- ONDO has finally decided to break free from its two-month-long sulk, posting a 20% gain on Wednesday. 🎉

- Metrics are waving a flag for market bulls, but let’s not forget the lurking risks—like that one friend who always shows up uninvited. 🙄

So, Ondo [ONDO] strutted its stuff with a 19.8% gain on Wednesday, and the trading volume was so high it could have been mistaken for a Black Friday sale. This was a delightful surprise for the market’s bulls, who have been waiting for a sign like a cat waiting for its human to return home. In fact, ONDO had been sulking in a descending channel pattern (white) for two months, but it finally decided to break out and show us what it’s made of during its latest rally.

But hold your horses! The market structure on the 1-day chart is still giving off some serious bearish vibes. 🐻

Technical analysis revealed that the 78.6% Fibonacci retracement level at $0.915 is still playing hard to get. It’s the lower high that ONDO needs to conquer to shift the structure into something resembling bullishness. The OBV didn’t bother to make a new higher high compared to March’s final week, which suggests that buyers are about as strong as a wet noodle. The RSI is sitting at a neutral 50, indicating a potential momentum shift—like a teenager deciding whether to clean their room or just scroll through TikTok instead.

Should traders trust this channel breakout and go long? Well, metrics are hinting at a buying opportunity, but let’s be real—metrics can be as fickle as a cat on a hot tin roof.

Buying opportunity for ONDO bulls as accumulation trends remain strong

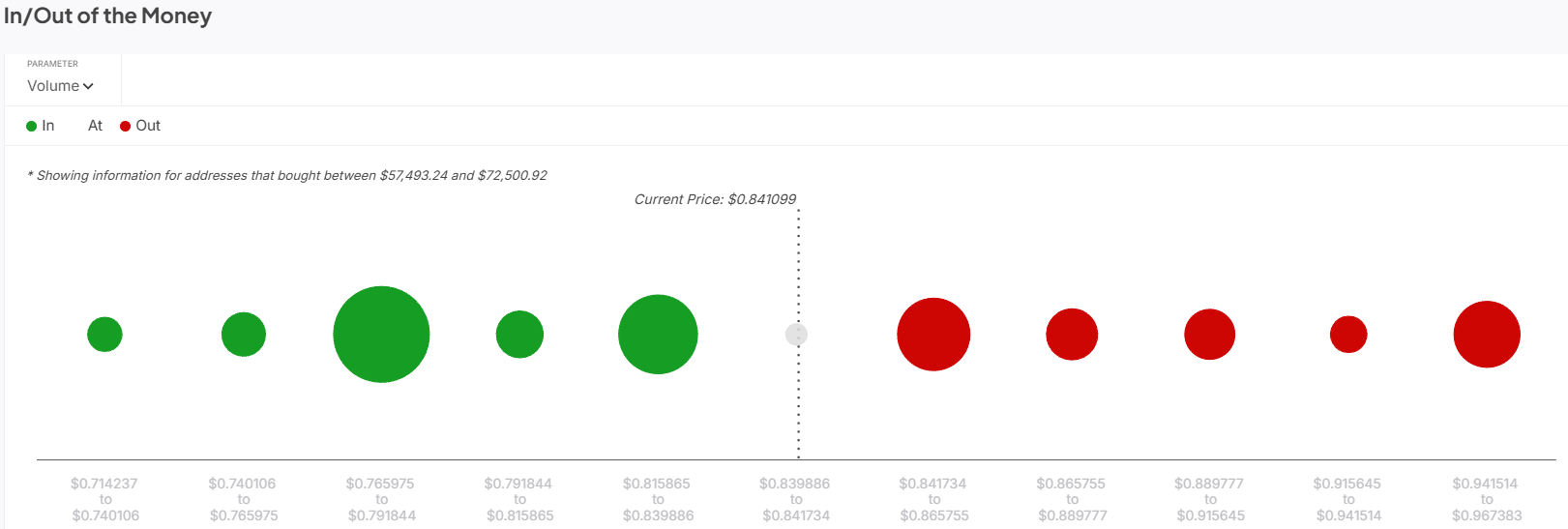

The in/out of the money around price metric has marked two nearby support zones for ONDO at $0.815 and $0.791. These are above the falling channel highs, which is like finding a dollar bill in your old coat pocket—unexpected but welcome.

