Ah, the winds of change are blowing through the realm of open interest, volume, and those ever-elusive technical indicators! It seems our dear OP is on the brink of a grand transformation. With whispers of bullish signals and a flurry of market activity, the anticipation is palpable. Will the token rise from its slumber and reclaim its lost glory? Only time will tell, but the stage is set for a potential breakout! 🎭

Buyers Regain Control as Open Interest Climbs

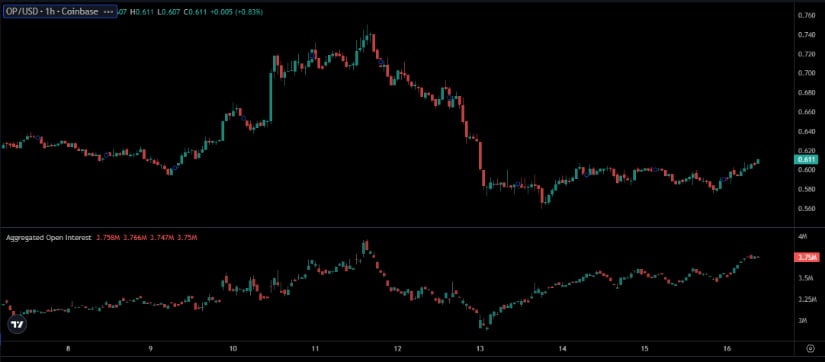

Behold the hourly chart of Open Interest, a tale of consolidation after a swift descent from lofty heights. Our brave OP found a temporary refuge at around USDT 0.56, before daring to venture into the current trading range of USDT 0.611. A steady recovery, you say? Indeed! Higher lows are forming, signaling a shift in sentiment as buyers cautiously step into the arena. The asset is making valiant attempts to breach immediate resistance zones, paving the way for further ascension if momentum holds. 🏔️

Open interest data adds another layer to this unfolding drama. As the price began its ascent from local lows, open interest surged, hinting at new long positions being established in anticipation of a bullish continuation. Previously, the metric had plummeted during the steep correction, signaling liquidations and trader exits. But lo and behold! The current uptick in open interest reflects a burgeoning confidence and a resurgence of market participation. 📈

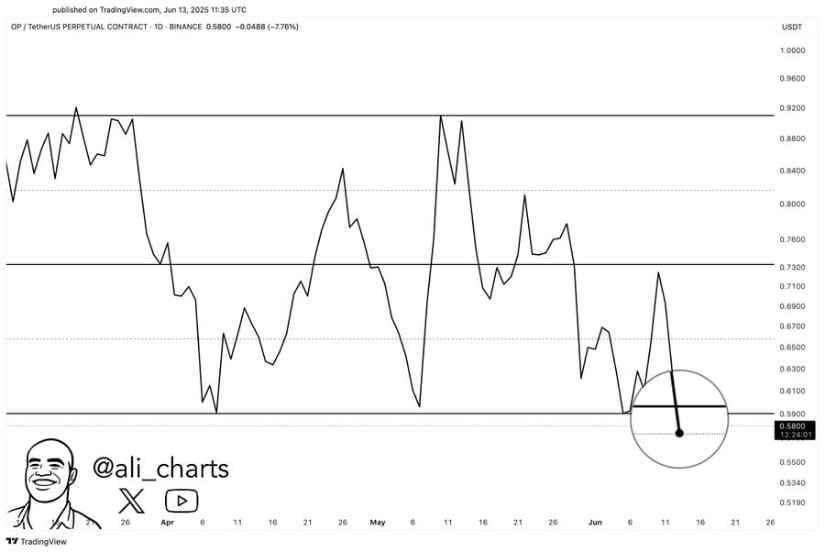

Our astute Analyst Ali, in a post shared on X, has noted that OP is on the verge of breaking free from a prior trading channel. While his earlier prediction pointed toward a dismal USDT 0.39, the market seems to be flipping the script, invalidating that bearish outlook. His keen observation remains pertinent, as OP’s structural shift may be laying the groundwork for a robust rebound, buoyed by heightened speculative interest and a sprinkle of renewed optimism. 🌟

