Itaú, Brazil’s largest private bank, recommends investors Bitcoin allocation 1%-3% of their portfolio in 2026. This is advised as a way to diversify risk and hedge against currency fluctuations.

Ah, the ever-astute Itaú, Brazil’s largest private bank, has deigned to advise investors to allocate a mere 1%-3% of their portfolios to Bitcoin in 2026. How daringly prudent! One might think they are hedging against currency fluctuations, but really, it’s just another way to ensure that the wealthy remain even wealthier while the rest of us are left to ponder the mysteries of blockchain. 🧠💸

Itaú’s Dedicated Digital Asset Strategy

The report argues that Bitcoin has already built a place as a relevant component in investment portfolios. This is particularly true for those who are exposed to economic uncertainties and geopolitical tensions.

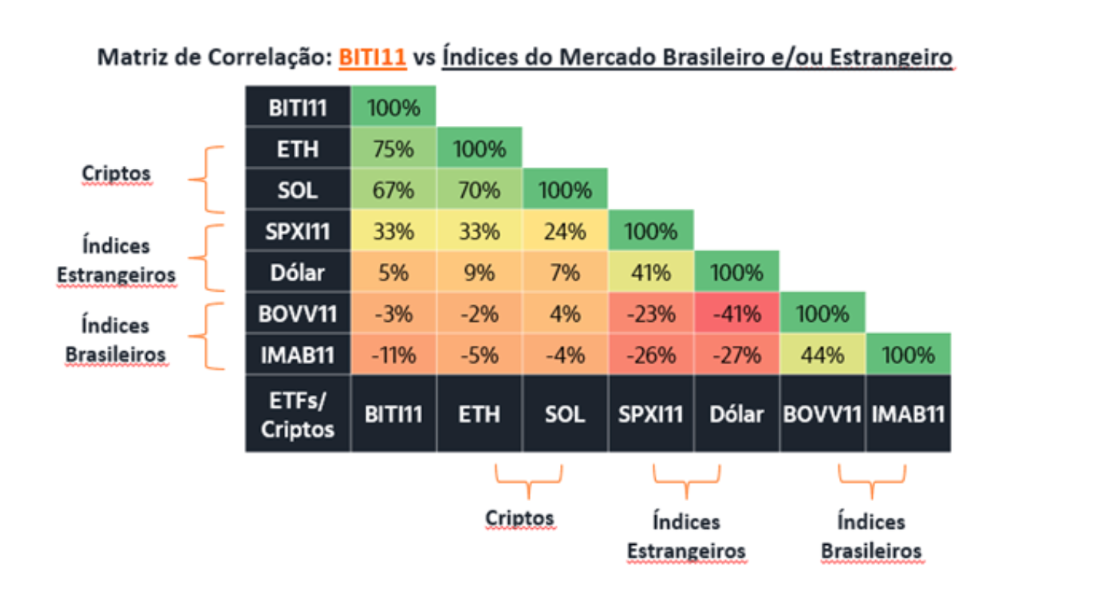

The document, which was signed by analyst Renato Eid, describes the function of the asset. Bitcoin is not like traditional stocks, fixed income, or local markets. Its global and decentralized structure provides unique opportunities. Investors looking for the balance of risk and return in unfavorable situations can benefit. Even with high volatility, the bank reinforces the fact that Bitcoin has potential for long-term appreciation.

Related Reading: Bitcoin ETFs News: BlackRock Sees Surging Demand for Bitcoin ETFs in Brazil | Live Bitcoin News

Itaau Asset is working with assets of approximately $185 billion. This recommendation comes as part of an institution-wide shift towards the digital asset space. The allocation is considered to be a means of managing risk. In addition, it helps to hedge against currency fluctuations. This also helps investors get through global economic uncertainty.

Itau already provides many controlled products based on cryptocurrency to its clients. These consist of a bitcoin exchange-traded fund (ETF). It also provides the index fund as well as the pension fund with BTC exposure. These products have a total of about R$850 million ($156 million) in assets.

Furthermore, Itau Asset set up a special team to work on digital assets in September 2025. Therefore, the team came together to build more innovative crypto investment solutions for clients. Moreover, they prioritize safety while ensuring easy access.

Brazilian Regulation Paves Way for Institutional Adoption

This institutional adoption of Bitcoin is taking place in an environment of rapidly changing regulations in Brazil. The Central Bank of Brazil (BNM) has a new comprehensive regulatory framework for virtual assets.

These new rules will apply in February 2026. They will need the licensing of all crypto companies. Existing banking regulations will apply to the crypto industry as well. These include AML/CFT measures and policies for the protection of customers.

Meanwhile, a large bill is moving through the Brazilian parliament. This bill calls for the creation of a Sovereign Strategic Bitcoin Reserve (RESBit). It would put up to 5% of the country’s international reserves into Bitcoin. If approved, this would make Brazil the first G20 nation to add Bitcoin to its official reserves. This would be a significant shift in the world.

Brazil is already a big market for crypto in Latin America. It has a high rate of adoption and usage, especially in terms of stablecoins. Ultimately, the movement of major private banks and the central government together is a decisive step towards the integrated adoption of crypto.

Read More

- Enshrouded: Giant Critter Scales Location

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- Best Finishers In WWE 2K25

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Top 8 UFC 5 Perks Every Fighter Should Use

- Best Anime Cyborgs

- All Carcadia Burn ECHO Log Locations in Borderlands 4

- Best ARs in BF6

- All Shrine Climb Locations in Ghost of Yotei

- Top 10 Must-Watch Isekai Anime on Crunchyroll Revealed!

2025-12-13 17:15