So, a retest of these levels or the channel as support could offer a buying opportunity in the coming days. Or it could just be a mirage in the desert of despair. Who knows? 🤷♂️

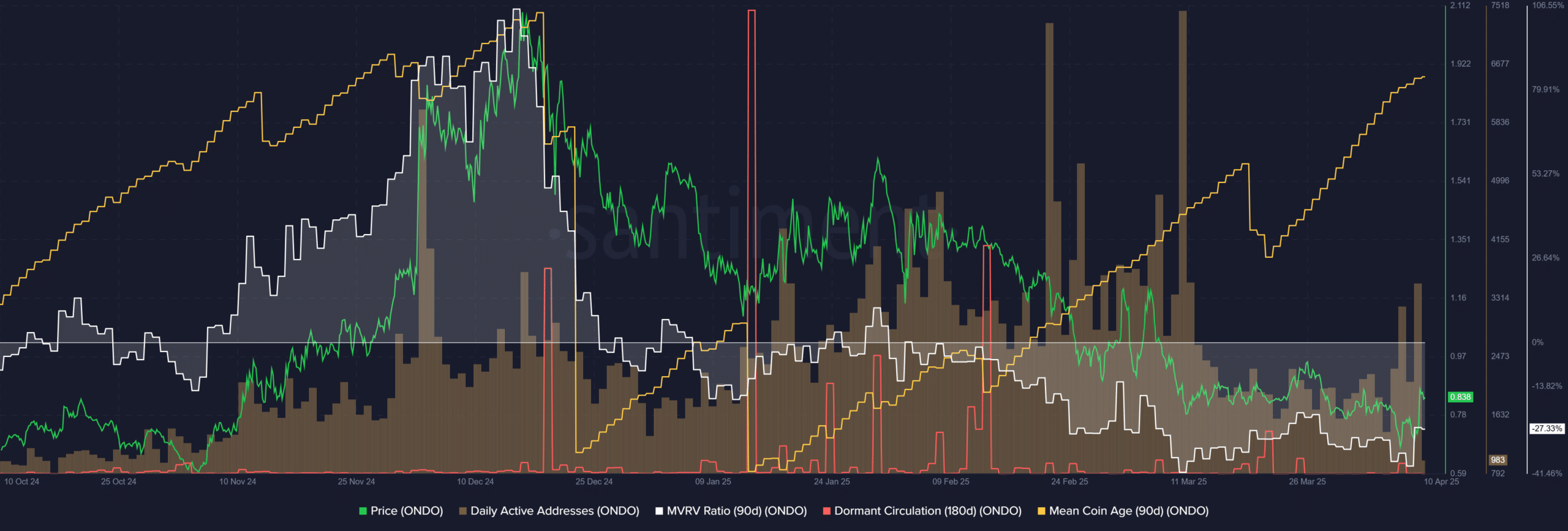

The daily active addresses metric took a nosedive from the second week of March, but over the past week, it’s started to climb again—like a phoenix rising from the ashes, or at least a slightly singed bird. Rising on-chain activity could indicate a hike in usage and demand, or it could just mean people are bored and looking for something to do.

The 90-day mean coin age has been on a steady uptrend since January, with a minor drop in mid-March. This rising MCA could mean coins are being transacted less, or it could mean they’re just taking a long vacation. Meanwhile, the ONDO dormant circulation metric has seen a few notable spikes in recent weeks, which is about as exciting as watching paint dry.

All of this points toward accumulation. The 90-day MVRV ratio is also negative, showing that short to medium-term holders are facing losses—like a bad haircut that just won’t grow out. The accumulation trends, alongside the breakout from the two-month channel, are an early sign that ONDO might be a decent buying opportunity. But let’s not forget, investors must remain cautious, given the market-wide bearish sentiment. After all, it’s a jungle out there! 🐾

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-04-11 12:10