Market Participation Signals Potential for Continuation

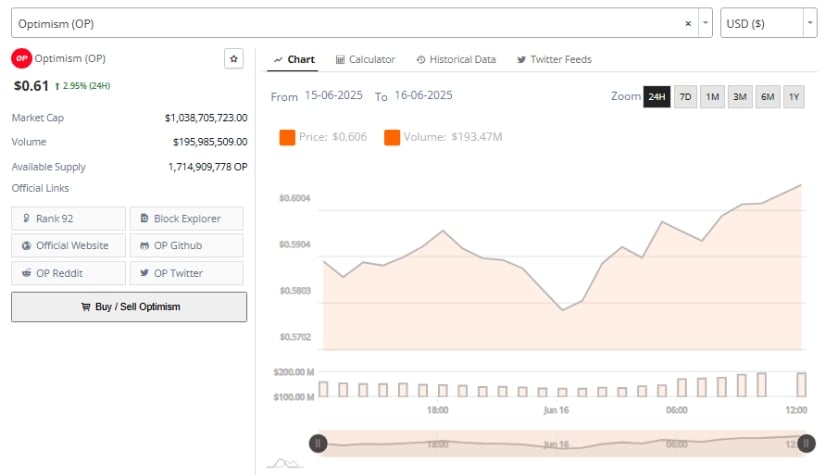

In the grand theater of trading, over the 24 hours between June 15 and June 16, OP Price Prediction experienced a modest upward movement. The token opened near USDT 0.606 and closed at approximately USDT 0.61, reflecting a 2.95% gain. A steady price movement, with a brief dip near midnight UTC, only to regain its footing! This pattern indicates a measured but sustained buying interest, allowing the token to hover above the psychologically significant USDT 0.60 level. 🕛

Volume data further supports the notion of an active market environment. Trading volume peaked at USDT 195.9 million during this window, with surges in volume aligning with periods of upward price movement. This correlation suggests that the recent price gains were not mere flukes but rather the result of genuine buyer activity, rather than the whims of short-term volatility. The presence of consistent volume is a positive technical signal, indicating that demand remains stable as the token attempts to build upward momentum. 💪

OP’s current market capitalization has risen above USDT 1.03 billion, with a circulating supply of over 1.71 billion tokens. Despite the short-term fluctuations, maintaining price stability above key levels reflects a balanced market, where both buyers and sellers remain engaged. The token’s ability to consolidate in a higher range may provide the groundwork for a move toward resistance at USDT 0.62–0.63 in the coming sessions. 🏦

Technical Indicators Highlight Critical Turning Point

On the weekly chart, Optimism Price Prediction continues to dance within a long-term downtrend that began after reaching a peak of USDT 4.86 in early 2024. The current price of approximately USDT 0.610 marks a considerable decline, but the latest weekly candlestick shows a 3.04% increase. This uptick may be signaling the beginning of a stabilization phase, particularly as the price approaches historically significant support areas near the current level. 📊

Technical indicators from TradingView suggest a mixed bag of sentiment. The Chaikin Money Flow (CMF) is currently at -0.10, indicating that capital outflows still outweigh inflows. However, the metric has started to recover from recent lows, hinting at early signs of renewed accumulation. A shift toward the neutral zone would reflect a healthier market structure with more consistent buyer activity. 🤔

Momentum indicators offer a cautiously positive outlook. The MACD line has moved to -0.250, slightly above the signal line at -0.267, while the histogram has turned positive at 0.017. This early bullish divergence points to a potential trend reversal, though confirmation will require a sustained move above the zero line, supported by volume expansion. 📈

At this stage, OP remains at a technical crossroads, with short-term bullish signals emerging against the backdrop of a longer-term bearish trend. Will it rise like a phoenix or remain in the shadows? Only the market knows! 🦅

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-06-16 23:41