A fresh wave of layoffs is surging through industries in 2025, signaling that the labor market might just be entering its most dramatic chapter since the pandemic-era collapse. Guess who else is tuning in? The crypto world, of course.

Job cuts aren’t just the exclusive playground of tech giants or government agencies anymore. No, the real economy is flashing its brightest red warning lights. Equity markets? Well, they’re drowning in the shallow end, while crypto investors are clinging to the faintest hope of rate cuts like it’s the last lifeboat on a sinking ship.

The Labor Market’s Sudden Crisis: Could Bitcoin‘s Next Macro Move Be About Jobs Instead of Inflation?

Employment data is gradually creeping up in importance as one of the US economic indicators that crypto investors are nervously eyeing. Who needs inflation when you’ve got mass layoffs?

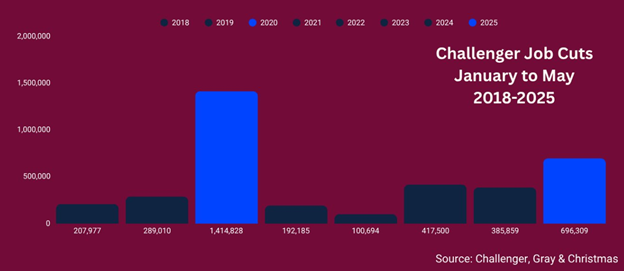

The layoff storm that shook markets in 2022–2023 is having a snappy comeback in 2025. In fact, US companies have announced more job cuts in the first five months of 2025 than in any comparable period in the last four years. Yes, you read that right. The labor market is practically *begging* for your attention.

“Tariffs, funding cuts, consumer spending, and overall economic pessimism are putting intense pressure on companies’ workforces. Companies are spending less, slowing hiring, and sending layoff notices,” wrote Forex Analytix, citing Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas. Well, isn’t that just the corporate dream?

Statistics confirm that the US labor market is definitely not in a healthy condition. May 2025 job cuts were up by 47% from the previous year. Year-to-date (YTD) cuts? A stunning 80% higher than 2024. Clearly, the US workforce is getting thinner by the month.

“Cuts are spreading to other sectors than Government, for other reasons than budget cuts and Dogecoin crashes,” the outplacement firm noted. Oh, the sheer drama of it all.

Andrew Challenger, Senior Vice President at the firm, offered a succinct view of the situation: Trump’s tariffs, funding cuts, consumer spending, and that ever-growing economic pessimism are the invisible hands squeezing companies to trim their workforces.

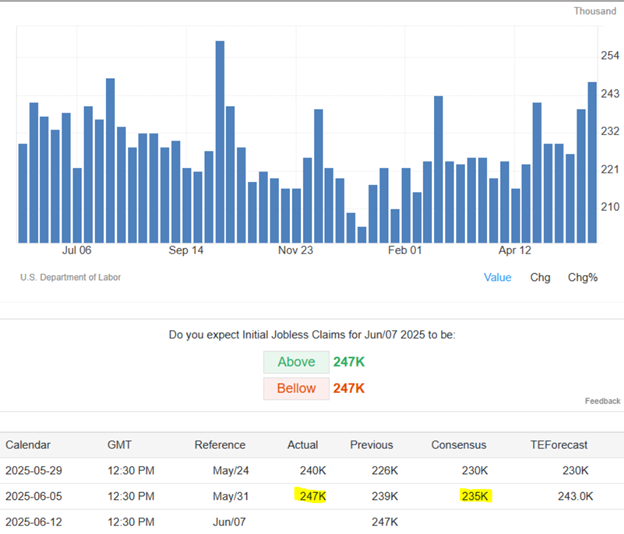

And just to add some extra spice, Thursday’s data showed a rise in initial jobless claims, by 8,000 to 247,000 for the week ending May 31. Can we say “softening labor market”? The suspense is killing me.

US JOBLESS CLAIMS +8K TO 247K IN MAY-31 WK; SURVEY 236K

US MAY-24 WEEK CONTINUING CLAIMS -3K TO 1,904,000

US MAY-24 WEEK JOBLESS CLAIMS REVISED TO 239K

— *Walter Bloomberg (@DeItaone) June 5, 2025

This jump in unemployment claims is a sign that the job market might be hitting the brakes. Meanwhile, Bloomberg noticed that the US trade deficit shrank in April, largely due to a record plunge in imports. A little silver lining in an otherwise dreary economic cloud?

