As a researcher with a background in financial markets and a keen interest in cryptocurrencies, I find Peter Brandt’s latest analysis on Bitcoin’s potential peak intriguing. His use of exponential decay theory to explain the diminishing momentum in each successive bull cycle is an insightful approach that warrants serious consideration.

As a crypto investor, I’ve come across Peter Brandt’s latest analysis with great interest. In his piece titled “Does History Suggest That Bitcoin Has Peaked?”, he shares some compelling insights based on market trends and historical data.

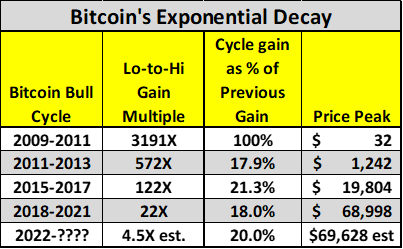

The seasoned trader explores the idea of exponential decay in his latest essay, implying that the drive behind Bitcoin’s bull markets has progressively weakened over the years.

As a researcher studying the trends in Bitcoin’s price movements, I’ve observed that Brandt identifies four major bull markets in Bitcoin’s history up to now. The recent surge represents the fifth cycle. However, I find it noteworthy that there seems to be a concerning pattern emerging. Each subsequent bull market shows a decreasing exponential growth rate, suggesting a loss of approximately 80% of the previous cycle’s momentum.

As a researcher studying Bitcoin trends, I project that we could see a peak price of approximately $72,723 in the current market cycle based on recent trading patterns and historical precedents set by halving events. However, it’s important to note the potential impact of exponential decay, which may suggest a 25% chance that Bitcoin has already reached its peak for this cycle. While acknowledging the significance of past price surges following halving events, I urge caution in interpreting these trends and remaining mindful of market volatility.

If the market reaches its peak, he anticipates possible price drops, predicting a decline to around $30,000 per BTC or possibly revisiting 2021’s lower prices. Although this outlook suggests a bearish trend, he believes such a correction could be beneficial in the future, as it may mirror chart patterns similar to those seen in the gold market.

Brandt finishes his examination, conceding the significance of the information, “I have reservations about accepting this analysis, but the data make a compelling case on their own.”

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- LBT PREDICTION. LBT cryptocurrency

- PRIME PREDICTION. PRIME cryptocurrency

- TAO PREDICTION. TAO cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

2024-04-27 13:13