As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous “sell-the-news” events that have left investors scratching their heads. The upcoming US elections are shaping up to be another one of those occasions, according to QCP Capital’s latest report.

This year marks the election period in the U.S., and Bitcoin and the wider cryptocurrency sector have found themselves deeply entwined with political matters. From the supportive stance of former President Donald Trump to the cautious approach adopted by Vice President Kamala Harris, there’s been a fair share of intrigue as the crypto market navigates the U.S. political arena.

Many different people have been talking about what will happen after the elections and how it might influence the world of cryptocurrencies. Recently, QCP Capital – a well-known trading company – has expressed their thoughts on the election results and their possible impact on cryptocurrencies, particularly Bitcoin.

QCP Thinks Bitcoin Price Will Drop Following Election Result — Here’s Why

According to a report published in early November, QCP Capital predicts that the upcoming US elections will likely trigger a “sell-the-news” event, regardless of the final result. Similar to what happened at the Nashville Bitcoin conference, the investment firm anticipates numerous investors will liquidate their Bitcoin holdings after the election on Tuesday, November 5.

Based on QCP’s findings, the short-term expected volatility has consistently remained above 72 for both Bitcoin and Ethereum in the lead-up to the upcoming elections. In essence, short-term implied volatility reflects the market’s predictions about price fluctuations in the immediate future.

Currently, the volume of this metric stands at a substantial 72, suggesting that investors might be preparing for significant fluctuations in the Bitcoin and Ethereum market post-elections. Yet, many traders predict an upward trend in put options’ premiums, indicating a perceived downturn in prices.

The increase in put options’ premium shows that traders are purchasing them as a precautionary measure, anticipating a potential market downturn. In essence, this aligns with the theory of “selling the news,” reflecting the trend observed following the Nashville Bitcoin conference.

Following an almost attainment of its record-breaking price last week, Bitcoin has seen a significant drop, falling below the $70,000 mark. Currently, it’s hovering around $68,150, signifying a 2.2% decrease over the past day.

Binance Traders Go Long On BTC Futures

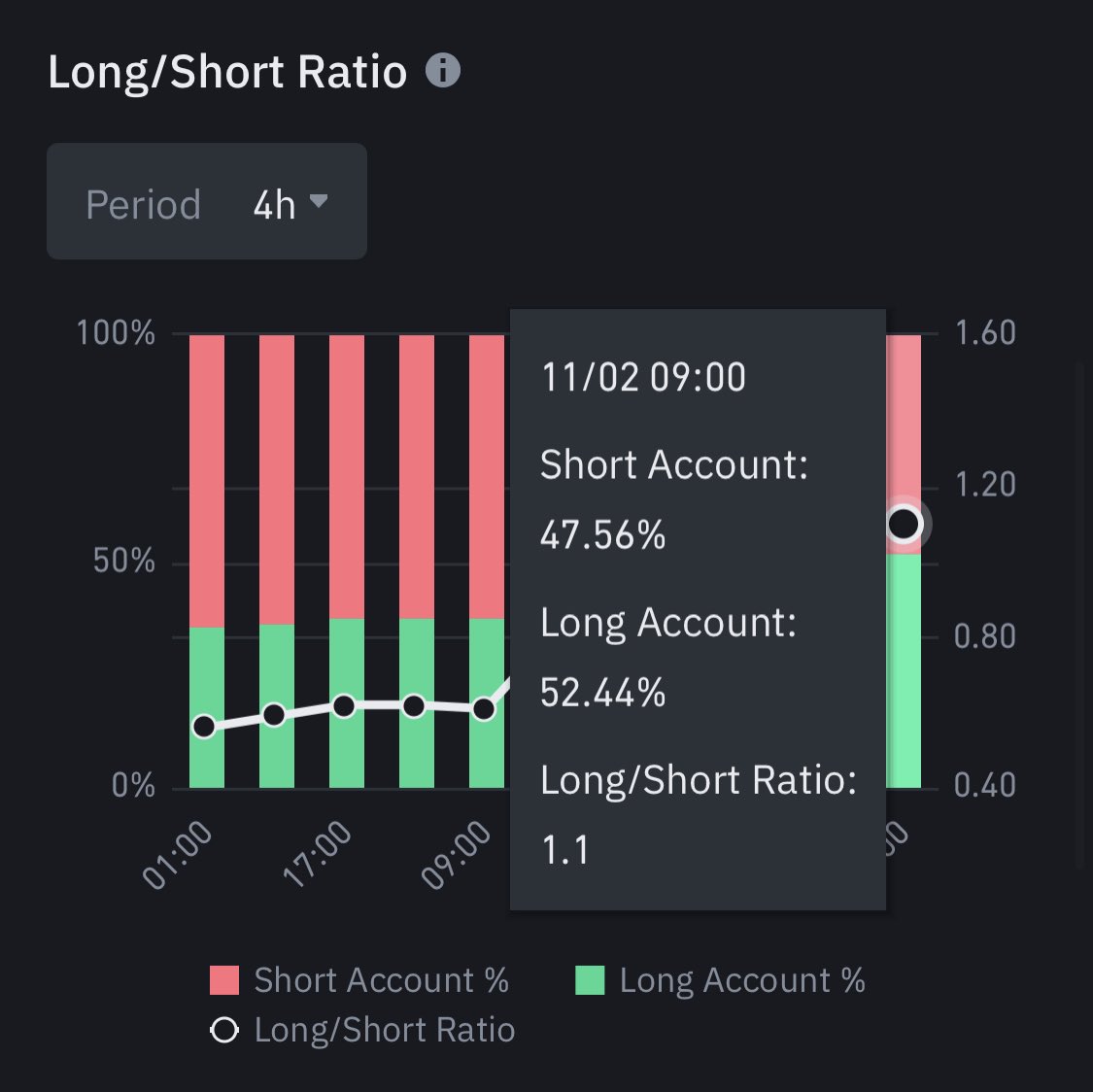

In a recent post on X, Ali Martinez revealed Bitcoin futures traders on Binance have begun to close their short position. According to the on-chain analyst, 52.44% of the Binance futures traders have now gone long on the flagship cryptocurrency.

An increase in long bets indicates that more investors believe Bitcoin’s value will go up soon. This recent trend suggests a change in investor sentiment, as the market appears to be becoming increasingly optimistic about Bitcoin just before the U.S. elections.

It’s noteworthy that the adjustments in Binance traders’ positions could well be due to the recent drops in Bitcoin’s value. Some analysts suggest that these investors might be taking advantage of the dip, considering it an ideal moment for entering the market.

Read More

- Marvel Rivals Announces Balancing Changes in Season 1

- “Fully Playable” Shenmue PS2 Port Was Developed By SEGA

- DMTR PREDICTION. DMTR cryptocurrency

- Marvel Rivals Can Earn a Free Skin for Invisible Woman

- EUR CAD PREDICTION

- Valve Announces SteamOS Is Available For Third-Party Devices

- What Borderlands 4 Being ‘Borderlands 4’ Suggests About the Game

- A Future Stardew Valley Update Should Right One Holiday Wrong

- Christmas Is Over: Bitcoin (BTC) Loses $2 Trillion Market Cap

- Kinnikuman Perfect Origin Arc Season 2 New Trailer and Release Date

2024-11-03 14:11