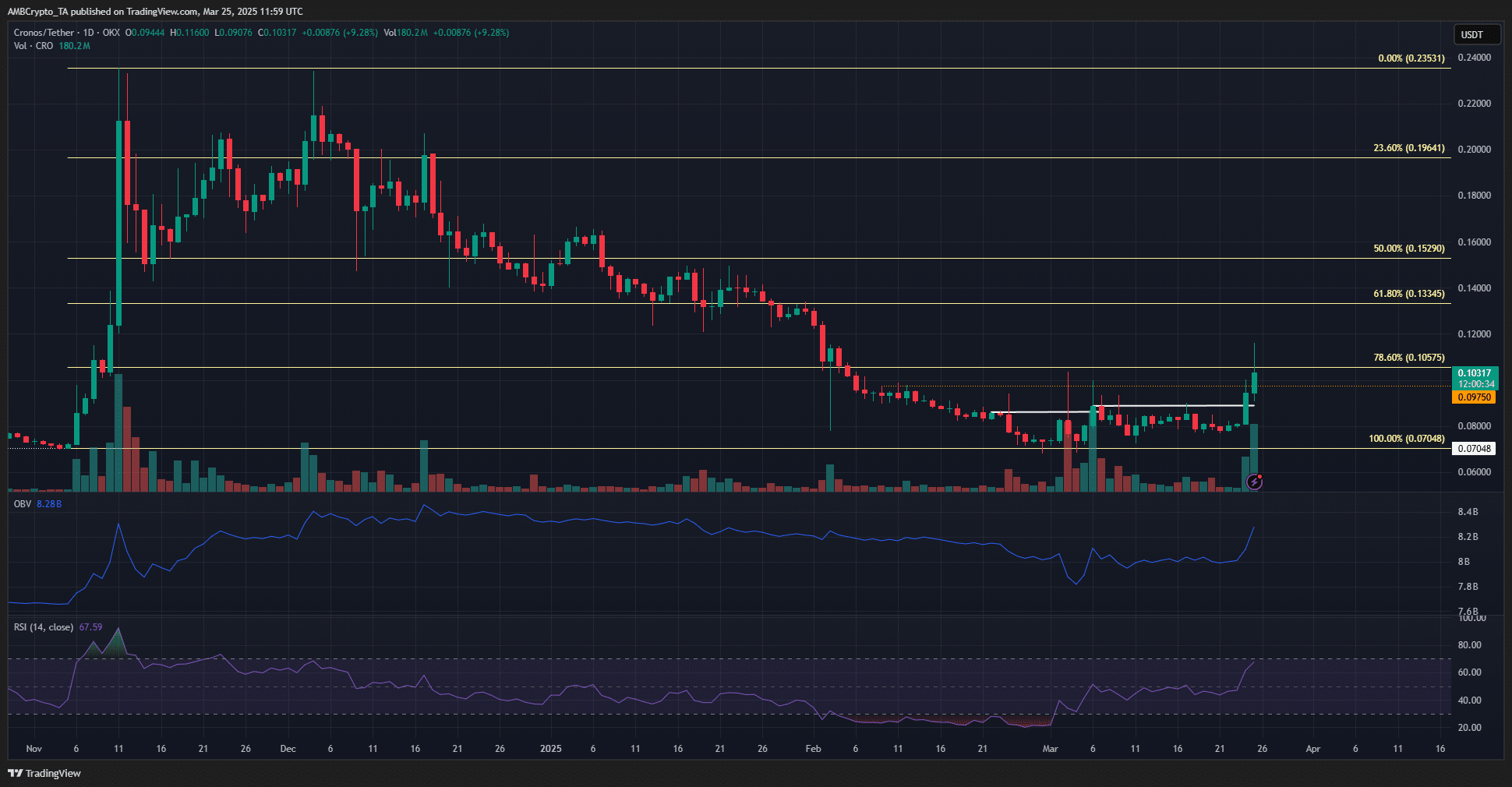

- Our dear friend Cronos has donned its bullish attire on the daily chart, attempting to flip $0.1 into a cozy support.

- With a veritable stampede of buying pressure accompanying the price breakout, further gains seem to be on the horizon, much like a well-timed entrance at a soirée.

