Quinn Thompson, helmsman of Lekker Capital, opines that the crypto sphere has endured a peculiar “positioning rinse,” leaving the collective wisdom of Twitter facing the wrong way at the most inconvenient hour. “Twice, thrice-no more!-do I witness the world turned upside down,” he mused on October 20, citing prior epochs in September 2023, September 2024, and February 2025 as moments when the crowd’s chorus sang a tune at odds with reason. With a flourish, he cited bearish musings from @qwqiao, @blknoiz06, and @cburniske, as if these were modern-day prophets of gloom.

Why The Bull Run Likely Isn’t Over (But Who’s Counting?)

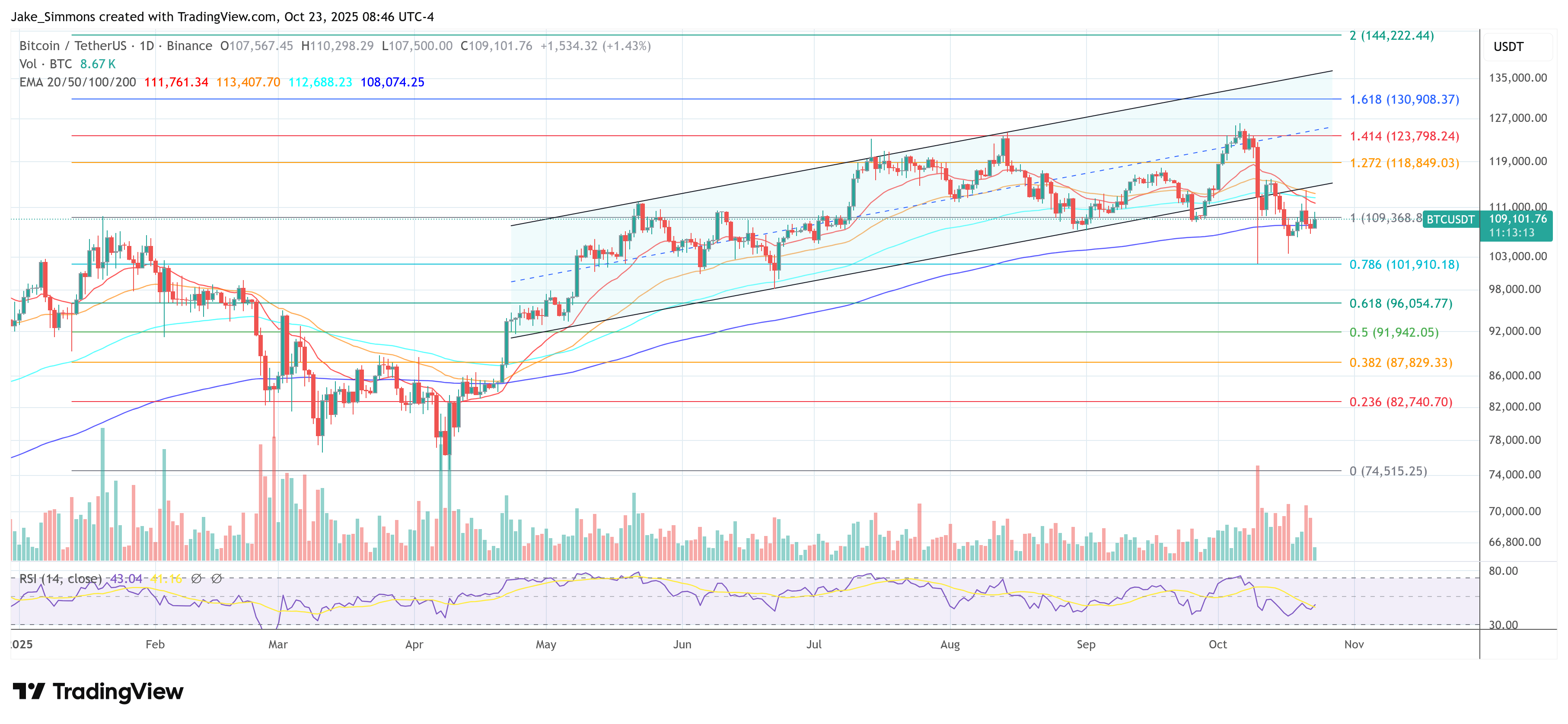

Thompson’s thesis, as delicate as a moth’s wing, insists the October 10 open-interest purge was not a death knell for Bitcoin and Ethereum, but a prelude to a grander tale. “Behold! The positioning here is rare-a tempest of liquidation on the cusp of macro ‘goldilocks’,” he wrote, comparing the event to a Trumpian victory in 2024. “A 10/10 liquidation, cleansing leverage more fiercely than the entire Jan-Apr ’25 saga,” he declared, as if summoning a storm to clear the air.

“It is absurd,” he added, “to debate right or wrong in these tweets. Let sentiment be a mirror, not a master. Sometimes, silence is the loudest hymn,” a sentiment that might have made Turgenev’s characters sigh in agreement-or roll their eyes at the absurdity.

His argument hinges on a simple truth: selling after a deleveraging event is as wise as dancing in a hurricane. “Who dares calculate the odds of profiting by turning bearish post-liquidation?” Thompson quipped, invoking the probabilistic wisdom of Alex Krüger and Vance Spencer, who both replied “0%” with the finality of a curtain falling.

Beyond the numbers, Thompson ties crypto’s fate to a “goldilocks” macro backdrop, a term he wields like a poet with a metaphor. In summer, he and Felix Jauvin pondered gold’s ascent on Forward Guidance, a thesis sealed when Vladimir Putin, Xi Jinping, and Narendra Modi clasped hands at the Shanghai Cooperation Organization summit. “This image,” Thompson wrote, “was the final nail in the coffin of doubt-a golden signal after months of consolidation.” Now, he suggests, Bitcoin stands at a similar crossroads after a decade-long wait.

“Do not miss the forest for the trees,” he urged, nodding to Brian Armstrong’s D.C. policy push. “To bring market structure to the President’s desk? A charmingly American drama, no?”

If you’ve followed @ForwardGuidance, recall my gold rants in late summer. That image of Putin, Xi, and Modi clasping hands? A golden omen after four months of stagnation. Now, we witness the same…

– Quinn Thompson (@qthomp) October 22, 2025

At the time of this writing, BTC traded at $109,101, a sum that might make a Turgenev character sigh, “Ah, the folly of men and their shiny trinkets.”

Read More

- All Carcadia Burn ECHO Log Locations in Borderlands 4

- Enshrouded: Giant Critter Scales Location

- Best Finishers In WWE 2K25

- Best ARs in BF6

- Top 10 Must-Watch Isekai Anime on Crunchyroll Revealed!

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- All Shrine Climb Locations in Ghost of Yotei

- Top 8 UFC 5 Perks Every Fighter Should Use

- Keeping Agents in Check: A New Framework for Safe Multi-Agent Systems

- Scopper’s Observation Haki Outshines Shanks’ Future Sight!

2025-10-24 01:58