Michael Saylor has been rewriting the corporate playbook like a kid with a crayon. What started as MicroStrategy, a tiny software outfit, is now Strategy-the biggest Bitcoin treasury on the planet. Imagine that: from nerdy coder to crypto cowboy. Yee-haw! 🤠

But hold onto your digital hats. With $8.2 billion in debt, $735 million drowning in new share dilution, and a Frankenstein’s monster of fancy financial products, critics whisper that Saylor’s steering this ship straight into the shark-infested waters of risk. Bombs away? Maybe. 🎲

Debt, Dilution, and Bitcoin Obsession – The Hot Mess

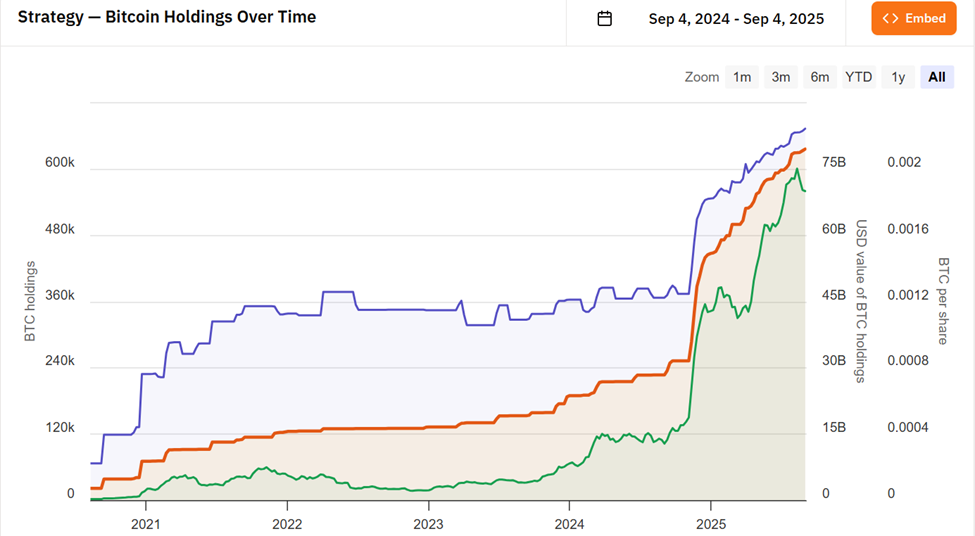

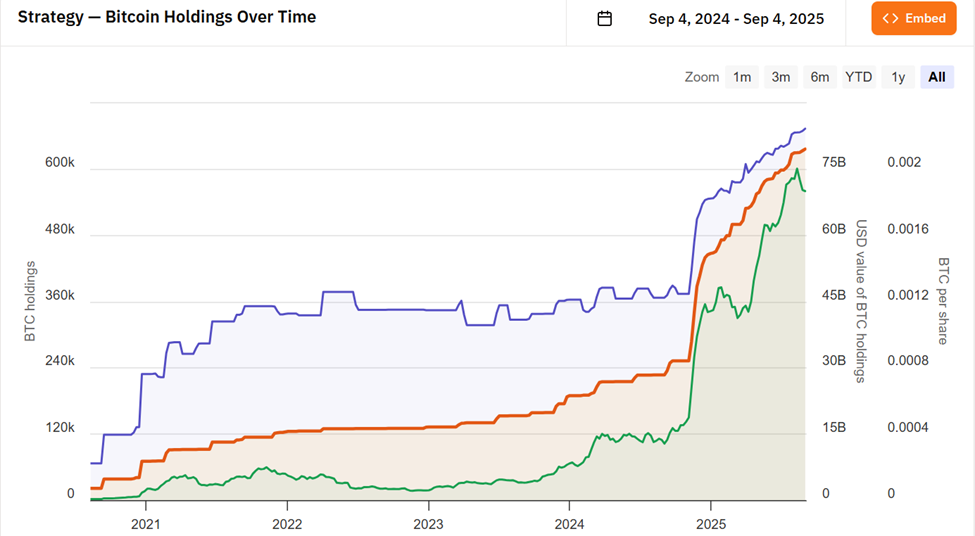

Over the past three years, Strategy has ditched its old school roots so hard it’s practically unrecognizable. No one cares about discounted cash flows anymore-they’re hooked on its mountain of 636,505 BTC and Saylor’s magic trick of monetizing that stash like a crypto Houdini. 🧙♂️