Ah, Cronos [CRO], once known as Crypto.com Coin, has been strutting its stuff with a splendid 27.7% gain over the past 36 hours. However, as is often the case with such exuberance, a slight pullback is on the cards—expected to be a modest 5%, mind you, not a full-blown fainting spell.

The 1-day price action for our gallant Cronos is positively bullish. With buying pressure rising like a soufflé, it appears the CRO bulls are poised to initiate a recovery, provided they don’t trip over their own hooves.

Cronos: The Second Bullish Market Structure Break – A Tale of Triumph!

In white, the two daily timeframe market structure breaks are marked, much like a well-placed bowtie at a wedding. The price has gallantly leapt above the local resistance level at $0.0975, making a valiant attempt to scale the $0.105 resistance like a determined mountaineer.

The OBV has seen a robust uptick, as trading volume has been as high as a kite in a windstorm. This breakout beyond local resistance, backed by high volume, is a sight to behold for the bulls, who are likely to be toasting with champagne at this news.

The 1-day RSI has also surged past the neutral 50, showcasing a bullish momentum that would make even the most stoic of bears reconsider their life choices.

If the current demand can be sustained, Cronos has a splendid chance of initiating a rally higher. However, should it sink below $0.1 and $0.0975 in the coming days, we might find ourselves in the midst of a classic fake-out, akin to a magician’s disappearing act.

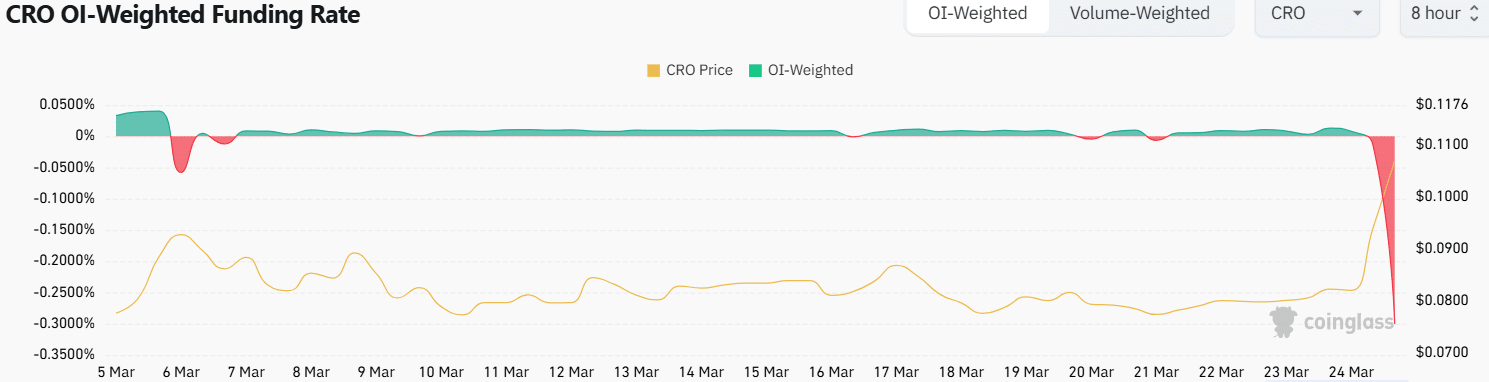

The Funding Rate, dear reader, is steeply negative, standing at a rather dismal -0.3% at press time. It last fell into negative territory on the 6th of March, marking the local price top at $0.093—an event that surely sent shivers down the spines of many a trader.

With short sellers crowding the derivatives market like guests at a poorly organized buffet, the recent surge might just mark the local top again. However, let us not forget that a local top does not detract from the bullish market structure on the daily chart, which remains as sturdy as a butler’s resolve to serve tea on time.

