In a world where fortunes are made and lost with the flick of a digital switch, Bitcoin‘s price has recently soared like a lark, only to be met with a correction that would make even the most stoic investor weep. Yet, like a phoenix rising from the ashes, the crypto king sets its sights on reclaiming lost ground and continuing its majestic ascent. 🦅

This rebound, dear reader, seems not only possible but probable, thanks to the unwavering support of investors who, like loyal subjects, stabilize the market and breathe life into the weary spirits of traders everywhere.

Bitcoin Investors Remain Bullish

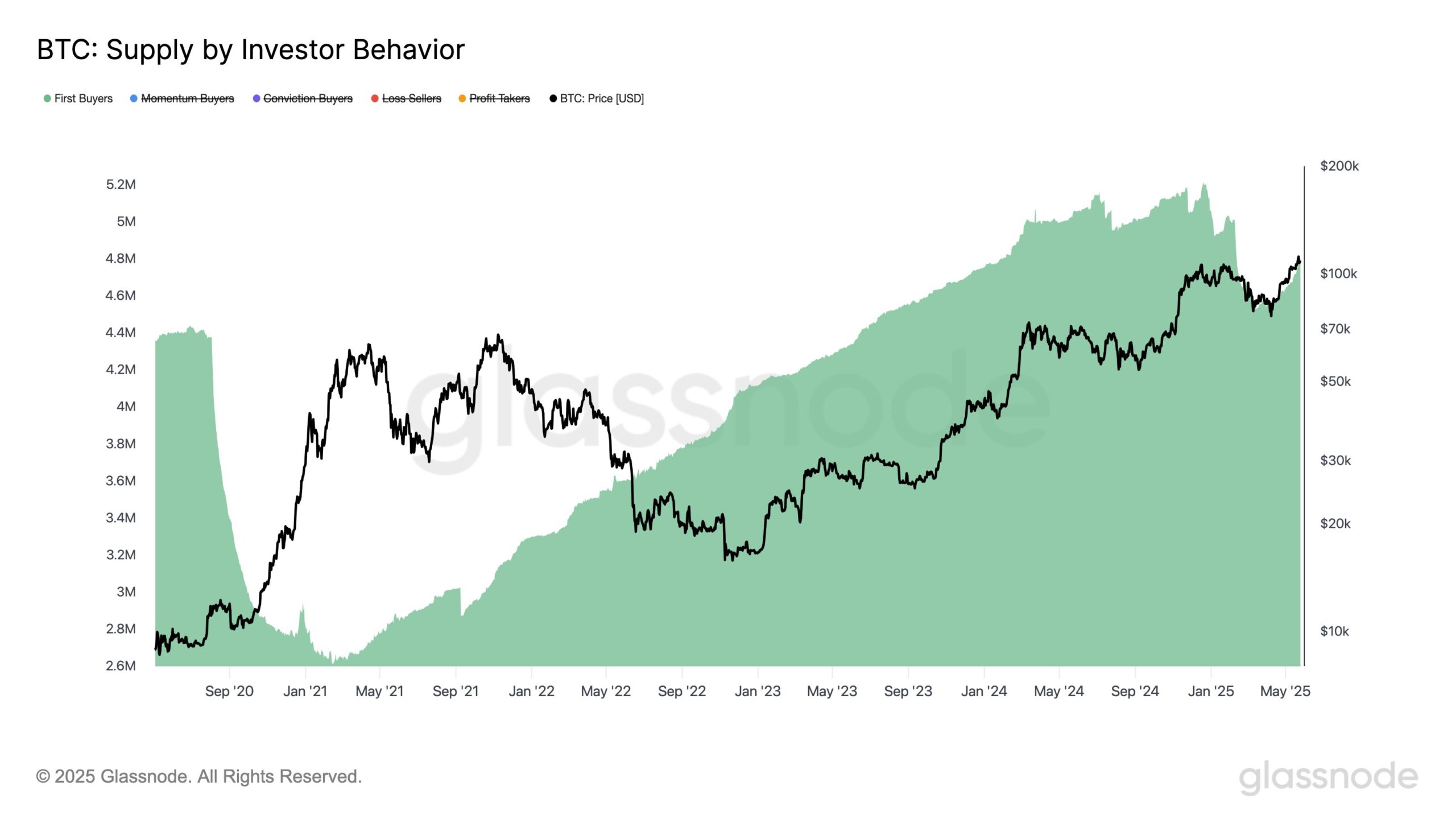

Ah, the Supply by Investor Behavior reveals a delightful uptick in Bitcoin. First-time buyers, those brave souls, have surged forth from July to December 2024 and again from March to May 2025. Coincidence? I think not! These periods align with significant price expansions, suggesting that fresh capital is flowing into the market like a river after a spring thaw.

