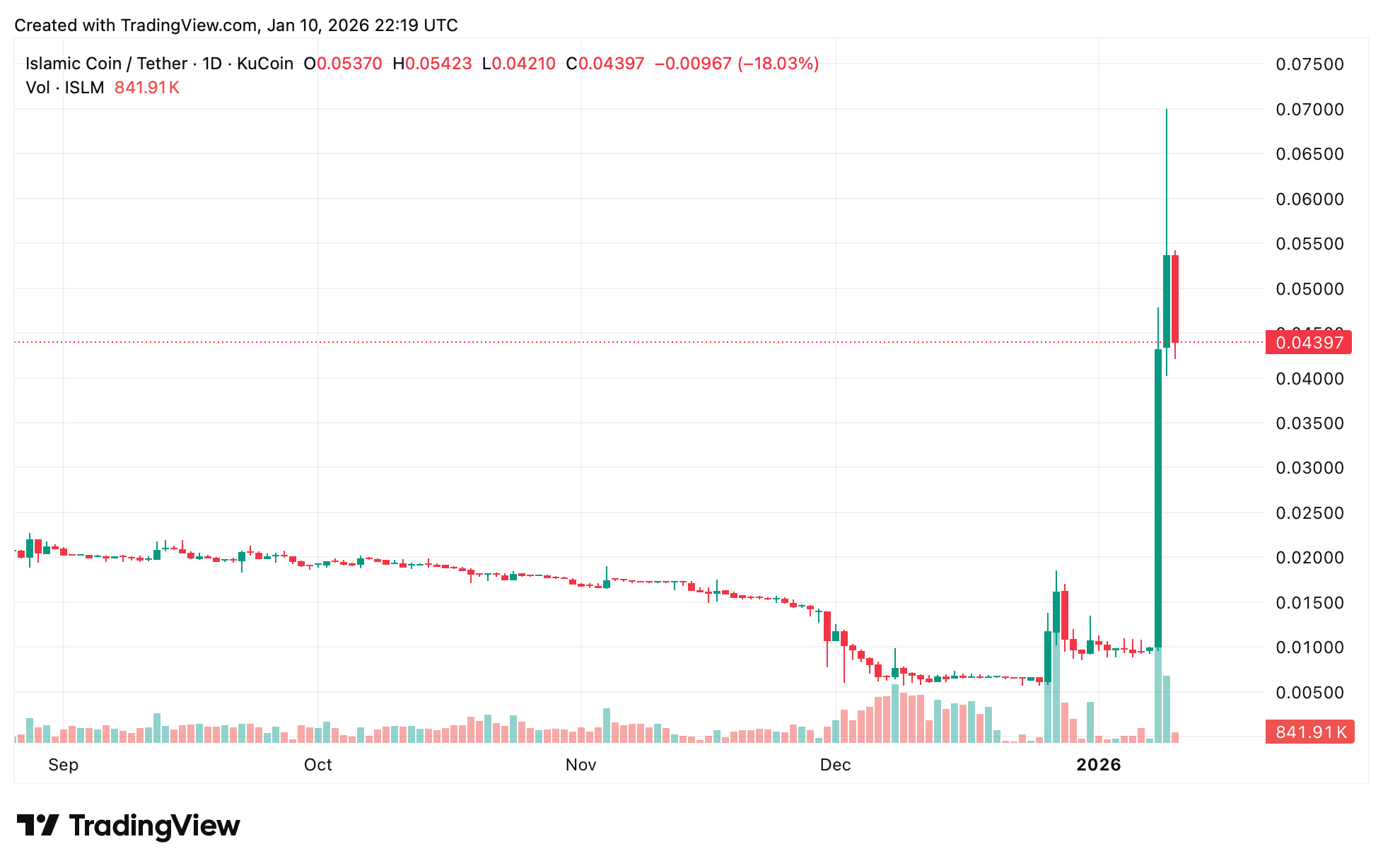

On the ninth day of January, the Islamic Coin, in a most theatrical display, ascended by a staggering 470%, leaping from its humble abode beneath $0.01 to nearly $0.06 within a mere 24 hours, before settling down somewhat daintily around the $0.045 to $0.05 mark.

