In a rather audacious proclamation, the ever-diligent Justin Bons, founder and chief investment officer of Cyber Capital, has posited that Bitcoin (BTC) could very well be heading for an untimely demise within a span of 7 to 11 years. Now, isn’t that a delightful thought?

He has astutely pointed out the waning security budgets, the ominous rise of 51% attacks, and what he categorizes as “impossible choices” for our dear digital currency. Bons warns that these fundamental vulnerabilities could very well erode trust and, heaven forbid, lead to chain splits! What a melodrama!

Bitcoin’s Economic Security Model Under Scrutiny

Over the years, experts have raised alarms about several risks to Bitcoin, most notably quantum computing, which may undermine current cryptographic standards-yes, because that’s exactly what we need, isn’t it? A little existential threat to spice things up!

However, in a rather detailed exposition, Bons outlined a different category of concern. He argued that Bitcoin’s long-term threat lies in its economic security model-not to be confused with your average economic model, mind you.

“BTC will collapse within 7 to 11 years from now! First, the mining industry will fall, as the security budget shrinks. That is when the attacks begin; censorship & double-spends,” he wrote, probably while sipping a cup of tea.

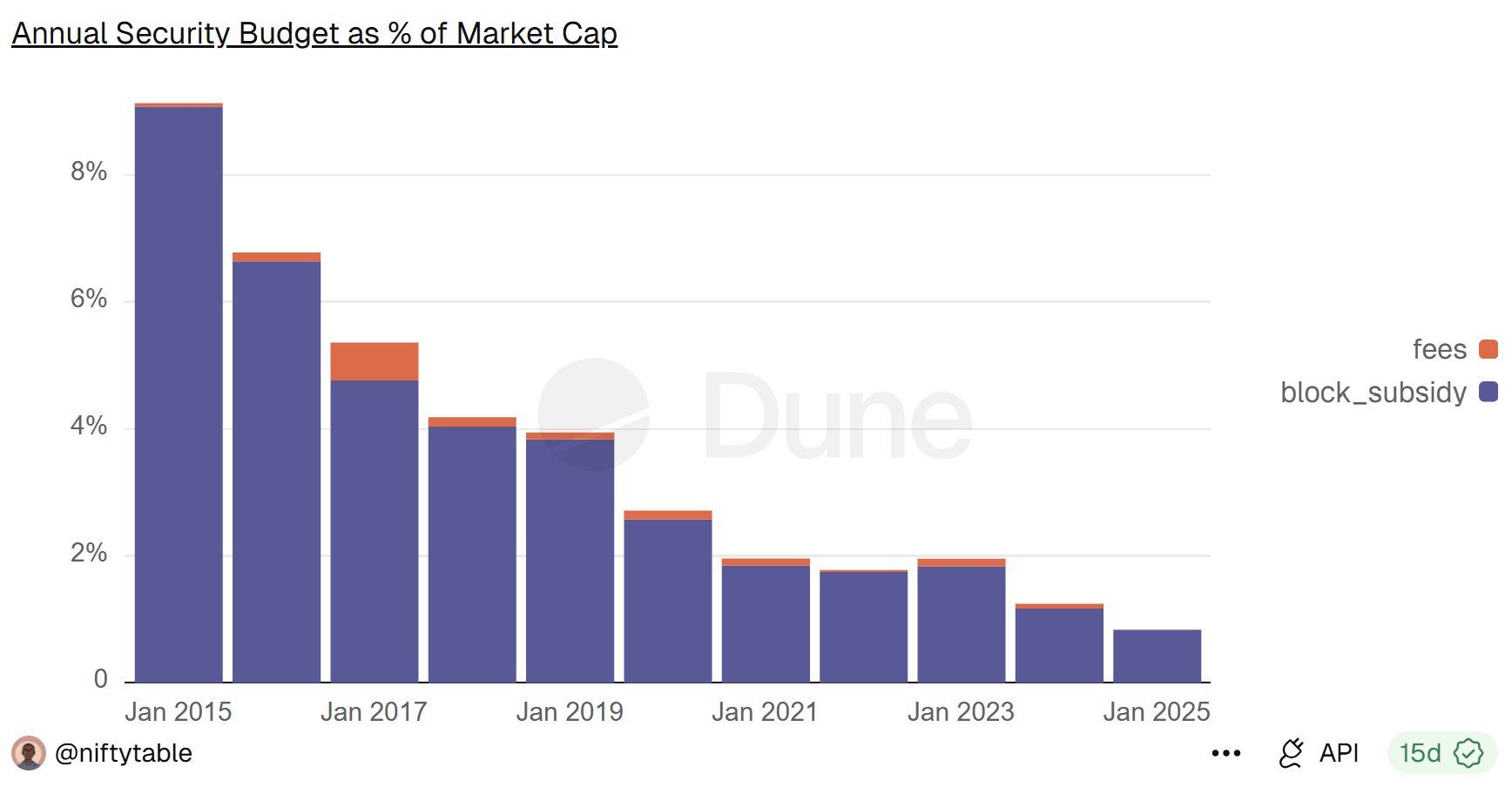

At the heart of his argument is Bitcoin’s declining security budget. After each halving event, miner rewards drop by half, which logically reduces the incentive to secure the network. Who would have thought, right?

The most recent halving took place in April 2024, with more scheduled every four years-like clockwork. Bons contended that to maintain its current level of security, Bitcoin would require either sustained exponential price growth or permanently high transaction fees, both of which he considers about as likely as finding a unicorn.

Declining Miner Revenue and Rising Attack Risk

According to Bons-who clearly enjoys being the harbinger of doom-miner revenue, rather than raw hashrate, is the most meaningful measure of network security. He highlighted that as hardware efficiency improves, hashrate can rise even while the cost of producing hashes plummets, which makes it a rather misleading indicator of attack resistance. Welcome to the paradox of Bitcoin!

In his self-proclaimed wisdom, declining miner revenue directly lowers the cost of attacking the network. Once the cost of mounting a 51% attack falls below the potential gains from double-spending or disruption, such attacks become economically rational-because who doesn’t love a good heist?

“Crypto-economic game theory relies on punishment & reward, carrots & sticks. This is why miner revenue determines the cost of an attack. When it comes to the reward side of the calculation: Double-spending, with 51% attacks targeting exchanges, is a highly realistic attack vector due to the massive potential rewards,” the post read, echoing the sentiments of a seasoned poker player.

