over four months; it then rebound like a rubber ball, bouncing back to about $101,500 (because who doesn’t love a good comeback story?).

“$100,000 Bitcoin – A Speed Bump Toward $56,000?“ The chart gods suggest a mild humility check-ordinary corrections, not full-blown panic attacks. So, breathe in, breathe out-probably still some time before everyone is selling their shoes in despair.”

– Mike McGlone (@mikemcglone11), November 6, 2025

Other onchain indicators, like the Market Value to Realized Value (MVRV), are whispering signals of a gentle correction, rather than a full-blown crisis. Their current ranges suggest investors are merely tidying up their virtual sock drawers, not fleeing from a burning house.

The Long View Gets a Slight Calming Potion

The ever-reliable Cathie Wood and her team have revised their crystal ball for Bitcoin from a lofty $1.5 million to a slightly more modest $1.2 million by 2030. Turns out, competition from stablecoins in emerging markets is like a persistent cat knocking over the future’s fragile glass of investor confidence. Even long-term bulls are adjusting-like changing a tire on a speeding motorcycle.

As the numbers and narratives tango, some indicators whisper calm, while others shout “dive now!” It’s a delightful dance, again and again. For every doom prophecy, there’s a sturdy blockchain metric hinting that perhaps, just perhaps, the whole thing is more of a complicated waltz than a terminal crash.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

2025-11-07 17:17