Ethiq Layer 2 Mainnet

Our dear Islamic Coin (ISLM), that scintillating native utility token of the HAQQ network, sparked a veritable market jubilee in the early days of January 2026. On the eighth, it languished, barely stirring at just under $0.01, but lo and behold! By the next day, it had soared to a dizzying height of nearly $0.06-a frolicsome 470% gain in a single day, as if propelled by divine intervention or perhaps a particularly enthusiastic press release.

After this meteoric rise, it settled somewhat amiably in the $0.045 to $0.05 range, effectively putting an end to a prolonged period of horizontal inertia-how thrilling! ISLM now found itself at the pinnacle of global performance charts, basking in the limelight after months of playing hide-and-seek.

The primary catalyst for this vertiginous ascent was none other than the grand unveiling of Ethiq, the HAQQ network’s strategic Ethereum Layer 2 ( L2) solution. The HAQQ team, in their infinite wisdom, announced via X that Ethiq would serve as the “Unified Value Layer”-the very liquidity and application anchor of this vibrant ecosystem.

With technical architecture that boasts institutional-grade security-inheriting the brawn of the Ethereum mainnet while embracing the whimsicality of the Optimism OP Stack-Ethiq also offers full Ethereum Virtual Machine ( EVM) compatibility. This neat little feature paves a seamless path for Ethereum developers to craft Shariah-compliant decentralized applications ( dApps), all whilst functioning as an economic engine ready to capture value from network activity and return it, like a benevolent uncle, to the HAQQ community.

Innovation vs. Controversy

Yet, dear reader, despite this technological triumph, ISLM finds itself a magnet for controversy, sparking debate across both the crypto and Islamic finance realms. Supporters trumpet its fatwa endorsement from esteemed scholars, while the project navigates a veritable storm of criticism. Detractors are quick to highlight a litany of allegations regarding fundraising transparency and a checkered regulatory past dating back to its launch in 2023. How thrillingly scandalous!

The endeavor has also faced scrutiny over supposed links to unsavory characters-charges the HAQQ Association vehemently denies with all the fervor of a righteous crusader. Moreover, purists have taken umbrage with the marketing of ISLM as an “ethics-first” asset, arguing that the inherent volatility and speculative traits of digital assets are fundamentally incompatible with the noble spirit of Islamic finance. How delightfully ironic!

While the momentum is undeniably robust, ISLM’s technical indicators hint at a treacherous path of price discovery ahead. The summit at $0.06 has propelled the relative strength index (RSI-14) into the lofty 90+ range, signaling extreme overextension. Even with a minor retreat, the asset finds itself in deep overbought territory, suggesting that the initial pangs of FOMO may be nearing their dramatic conclusion and a more profound mean reversion might be looming ominously on the horizon.

In similar fashion, the moving average convergence divergence ( MACD) histogram confirms a robust bullish crossover on both daily and weekly timeframes. However, the widening gap between the MACD and Signal lines hints at a parabolic “blow-off” structure, which traditionally precedes a phase of tumultuous consolidation or a cooling-off interlude. The trading volume, a staggering $8 million during the peak-its highest in nearly two years-confirms that this rally was no mere mirage, but rather a bona fide capital influx rather than the whims of thin liquidity.

In the short term, the technical outlook for ISLM remains decidedly bullish, with analysts peering through their crystal balls at a potential test of the $0.086 resistance, should it manage to transform the $0.055 level into support. However, given the controversial narrative and the exhilarating verticality of this move, investors are advised to tread carefully lest they find themselves caught in a sharp correction or an exuberant “ liquidity grab” as those who entered early look to cash in on their newfound fortunes.

FAQ ❓

- What drove ISLM’s 470% surge? The launch of Ethiq, HAQQ’s Ethereum Layer 2, fueled the explosive rally.

- How did the market react worldwide? ISLM’s cap jumped from $23M to $120M, reclaiming mid‑cap status across global charts.

- Why is the project controversial? Critics cite past regulatory hurdles and fundraising transparency concerns despite fatwa endorsements.

- What’s the short‑term outlook for traders? Analysts warn of overbought signals and possible sharp corrections after the vertical move.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

2026-01-11 01:59