Key Insights:

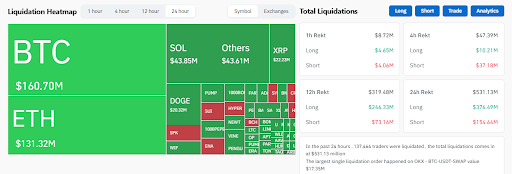

- Bitcoin succumbed to a nosedive below $116,000, unleashing a veritable tsunami of liquidations across the crypto seas to the tune of $585 million.

- In a plot twist worthy of a bestseller, Ethereum not only survived but thrived, buoyed by whispers of ETF enchantment.

- Memecoins and altcoins danced wildly in a bizarre circus, some pirouetting over 50% in value like they were auditioning for a crypto talent show.

It was on that fateful Friday that Bitcoin, in a moment reminiscent of tragic heroes, fell below $116,000. This upheaval sparked a catastrophic wave of trader liquidations, culminating in a staggering 213,000 casualties within just 24 hours. A veritable apocalypse of misplaced optimism!

This calamity brought forth nearly $600 million lost, predominantly from bullish positions that clung to hope like an overenthusiastic fan at a pop concert.

Allegedly guided by the winds of fate, data from CoinGlass reported Bitcoin itself was responsible for a cancellation of $140 million in longs, as its value took a 2.63% hit, plummeting to a low of $115,356. Meanwhile, Ethereum and its fellow altcoins found themselves grappling with the fallout, yet some shining stars, like ETH, showcased a surprising resilience—a bold statement amid the chaos.

A Leverage Flush That Caught Traders Off Guard

In a scenario that would make even seasoned poets cry, the sudden downturn startled traders who had raised their flags high on Bitcoin’s recent pinnacle of $123,100. Revered trader Ash Crypto dubbed the episode “a pure leverage flush.” One can almost hear the collective sigh of disbelief.

As Ethereum surged earlier in the week, a parade of traders filled the streets with long positions on altcoins, blithely unaware of the lurking shadow of market makers. Their daring actions triggered a cascade of liquidations far beyond $731 million, sweeping longs away like autumn leaves.

Strikingly, Dogecoin emerged as the unfortunate victim among the foremost cryptocurrencies, suffering a 7% fall to $0.22, an ordeal that caused $26 million in liquidated longs—a tragicomic turn of events in this ongoing drama.

Ethereum Shows Strength Amid Bitcoin’s Decline

While Bitcoin faltered, Ethereum stood tall, shaking off the gloom with an ascent of up to 1.65%, lingering near $3,700 come Friday. Who knew resilience could be so fashionable?

ETH’s performance indicates a peculiar truth: not all crypto assets dance to Bitcoin’s tune, especially in turbulent times. Institutional intrigue and wild ETF activity propelled Ethereum into the spotlight while others stumbled in the shadows.

At the time of this report, Ethereum commanded a 10.4% market share, even as the overall market cap dipped by a disheartening 4.4%. Talk about perseverance!

Moreover, Galaxy Digital CEO Mike Novogratz recently expressed his expectation of Ethereum dancing its way to $4,000, amid robust fundamentals and growing institutional allure. If only optimism were an actual currency!

The sell-off sent altcoins reeling; some collapsed like houses of cards, while others soared like eagles. Memecoins, especially, took center stage, reacting with enthusiasm that seemed best suited for an Olympic event. Even the stalwarts like Binance Coin (BNB), Solana (SOL), and Dogecoin (DOGE) were treated to a mixed bag of results.

Market Sentiment Still in “Greed” Despite Red Charts

The Crypto Fear & Greed Index, despite the dramatic plunge, stubbornly remained in “Greed” territory at 66—an ironic twist in this tale of woe.

Traders continue to hold their candles high, and Bitfinex analysts recently carped their expectation that Bitcoin could still ascend to $136,000. However, they playfully warned that such heights might mark a local apex, as euphoric sentiment often leads to delights best avoided.

Some traders are covering their bets, wagering that a Bitcoin rebound to $119,500 could set off yet another wild rollercoaster of volatility, with approximately $3.07 billion in short positions ready to meet their destiny.

Ultimately, the crypto market’s recent plunge below $116,000 may have rattled the overly self-assured, yet the long-term optimism remains poised for a comeback, with Ethereum still enjoying its rise due to ETF magic. Perhaps this is merely a brief hiccup in a year destined for glory!

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-07-25 19:25