Well, hold onto your overpriced lattes! On a seemingly ordinary Monday, Bitcoin decided to throw a little party, crashing through the glorified barrier of $105,000 like a toddler at a cake shop—a sight to behold if you’re into high-stakes chaos.

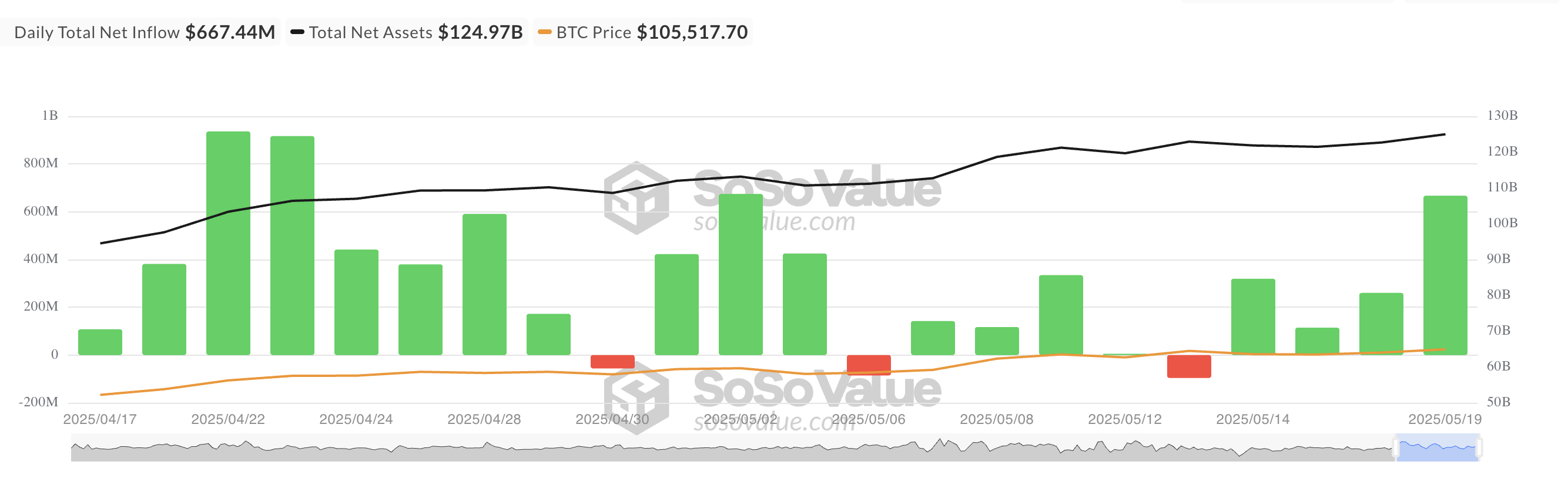

That very day, institutional investors celebrated by pouring over $650 million into spot Bitcoin exchange-traded funds (ETFs), led by none other than the caffeinated giants over at BlackRock, who clearly don’t care about your 10% annual return anymore.

Spot BTC ETFs Post Four-Day Inflow Streak

Yesterday, US-listed spot BTC ETFs raked in a staggering $667.44 million in a day—cue the confetti—marking the largest single-day inflow since early May when everything was a little less chaotic. I mean, who knew there was so much institutional appetite? And here I thought they were all just stockpiling toilet paper and cilantro.

During this wild trading escapade, Bitcoin momentarily flirted with the $107,108 mark, as if trying to impress that one snobby friend who only dates millionaires. Sure, it retreated a bit—but hey, staying above $105,000 was enough to nudge investors back to the edge of their chairs.

BlackRock’s glitzy ETF IBIT saw the biggest net inflow, scooping up $305.92 million like it was rummaging through a discount bin. Its total net inflows now stand at $45.86 billion, because why not? Might as well build a Bitcoin-themed amusement park while we’re at it.

Meanwhile, Fidelity’s ETF FBTC, taking notes from its demure cousin, attracted a respectable $188.08 million, nudging its historical total to a cozy $11.78 billion. This is all very touching, like a Hallmark movie—but with more greed and fewer warm hugs.

