Ah, John Bollinger, that sage of the trading world, is not yet succumbing to the siren song of bear market hysteria. The architect of the famed Bollinger Bands, a tool revered by many a trader, has recently graced us with his thoughts on Bitcoin‘s latest descent into the abyss. His proclamation? Let us refrain from hastily dubbing it a bear market—at least for the time being.

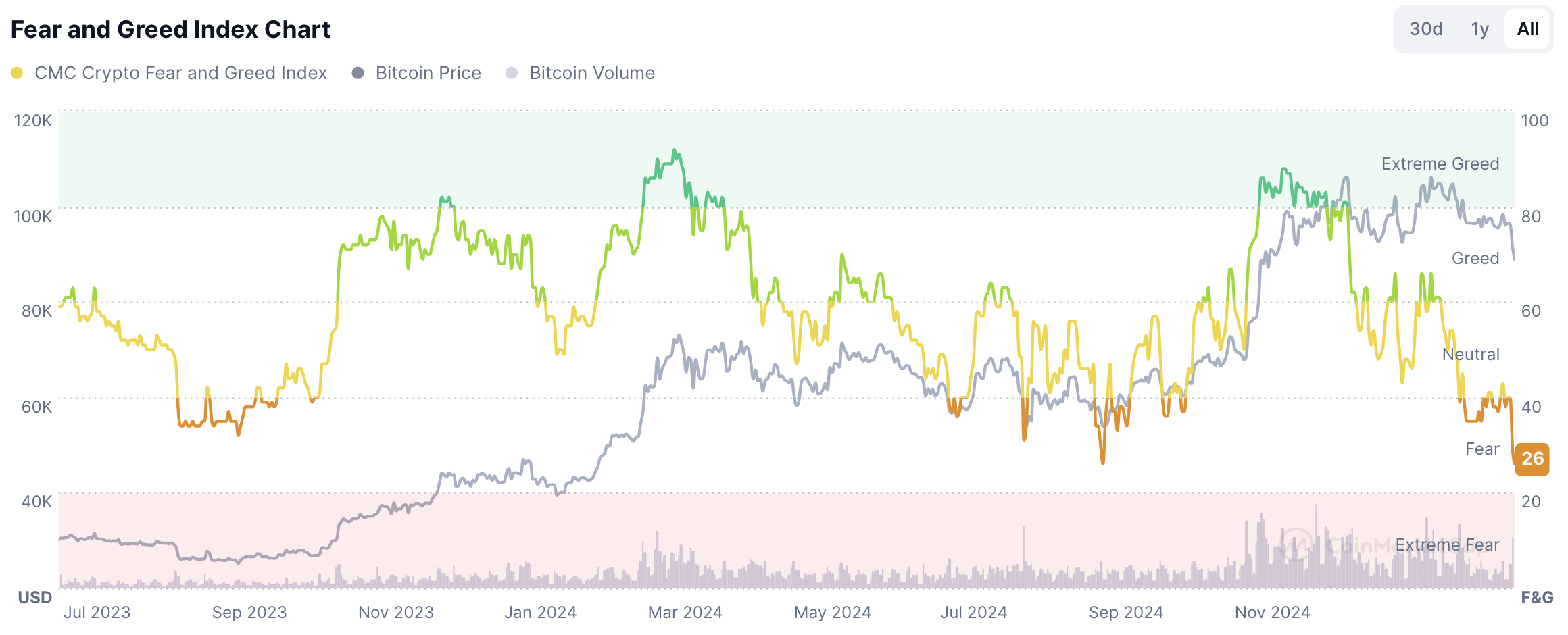

Indeed, Bitcoin has been on quite the tumultuous journey, plummeting to a staggering $85,000, dragging along the altcoins like a reluctant child being pulled to school. The market, understandably, is in a tizzy, with the Fear and Greed Index plummeting to a dismal 29—a level of trepidation we have not witnessed since the fateful days of September 2024.

As the narrative shifts, traders are murmuring about the dawn of a protracted downturn. Yet, Bollinger, with a twinkle in his eye, does not share this gloomy outlook—not just yet, anyway.

He took to the platform known as X, valiantly pushing back against the tide of bearish sentiment, asserting that it is far too premature to draw any definitive conclusions. His wisdom? Wait for a sustainable bottom to emerge. That, dear friends, is the true signal. Only then does it make sense to consider taking the other side of the trade.

Saw a couple of headlines today about #bitcoin being in a bear market. NO SO FAST! Wait for a sustainable bottom to appear, then take the other side of the trade. (BBs can help a lot here.)

— John Bollinger (@bbands) February 25, 2025

Now, if you find yourself pondering how to discern that elusive bottom, the Bollinger Bands may just be your guiding light.

Bitcoin price through Bollinger Bands

When one gazes upon Bitcoin through the prism of the Bollinger Bands on the daily time frame, a singular truth emerges—it has ventured beyond the lower band, a classic harbinger of an oversold asset. Ah, the drama!

Historically, when prices dip below that lower boundary, a reversal is often lurking just around the corner. But let us not be so naive as to consider it a certainty; it is merely a possibility, like finding a five-dollar bill in an old coat pocket. The upper bands are perched at $95,640 and $100,910—7.57% and 13.46% above the recent nadir, respectively. Not exactly chump change!

Bollinger’s perspective is a clarion call for patience. Instead of rushing to slap a bearish label on this market, he advocates for a more measured approach, waiting for a clearer tableau to unfold.

Yes, market fear is palpable. Yet, the technical indicators whisper that there is more to this tale than meets the eye. Traders in search of direction might find solace in the bands, eagerly anticipating that next pivotal move.

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- USD ILS PREDICTION

- Top 8 UFC 5 Perks Every Fighter Should Use

- Slormancer Huntress: God-Tier Builds REVEALED!

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- How to Unlock the Mines in Cookie Run: Kingdom

- REPO’s Cart Cannon: Prepare for Mayhem!

- Nine Sols: 6 Best Jin Farming Methods

2025-02-26 14:01