Oh, how the mighty have fallen! Bitcoin‘s network activity has recently dropped into what we so lovingly call the “bear market zone.” Should you run for the hills, or should you start stocking up on more of those precious digital coins? Let’s dive in and see.

CryptoQuant’s Bear Market Alert—But Is It Really a Bear?

As pointed out by an analyst in a recent CryptoQuant Quicktake post, Bitcoin’s Network Activity Index has recently dipped into the dreaded “bear phase.” Now, don’t let that sound too scary—this index simply tracks how busy Bitcoin’s network is, measuring everything from transaction counts to daily active addresses. It’s a fancy way of saying, “How much are people actually using this stuff?”

Here’s a chart to help you visualize the panic (or the opportunity—your choice):

From the chart, it’s clear: Bitcoin’s Network Activity Index hit a glorious peak last year, but since December, it’s been on a downward spiral. Translation? People are losing interest in using Bitcoin. And let’s be real—without network activity, Bitcoin can’t keep soaring. So, when the index drops, it’s not exactly a good sign.

But wait! There’s a twist. Despite this downward trend, the Bitcoin Network Activity Index is still stuck in the “bear phase” even after the latest price recovery. Yep, that red flag is still flying high. Historically, this has been the precursor to a bear market, right before the price crashes. But here’s the catch: the last time this happened, in the second half of 2021, Bitcoin defied the odds and surged. Go figure.

So, what does this mean for you, dear investor? Is this bear market signal a warning to sell everything, or is it an opportunity to pick up some discounted Bitcoin? While a decrease in network activity can signal doom, it also means it might be a prime time to buy while others are in panic mode.

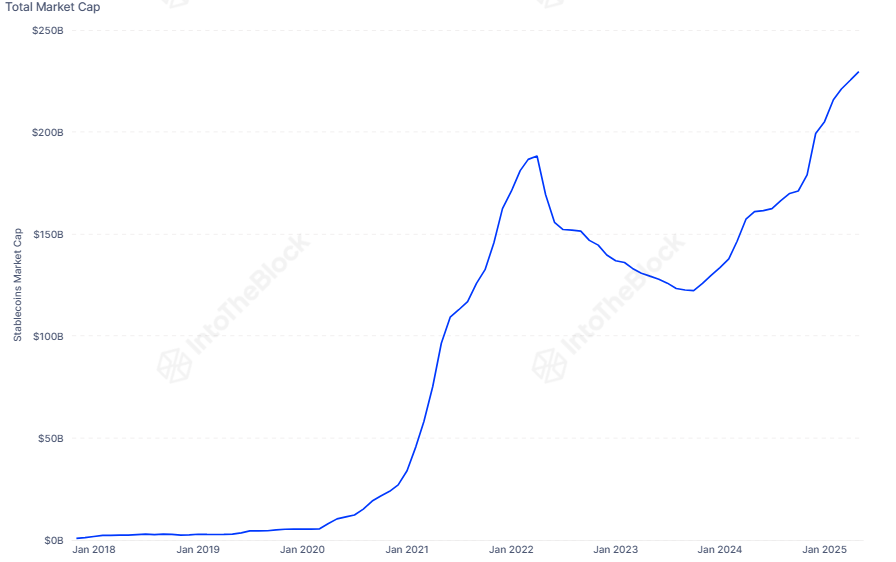

In other news, the combined market cap of stablecoins just hit a new all-time high (ATH), according to IntoTheBlock. Maybe stablecoins are the new hot ticket for investors? Who knows. Maybe that capital will spill into Bitcoin like a flood of digital optimism.

So, what does that mean? Well, more stablecoins mean more money potentially flowing into Bitcoin. Maybe, just maybe, that’s a bullish sign for the whole crypto market. But then again, maybe not. Who knows?

BTC Price

As of now, Bitcoin is hovering around $93,800—down by a whole 1% this week. Seems like the market’s got a case of the blues. But hey, don’t count it out just yet.

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- USD ILS PREDICTION

- How to Get 100% Chameleon in Oblivion Remastered

- How to Reach 80,000M in Dead Rails

- Invincible’s Strongest Female Characters

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

2025-05-07 02:31