BTC Rally Gathers Steam

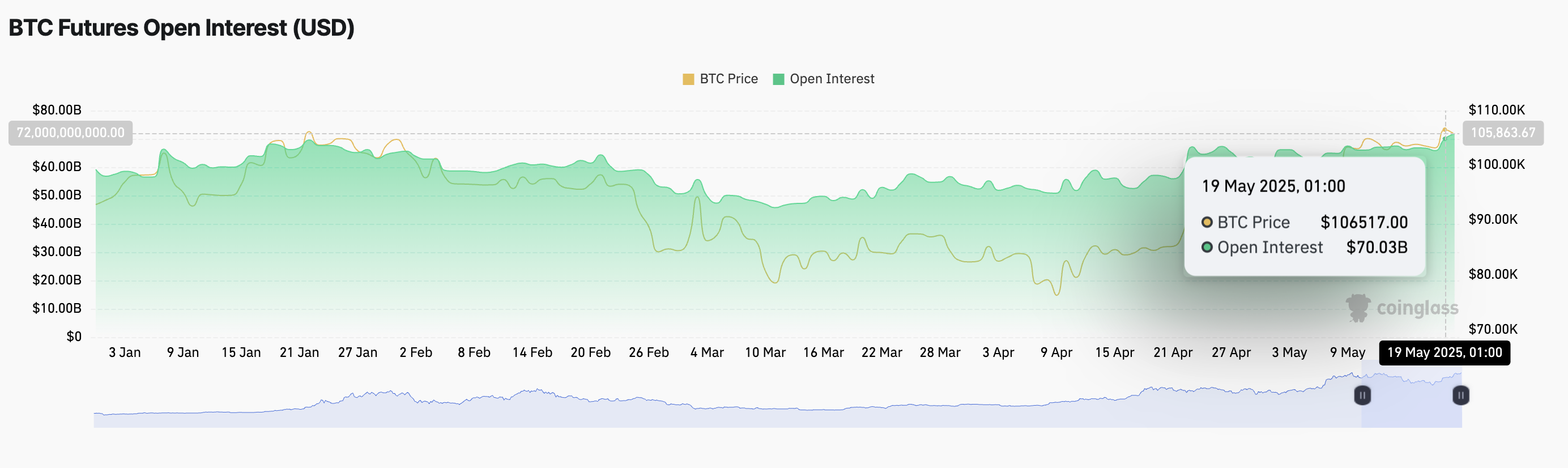

Currently, Bitcoin is up 3% and trading at $105,543. It’s like watching a puppy grow taller—so much potential! The bullish outlook is practically palatable, especially given that futures open interest has ballooned to over $70 billion, up just a smidge over the last 24 hours. Hold onto your wallets!

Now, when an asset’s open interest is having a growth spurt along with its price, you know there’s some fresh cash sloshing into the market like a kid at a candy store. This suggests we may have the makings of a substantial Bitcoin price rally—or at least a particularly boisterous game of who-can-hold-their-breath-the-longest.