The boss has been loud and proud about his mission: to make Bitcoin credit sexy with new securities like STRK, STRF, STRD, and STRC. Basically, Saylor’s trying to turn BTC into a yield-generating machine. Sounds like a fintech version of alchemy, but hey, why not? 🧪

$STRC is $MSTR’s secret sauce.

While everyone else sells stock to keep the lights on, Saylor’s launching 1-month paper to print fake money, buy more BTC, and pump up NAV – all while pretending he’s not leveraging the hell out of it.

This isn’t leverage.

It’s a Bitcoin yield curve in disguise.Hyperbullish. 💸

– financialconspirator (@financialcnspr) July 22, 2025

This makes Strategy less a company and more a Bitcoin-backed shadow bank. Every debt new sale or fancy product is just another way to get more BTC, which means more risk, but also more adrenaline. It’s a rollercoaster with a bankroll, baby!

But then, the latest plot twist: on July 31, the execs promised not to dilute shares beyond a 1-2.5x net asset value (mNAV). Fast forward to August 18, and poof-this promise vanished like a magician’s rabbit. Poof!

Since then, they’ve sold $735.2 million worth of stock-right within that now-vanished safety zone-fueling accusations they’re just cashing out while the going’s good. 🎩

“Saylor pulled the rug… This was never about Bitcoin; it’s about Saylor cashing in,” said WhaleWire CEO Jacob King, who’s probably got better things to do than watch this soap opera.

Some say it’s just good old Wall Street tricks-shift the risk, preserve the control, and leave the little guys holding the bag. Sweet deal, huh? 🥂

Transparency or Target Practice? Systemic Risks Hiding in Plain Sight

Now, the fun part: Arkham, the blockchain snoop squad, found that 97% of Strategy’s Bitcoin wallets-nearly $60 billion worth-are all traceable. Yes, every squirrelly move is on a map. 💼

Some cheer it as proof of reserves; others scream, “Bad idea!” Because if Saylor or anyone else even *touches* those wallets, the market could implode faster than you can say ‘liquidity crunch.’

“If they ever move that BTC from the wallets, expect a market collapse,” said a wise old trader, probably clutching a coffee and a lucky charm.

Plus, with his name attached to a huge target on his back, Saylor might soon be playing crypto’s version of hide and seek-except the game involves a lot of dangerous people with guns. 🔫

All this debt, dilution, transparency-they’re basically walking a tightrope over a pit of quicksand. One big crypto dip and everything could tumble down like a house of cards on a windstorm.

Fans say Saylor’s playing the long game, turning fiat into Bitcoin dominance-think of it as a hi-tech game of Monopoly with a trillion-dollar twist. Critics warn that putting all your chips with one volatile asset isn’t exactly ‘smart money.’

“The updated MSTR Equity Guidance… could dilute shareholders, scare off investors, and make the whole thing wobble-like Jenga with too many Bitcoins on top,” warned some cynical observer.

While Michael Saylor keeps smiling and stacking sats, the company’s balance sheet and wallets are feeling the heat. It’s like a high-stakes poker game, and everyone’s holding their breath.

This crypto soap opera’s ending is uncertain, but one thing’s for sure: whether he’s a visionary or just reckless, Saylor’s experiment might just turn into a systemic risk for Bitcoin itself. Buckle up, folks. It’s gonna be a wild ride. 🏴☠️

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- EUR USD PREDICTION

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- God Of War: Sons Of Sparta – Interactive Map

2025-09-04 11:55