Currently, transaction fees account for only a small portion of miner income. As block subsidies approach zero over the coming decades, Bitcoin would need to rely almost exclusively on fees to secure the network. However, Bitcoin’s limited block space caps transaction throughput and thereby total fee revenue, making this a delightful conundrum!

Bons further claimed that sustained high fees are unlikely, as users tend to exit the network during fee spikes-because, of course, nobody likes spending money!

Congestion, Bank-Run Dynamics, and a Potential Death Spiral

Apart from concerns about the security budget, Bons warned of potential “bank-run” scenarios. According to him:

“Even according to the most conservative estimates, if every current BTC user only did one transaction, the queue would be 1.82 months long!”

He explained that during moments of panic, the network may be unable to process withdrawals quickly enough, effectively trapping users through congestion and rising fees-much like my last visit to the DMV.

Bons also pointed to Bitcoin’s two-week difficulty adjustment mechanism as a compounding risk. In the event of a sharp price decline, unprofitable miners might just shut down, slowing block production until the next adjustment. A perfect storm, really!

“As the panic would cause the price to crash, which in turn causes more miners to shut down, which in turn slows the chain down even more, causing even more panic & the price to crash again & even more miners shutting down, etc, etc; ad infinitum… That is known as a vicious cycle in game theory, also referred to as a negative feedback loop or a death spiral,” he remarked, perhaps while contemplating a career in stand-up comedy.

He further added that such congestion risks make mass self-custody unsafe during periods of stress, warning that users may be unable to exit the network when demand spikes-because nothing says “safety” like being trapped in a digital maze!

An Unavoidable Dilemma for Bitcoin

Bons concluded that Bitcoin faces a fundamental dilemma of epic proportions. One option would be to increase the total supply beyond the 21 million coin limit to preserve miner incentives and network security-a move that would undoubtedly cause the purists to clutch their pearls. However, he noted this would undermine Bitcoin’s core value proposition and likely lead to a chain split. Oh, the drama!

The alternative, he said, is to tolerate a steadily weakening security model, increasing exposure to attacks and censorship-which sounds positively thrilling, doesn’t it?

“The most likely outcome is that in 7-11 years from now, both of the options I described & more occur simultaneously,” Bons wrote, undoubtedly enjoying the chaos.

He also tied the issue to the legacy of the block size wars, arguing that governance constraints within Bitcoin Core make meaningful protocol changes politically unlikely until a crisis forces action. By that point, he warns, it may already be too late-an absolutely charming thought!

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Who Is the Information Broker in The Sims 4?

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2026-01-16 16:43