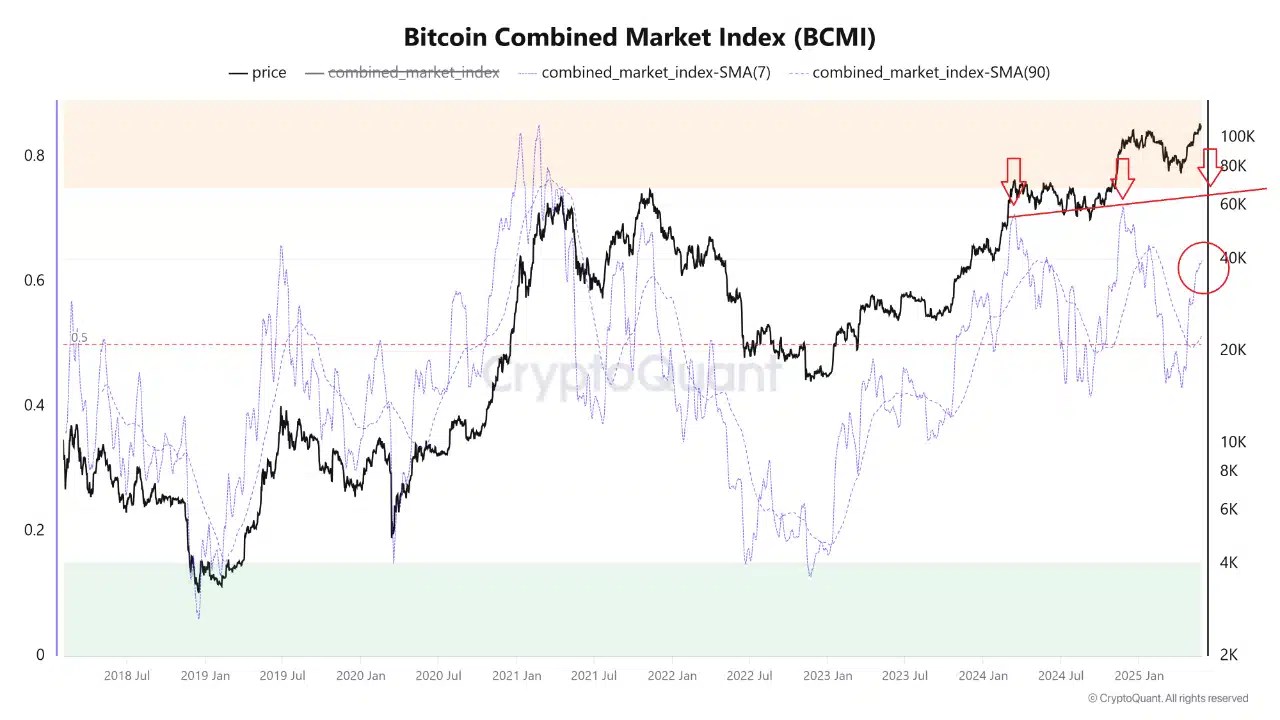

- Bitcoin CMI bounces back to 0.6, hinting at a glimmer of hope as sentiment and metrics improve. 🌟

- Excessive short positioning could turn the tables if accumulation picks up steam. 🚀

Bitcoin’s [BTC] Combined Market Index (BCMI) has made a sharp U-turn, with its 7-day SMA soaring to ~0.6. This could be an early sign that the market is starting to feel a bit more optimistic. 🌈

This little bounce comes as profit-taking slows down and core on-chain metrics start to look a bit rosier. Of course, the long-term picture is still a bit more reserved.

The 90-day SMA is holding steady around 0.45, which means the market is still in a neutral zone, far from being overly excited. 🤷♀️

Now, with profit-taking slowing and on-chain fundamentals stabilizing, the big question is: Is this bounce for real, or is it just another fakeout? 🤔

Bitcoin’s NVT Metrics Take a Tumble, Signaling a Valuation Reset

The NVT Golden Cross took a nosedive of 78.68% to 0.29, suggesting the market might have just exited a local peak. 📉

Meanwhile, the standard NVT Ratio dropped by 13.1% to 27.37, indicating that transaction volume is picking up relative to market cap. 📊

These declines point to a valuation reset and hint at stronger organic network activity. So, while prices are still a bit lackluster, the underlying value is getting stronger. 🌱

This makes the BCMI’s uptrend feel a bit more genuine and less like a mirage. 🌴

Exchange Reserves Show Light Accumulation, But Low Conviction

Bitcoin’s total Exchange Reserve dipped by 1.36% to $263.45 billion, indicating a slight outflow. Historically, decreasing reserves mean coins are moving off exchanges into long-term storage. 🏦

However, the scale of these outflows is pretty modest, suggesting that market confidence is still on the low side. This aligns with the muted tone of the 90-day BCMI SMA.

So, while accumulation might be starting, it’s happening cautiously. We’d need to see more significant reserve drops to confirm a stronger recovery phase. 🤞

Bitcoin’s Short Dominance Could Spark Volatility if Sentiment Shifts

As of May 29th, the Long/Short Ratio fell to 0.886, with short positions making up 53.01% of the total. This shows that traders are still leaning bearish, despite the improving sentiment signals. 🐻

When shorts dominate, it increases the risk of a short squeeze if the price suddenly moves higher. 🚨

So, while the BCMI rebound reflects better sentiment, this short-heavy positioning could amplify volatility in either direction. If buyers take control, we could see Bitcoin rocket past $110K in no time. 🚀

Is the BCMI Rebound the Start of a Real Recovery?

Possibly.

The BCMI’s sharp 7-day rebound, coupled with improved NVT ratios and modest reserve outflows, suggests early accumulation. However, stable long-term metrics and prevailing short positions indicate the market is still being cautious. 🤔

A sustainable recovery might be on the horizon, but we need stronger accumulation and price momentum to confirm it. 🌟

Read More

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail The Fall of Avalon: How To Romance Alissa

- Nine Sols: 6 Best Jin Farming Methods

- USD ILS PREDICTION

- AI16Z PREDICTION. AI16Z cryptocurrency

- Slormancer Huntress: God-Tier Builds REVEALED!

- Delta Force: K437 Guide (Best Build & How to Unlock)

- Tainted Grail: How To Find Robbie’s Grave

- LUNC PREDICTION. LUNC cryptocurrency

2025-05-30 04:11