As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market cycles and trends. The recent prediction by Kyle Doops, a well-respected voice in the crypto community, that Bitcoin is still far from reaching this cycle’s top, resonates with me.

In the constantly changing landscape of cryptocurrencies, figuring out Bitcoin‘s maximum point in its growth phase has been a significant debate and hurdle within the industry as the bull market gains momentum. Nevertheless, an industry analyst studying Bitcoin’s performance and crucial indicators believes that this ongoing cycle peak is yet to be attained by the digital asset.

Bitcoin Is Distant From This Cycle’s Top

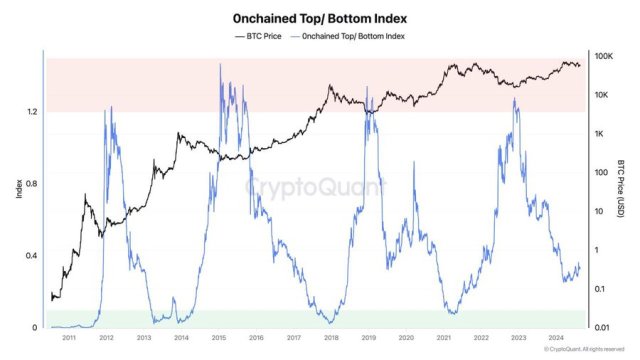

As a crypto investor, I’ve been closely watching the Bitcoin Onchain Index, and it seems we might still have some distance to cover before reaching this cycle’s peak. This index, which tracks vital factors like market trends, long-term holder behavior, and network activity, suggests that Bitcoin is currently in an accumulation phase rather than nearing a market zenith. This means there could be significant upside potential ahead, especially considering the recent steady recovery we’ve seen in BTC prices over the past few days.

Kyle Doops, a market guru and host of Crypto Banter, discussed advancements on the X platform (previously known as Twitter). As a specialist noted, the Onchained index is an innovative device that leverages investor behavior studies to pinpoint peaks and troughs in the Bitcoin market.

At present, Kyle Doops emphasizes that Bitcoin (BTC) is not yet close to reaching its maximum in this ongoing bull market. In fact, he suggests that the price could potentially double or even triple from its current level before the peak is reached. If this occurs, Bitcoin would be valued anywhere between $127,000 and $191,000 at the conclusion of the bull run.

An authority regards the index as a dependable benchmark that sophisticated investors find credible, due to its consistent reliability and accuracy over the past 13 years. As Bitcoin, the leading cryptocurrency asset, recovers in value, this index provides a promising perspective on Bitcoin’s future growth trend.

The post read:

As a crypto investor, I’m keeping a close eye on the “0nchained Index.” This innovative tool uses data analysis on investor behavior to predict Bitcoin market highs and lows. Currently, it suggests we’re not near the peak yet, indicating a possible price surge of 2-3 times its current value. Since 2011, this index has proven reliable for smart investors like myself, serving as a dependable gauge in our crypto journey.

In a previous article, Kyle Doops analyzed the Short-term Holders Market Value to Realized Value (STH-MVRV) ratio for Bitcoin, which has recently dipped below 1.0. This decrease in the STH-MVRV ratio signifies that newly invested Bitcoin holders are currently facing losses.

This month’s Bitcoin price drop due to Japan’s stock market decline might lead to increased selling, potentially causing fear and mass selling among short-term investors, increasing the chances of a panic sell-off or a point where they give up their positions altogether (capitulation).

BTC’s Price Rebounds Strongly

Following a period of stability around $58,000 and $60,000, Bitcoin surpassed that range, reaching $65,000 on Sunday. This breakout suggests potential for more growth in the coming days, given this new surge in price movement.

Today’s Bitcoin price drop to approximately $63,800, caused by resistance at the $65,000 mark, has not stopped it from experiencing a 8.1% rise over the last week, as per CoinMarketCap data. However, in the past day, its market capitalization and trading volume have decreased by 0.32% and 4.4%, respectively.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- USD COP PREDICTION

- MDT PREDICTION. MDT cryptocurrency

- LOVELY PREDICTION. LOVELY cryptocurrency

- SCOMP PREDICTION. SCOMP cryptocurrency

- WELL PREDICTION. WELL cryptocurrency

2024-08-26 17:12