Key Takeaways:

- In a dramatic twist, AVAX has plummeted by 13.49% this week, now flirting with the perilous $20.07 mark, a level reminiscent of February’s lows, and ominously approaching the March support at $15.28. 🥶

- With a 6.82% drop in DeFi TVL and a net outflow of $2.47M on May 31, it seems the market is in full retreat mode. 🏃♂️💨

- The SEC’s decision to delay Grayscale’s AVAX ETF verdict until July 15 has sent shockwaves through market confidence, leaving many to wonder if the bears are now in charge. 🐻

- As if scripted by fate, the price has confirmed a descending triangle breakdown, slipping beneath the $21 support like a clumsy dancer at a ball. 💃

- Over 90% of AVAX holders are now nursing losses, a clear sign that the bears are having a field day. 🎉

AVAX Price Update: Avalanche Slips Below February Floor

In a tale of woe, Avalanche (AVAX) has broken through February’s low of $20.20, now trading at a disheartening $20.07 — its weakest level in three months. Despite a staggering 24-hour volume exceeding $568 million, the sellers are still calling the shots. 🎭

Attempts to cling to the $20.85–$21.00 support have failed miserably, with the price now careening towards March’s critical low of $15.28. The short-term structure has crumbled, increasing the likelihood of further declines. 📉

ETF Delay and Market Mood Drag AVAX and ADA

The SEC’s delay of Grayscale’s AVAX ETF verdict to July 15 came just after VanEck launched a shiny new institutional fund for Avalanche. Instead of igniting confidence, this delay has left the market feeling as deflated as a punctured balloon. 🎈

Cardano (ADA), caught in the same storm, has also seen its fortunes dwindle, proving that ETF indecision is a heavy anchor for layer-1 ecosystems. ⚓

Technical Outlook: Descending Triangle Breakdown in AVAXUSD

The daily AVAXUSD chart reveals a breakdown from a descending triangle pattern, as if the price were a soap bubble bursting under pressure. Lower highs since April have been compressing toward the $21 support base, which has now crumbled like a stale cookie. 🍪

The bearish continuation was confirmed by rising sell volume and the failure to defend $20.50. If $19.50 breaks, the $15.28 level becomes the next significant support, like a lifebuoy in a stormy sea. 🌊

Moreover, AVAX remains under all major EMAs — with the 20-day EMA at $22.55, 50-day at $22.18, 100-day at $23.15, and 200-day at $25.55 — forming a full bearish EMA stack that reinforces the downward spiral. 📉

Momentum Indicators Confirm Bearish Bias

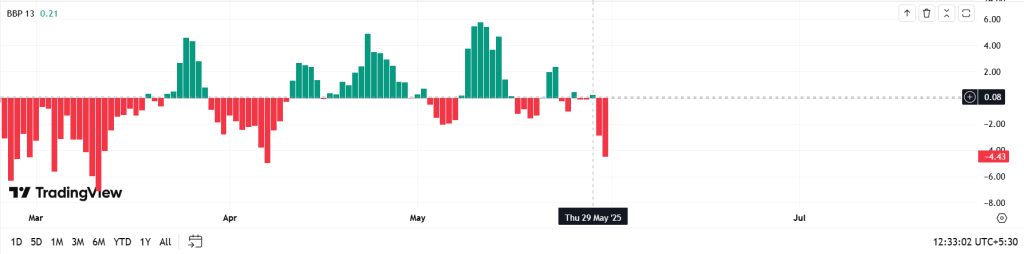

RSI is now at 39.79, clearly indicating bearish momentum. The MACD histogram has deepened into the red, with both the MACD and signal lines drifting further apart — a clear sign that the bears are in control. 🐻

The Bull-Bear Power (BBP) indicator has plummeted to -4.44, its lowest level since April. This sharp decline highlights that sellers have completely overwhelmed any bullish strength, reinforcing that the current move is not just a hiccup, but part of a sustained bearish trend. 😱

On-Chain Trends Signal Persistent Weakness

Avalanche’s DeFi TVL has dropped from $1.581b on May 28 to $1.473b by May 31 — a staggering $108M erosion in just three days, reflecting capital flight and reduced protocol engagement. 💸

Exchange activity also supports the bearish narrative. Over May 30–31, net outflows reached $4.34M, showing consistent user exits. 🚪

More than 90% of AVAX holders are now underwater, with only 3.93% in profit. This highlights a risk-off sentiment and increases the likelihood of further capitulation if support levels break. 😬

Conclusion: Breakdown Below $20.20 Sets Up Retest of March Support

AVAX has now breached its February low and is heading toward March’s $15.28 level. This confirms a bearish structure with potential continuation unless strong buyer interest emerges. 🧐

The full bearish EMA alignment and momentum indicators continue to support downside pressure. If $19.50 fails to hold, AVAX could test $15.28 in the short term.

Given ETF delays and heavy holder losses, the bearish trend may persist well into mid-June unless market structure flips decisively bullish. 🤷♂️

Read More

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail: How To Find Robbie’s Grave

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Hands-On Preview: Trainfort

- Slormancer Huntress: God-Tier Builds REVEALED!

- LUNC PREDICTION. LUNC cryptocurrency

- Best Awakened Hollyberry Build In Cookie Run Kingdom

2025-05-31 17:53