Such inflows of new investors indicate a burgeoning confidence in Bitcoin’s future. This influx can sustain price growth by increasing demand, which, when paired with the limited supply, creates a delightful upward pressure on prices. Investors, it seems, are optimistic about Bitcoin’s long-term potential—perhaps they’ve been reading too many fairy tales! 📈

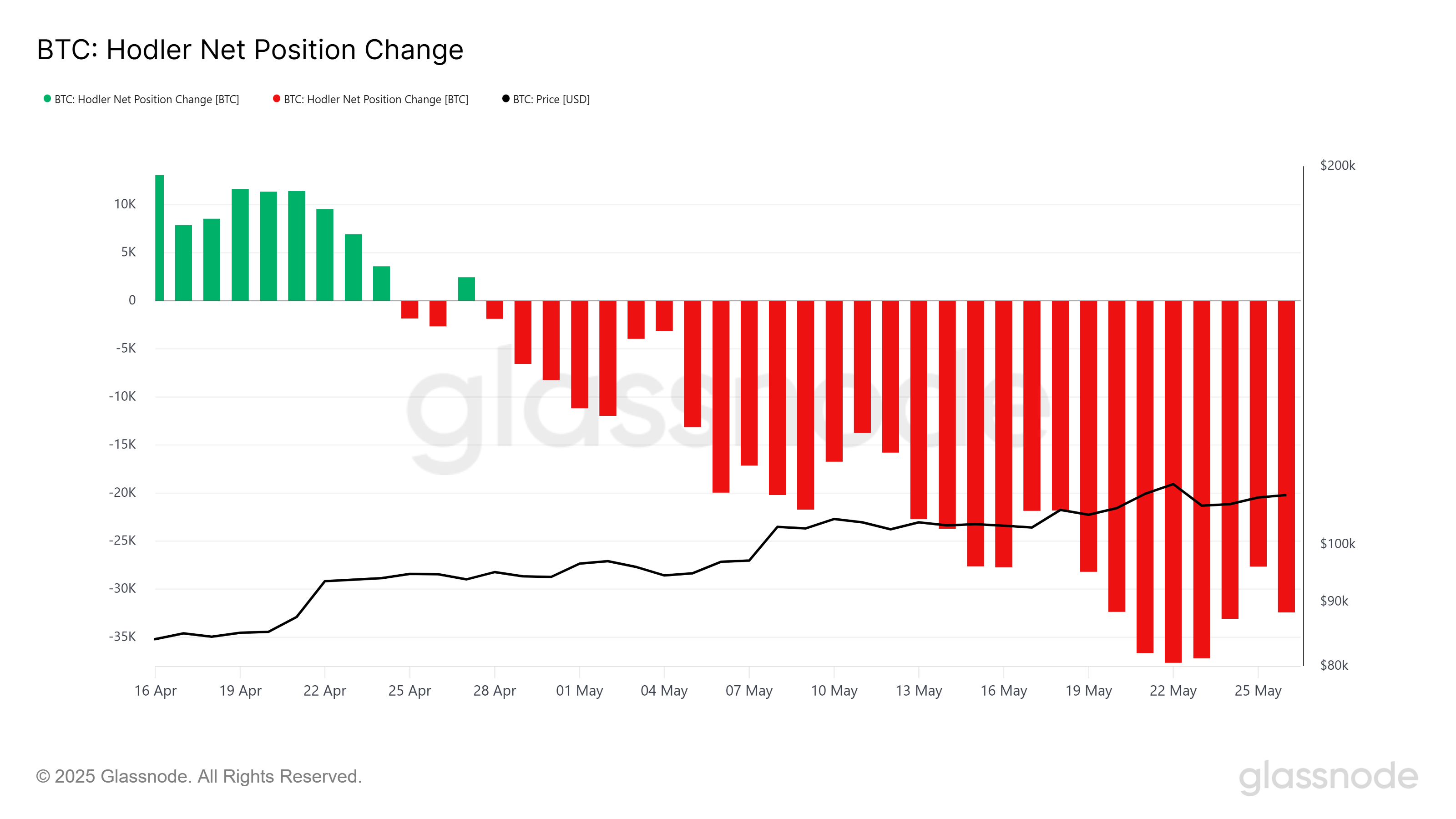

The HODLer Net Position Change reveals that long-term holders (LTHs) remain steadfastly bullish. These holders are akin to the wise old owls of the market, reducing the circulating supply by clutching their coins tightly. The extended red bars in the indicator signal active accumulation, keeping the price buoyant—like a well-fed cat lounging in the sun. 🐱

This steady accumulation by LTHs reflects a conviction so strong it could move mountains, helping Bitcoin maintain its resilience against the capricious winds of short-term market fluctuations. The continued buying pressure from these holders provides a sturdy foundation for sustained price increases, much like a well-built house in a storm.

BTC Price Needs To Secure Support

As it stands, Bitcoin’s price hovers at $109,160, just shy of the illustrious resistance level of $110,000. Flipping this psychological barrier into support is as essential as a good cup of tea on a rainy day for Bitcoin’s continued rise. Securing this level would restore bullish momentum and attract further buying interest, like moths to a flame. 🔥

If Bitcoin manages to hold above $110,000, the path to surpassing its all-time high of $111,980 appears as clear as a sunny day. This breakout could ignite a rally toward $115,000 in the coming days, fueled by renewed investor enthusiasm and favorable market conditions—like a well-timed joke at a dull party.

However, should the accumulation by LTHs slow or be countered by selling pressure, Bitcoin could find itself in a precarious position. A drop below $106,265 might send the price tumbling to $105,000, invalidating the current bullish outlook and sending traders into a cautious frenzy, much like a cat startled by a cucumber. 🥒

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-05-27 10:17