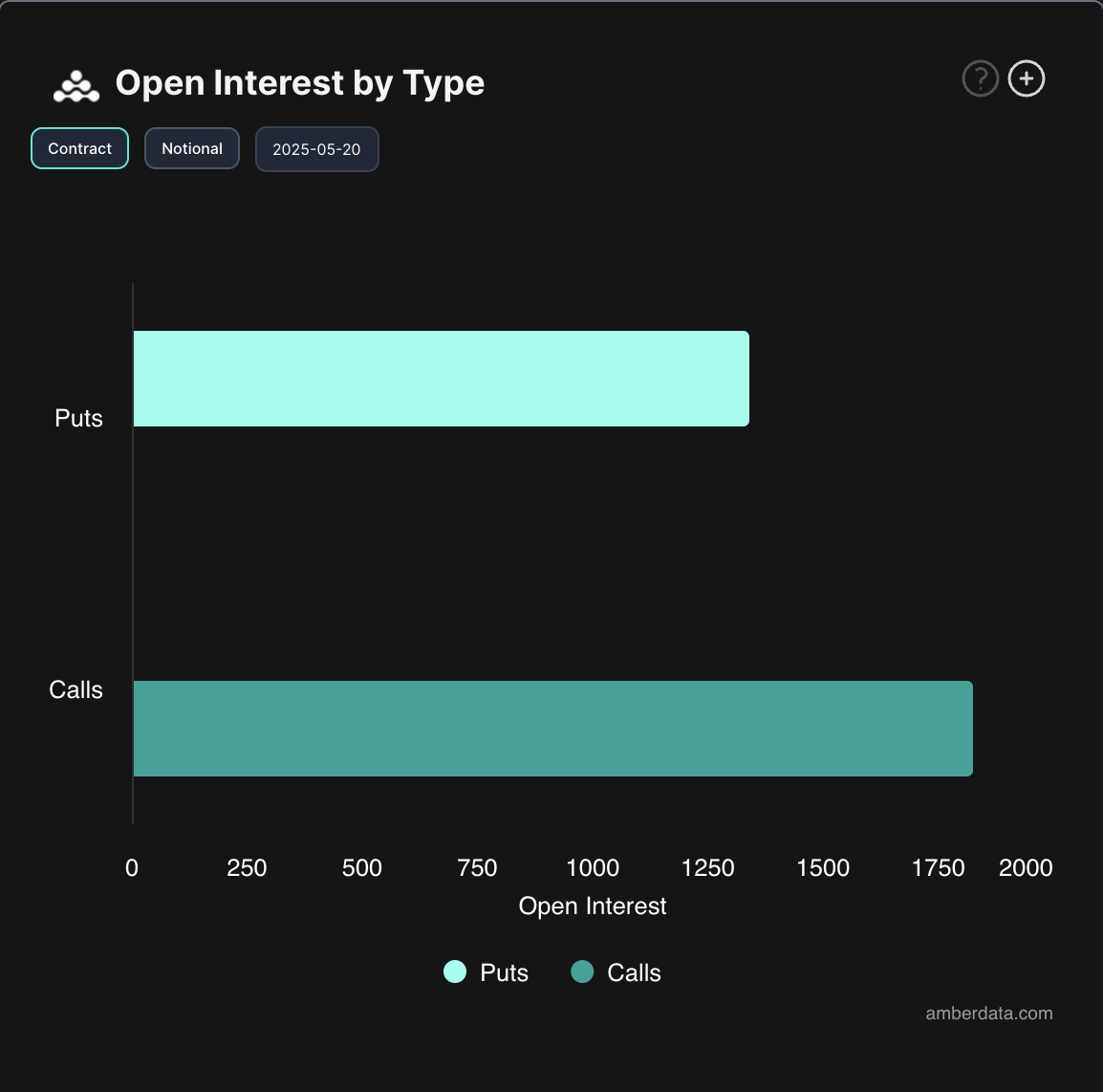

Oh, and speaking of exciting news, the options market is buzzing with call options—those delightful little contracts you buy when you’re betting that the price will soar higher than your expectations for a holiday dinner. Looks like optimism is back on the menu.

So here we are, with ETF inflows resembling a torrential rainstorm, climbing derivative activity, and Bitcoin tearing into a key psychological price level. It seems we might just be on the cusp of witnessing the king coin touch a brand-new all-time high. Or, you know, crash dramatically in a fit of existential despair—stay tuned!

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Tainted Grail The Fall of Avalon: How To Romance Alissa

- Nine Sols: 6 Best Jin Farming Methods

- AI16Z PREDICTION. AI16Z cryptocurrency

- USD ILS PREDICTION

- Rick and Morty S8 Ep1 Release Date SHOCK! You Won’t Believe When!

- Slormancer Huntress: God-Tier Builds REVEALED!

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1130: The Shocking Truth Behind Kuma’s Past Revealed!

2025-05-20 11:23