In the grand theater of finance, where fortunes are made and lost with the flick of a digital switch, XRP finds itself in a curious dance, trading between the modest bounds of $2.246 and $2.26 over the last hour. With a market capitalization that would make even the most seasoned investor raise an eyebrow—$133 billion, and a 24-hour trading volume that could fund a small nation at $2.34 billion—this cryptocurrency is not merely a number; it is a living, breathing entity, fluctuating between $2.23 and $2.29 on this fine day of June 9, 2025, as the market holds its breath in a state of restrained volatility.

XRP

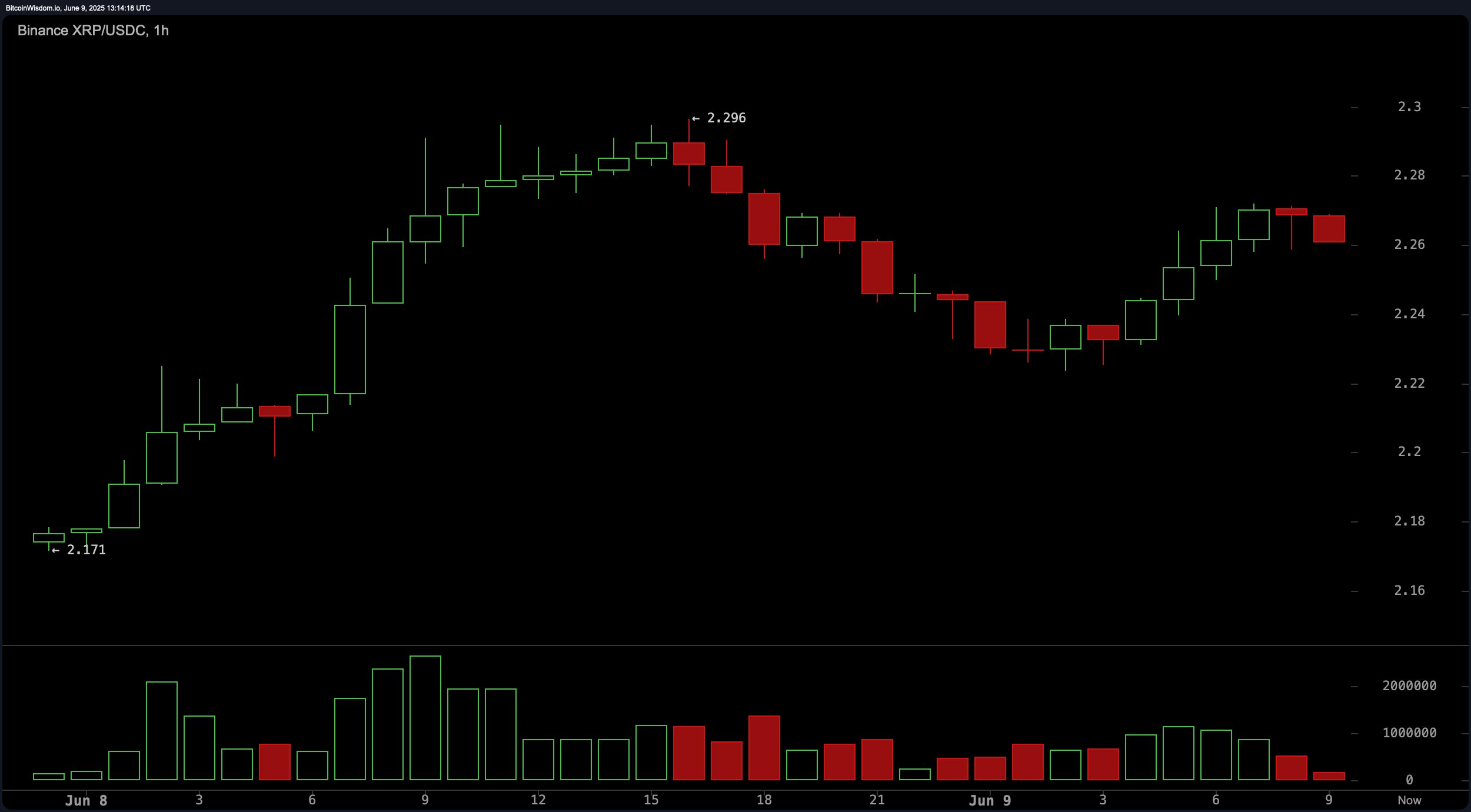

On the 1-hour chart, our dear XRP has displayed a bullish continuation setup, as if it were a young artist preparing for a grand debut. The price, having retraced from $2.296 to a humble $2.24, has formed a micro higher low pattern, signaling a renewed buying pressure that could make even the most stoic of traders crack a smile. This structure hints at the early stages of an upward leg, with critical resistance resting at $2.296. Should it break above this level, confirmed by a chorus of volume, we might just see a test of the $2.33 mark. But beware! A failure to hold above $2.24 could lead us back to the $2.21 support area, a place no one wishes to revisit.