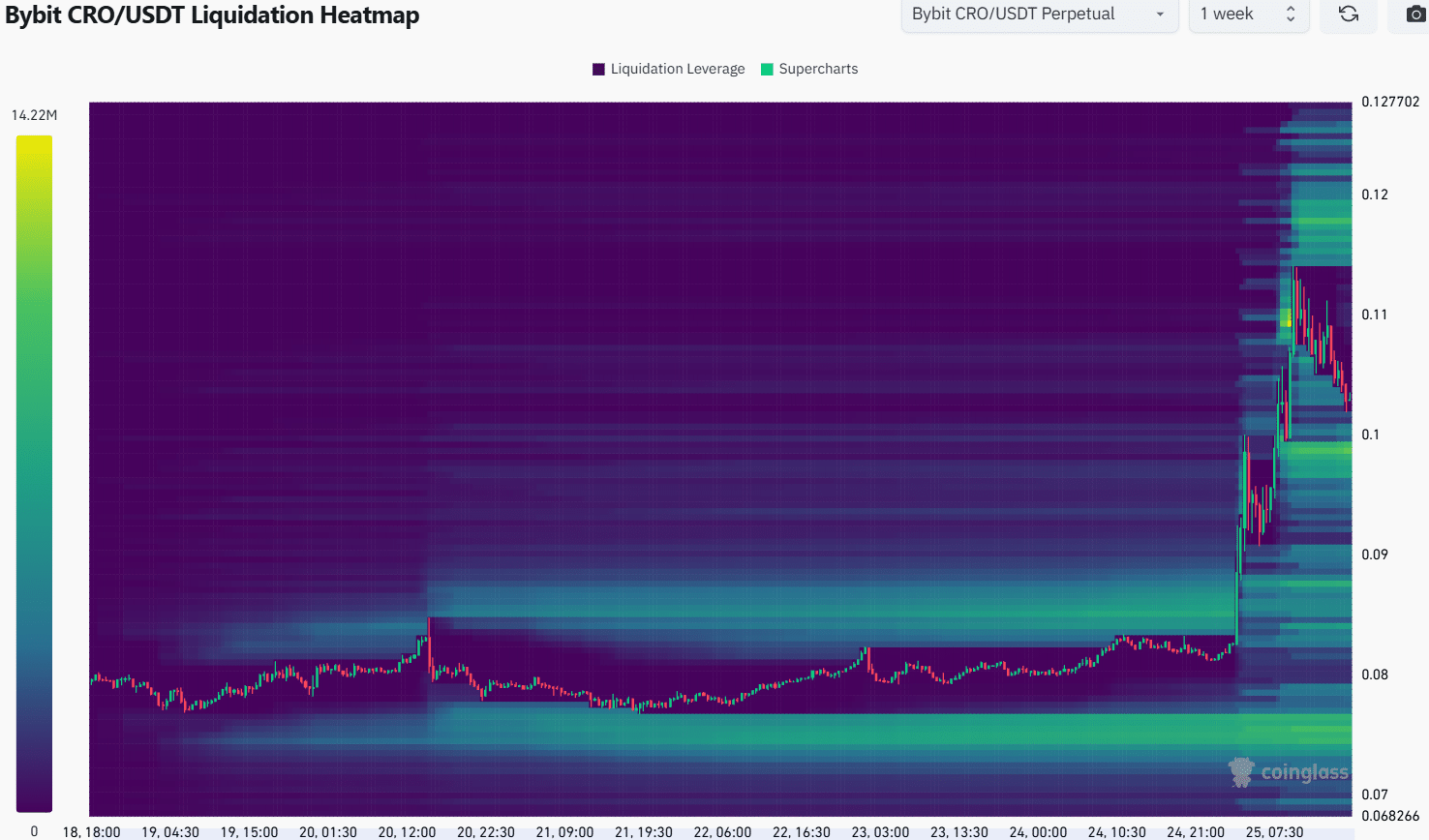

The 1-week liquidation heatmap has noted two magnetic zones of interest at $0.098 and $0.118, much like the siren call of a well-stocked bar.

The negative Funding Rate, combined with overbought conditions in the lower timeframes, suggests that a CRO price dip to $0.098 is not just possible, but probable—like a cat finding a sunny spot to nap.

Thus, swing traders may wish to prepare their nets to catch this token upon a retest of the nearby demand zone, targeting the $0.118-$0.12 liquidity cluster, which is as enticing as a freshly baked scone.

Read More

- UNLOCK ALL MINECRAFT LAUNCHER SKILLS

- The White Rabbit Revealed in Devil May Cry: Who Is He?

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- REPO: How To Fix Client Timeout

- One Piece Episode 1124 Release Date And Time Countdown

- 8 Best Souls-Like Games With Co-op

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Top 8 UFC 5 Perks Every Fighter Should Use

- Minecraft Movie Meal Madness

- BOOST FPS IN LAST OF US 2 REMASTERED PC TODAY!

2025-03-26 04:11