Meanwhile, The Kobeissi Letter has pointed out an even deeper trend: job openings are on a steady decline, down to 7.36 million in April, the lowest since 2021. Apparently, the job market is feeling like a crowded dance floor with fewer partners to choose from.

“US job openings continue to trend lower…The job market is clearly weakening,” wrote The Kobeissi Letter. Can’t argue with that.

However, not all news is grim. The May jobs report showed that the US economy managed to add 139,000 nonfarm payrolls in May—better than the 126,000 expected. So, what’s the takeaway here? It’s like the economy has a hangover but is still partying hard enough to keep the music going.

“The US Labour market has shrugged off the tariff uncertainty that rocked global stock and bond markets in April and May. While the Federal government has continued to shed a small number of jobs, the wider economy has more than made up the difference, with the US adding slightly more jobs than expected in May. Wage growth also came in higher than expected – suggesting the economy is in rude health,” Nicholas Hyett, Investment Manager at Wealth Club, told BeInCrypto.

AI, Demand Plunges, and VC Retreat: The Perfect Storm for Labor Market Strain

Let’s be real—this wave of layoffs isn’t just some cyclical hiccup. Oh no, it’s more structural, with the biggest culprit potentially being AI. According to macro commentator Zachary T. Bravo, many companies are not (yet) admitting it, but some jobs are basically *obsolete* thanks to artificial intelligence. Who needs humans when you’ve got robots doing the heavy lifting?

“We’re in the early innings now; companies aren’t calling it AI-related (that’s politically unacceptable); the point is, companies are downsizing and some roles are now fully obsolete,” Bravo noted. A subtle admission, don’t you think?

Bravo sees four waves of job loss hitting the market: tech and government layoffs, AI-driven job cuts, companies cutting staff further as consumption dips, and, of course, robots stealing your jobs. Who knew the future would come with a side of unemployment?

And, as if things weren’t juicy enough, Bravo predicts that the government will print money to rescue the economy, citing public works projects, increased debt, and—surprise!—potentially some *better* infrastructure. A nice twist, eh?

“Prediction: the government will print money to pull us out. Expect public works projects, increased debt to fund them (weak dollar, expensive credit), and (silver lining) some better infrastructure,” Bravo mused.

Crypto-native firms are also feeling the heat. BeInCrypto reported that the Ethereum Foundation had to lay off staff, which could point to some serious cost-cutting even in the most “mission-critical” blockchain organizations.

Meanwhile, venture capital is tightening its grip, with Greg Isenberg, portfolio manager, calling attention to the broader ripple effects.

“Layoffs come in waves, not all at once. First round in Q2 (10-15%), then again in Q4 (15-25%) as companies realize the first cut wasn’t deep enough…VCs get quieter. LPs pull back commitments when markets drop, slowing capital calls… Corporate spending gets cold/freezes,” he warned.

Isenberg also mentioned a double whammy for consumer startups: recession-conscious customers are spending less, and tariffs are pushing the cost of goods up. Meanwhile, high-burn direct-to-consumer brands are having a particularly bad day at the office.

“The losers… high-burn DTC brands… late-stage startups that prioritized growth over unit economics… The winners… profitable companies, solo founders with low burn, startups with pricing power, and AI companies solving genuine business problems,” Isenberg explained.

As layoffs rise, job openings dwindle, and investor enthusiasm wanes, the second half of 2025 may focus more on the state of employment than inflation or interest rates. The implications for crypto, capital, and consumer demand? Well, that’s the real cliffhanger here.

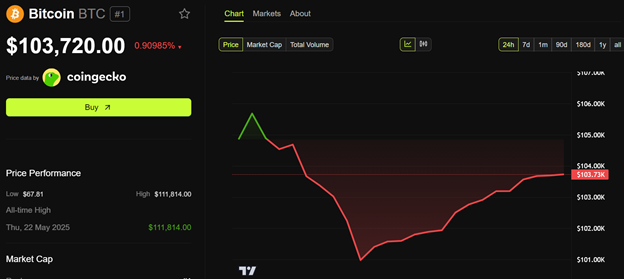

Bitcoin is currently priced at $103,720, slipping by almost 1% in the last 24 hours. Will the labor market be the next big macro event to impact crypto? Stay tuned—it’s about to get interesting.

Read More

- AI16Z PREDICTION. AI16Z cryptocurrency

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Tainted Grail: How To Find Robbie’s Grave

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Mandragora Adds Permadeath & New Game Plus

2025-06-06 16:57