The 4-hour XRP chart reveals a mid-term reversal pattern, much like a phoenix rising from the ashes of a low of $2.059. This timeframe illustrates a gradual recovery from a sharp decline, with XRP forming what appears to be a rounded bottom, a shape that could inspire a sculptor. Strong buying pressure was observed at the $2.05 zone, suggesting that investors are keen to scoop up bargains. The price has managed to climb toward the $2.296 resistance area, and should it maintain strength above $2.25, XRP is poised to target $2.30 to $2.32 in the near term, like a child reaching for the cookie jar.

The daily chart, a canvas of larger trends, attempts to bottom out from a prolonged bearish phase for XRP. After rebounding off the $2.05 support, XRP tested the $2.30 region, though it faces strong resistance at $2.65, a formidable fortress. Volume has shown signs of tapering, indicating a possible consolidation, as if the market is taking a deep breath. The $2.05 support remains crucial; holding this level could set the stage for a trend reversal, while failure would imply deeper retracement risk. Technical sentiment remains cautiously optimistic, like a cat eyeing a sunny spot on the floor, pending a clear breakout above $2.30.

Looking at the oscillators, sentiment appears mixed but cautiously constructive, much like a family dinner where everyone pretends to get along. The relative strength index (RSI) is at 51.02, suggesting a neutral stance without overbought or oversold conditions. The Stochastic oscillator stands at 59.41, while the commodity channel index (CCI) posts a near-flat value of 0.18—both indicating neutrality. The average directional index (ADX) at 18.24 also suggests a lack of strong directional momentum, as if the market is stuck in traffic. Meanwhile, the Awesome oscillator shows a slightly negative value of -0.123, reinforcing the consolidation outlook. Two indicators provide bullish signals: the momentum oscillator at 0.12355 and the moving average convergence divergence (MACD) level at -0.02711, both reflecting a subtle shift toward buying interest, like a whisper of hope in a crowded room.

Moving averages (MAs) collectively lean bullish, although with a few exceptions, much like a family with one eccentric uncle. Short-term indicators such as the exponential moving average (EMA) and simple moving average (SMA) for 10, 20, and 30 periods all reflect positive signals, with the EMA (10) at $2.21941 and the SMA (20) at $2.25278. Longer-term signals remain split: the EMA (50), EMA (100), and EMA (200) suggest bullish trends, while the SMA (30), SMA (50), and SMA (200) give bearish signals, the latter reading at $2.35403. This divergence between EMAs and SMAs suggests that while short-term momentum is strengthening, broader market participants are still cautious, like a cat approaching a new box.

Bull Verdict:

If XRP holds above the $2.24 level and breaches the $2.296 resistance with accompanying volume, the short-term technical setup supports a bullish continuation toward $2.33 and potentially $2.40. The alignment of momentum indicators and moving averages in favor of buyers strengthens the case for a trend reversal, suggesting bulls may soon regain control, like a triumphant return of the prodigal son.

Bear Verdict:

Failure to sustain support above $2.24, combined with waning volume and resistance rejection at $2.296, could invite renewed selling pressure, much like a bad sequel to a beloved movie. The overall trend on the daily chart remains fragile, and with several longer-term moving averages signaling weakness, XRP could revisit $2.21 or even the critical $2.05 support if bearish momentum returns, leaving investors to ponder their choices over a cup of tea.

Read More

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Hollow Knight: Silksong is Cutting It Close on a 2025 Release Window

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Don’t Expect Day One Switch 2 Reviews And Here’s Why

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Silent Hill f 2025 Release Date Confirmed, And Pre-Orders Are Already Open

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Game of Thrones Writer George R. R. Martin Weighs in on ‘Kickass’ Elden Ring Movie Plans

- Silent Hill f Reveals Release Date and Terrifying New Monsters

- Hollow Knight: Silksong Steam Update Excited Fans

2025-06-09 18:00