In the grand bazaar of digital baubles, the humble LINK has emerged as the belle of the ball, its exchange balances dwindling to levels not seen since the last time society had faith in anything. The cognoscenti, ever eager to clutch at straws, now whisper of a rally so magnificent it could make even the most jaded aristocrat blush. With sentiment as buoyant as a debutante’s hopes, the target of $46 dangles like a carrot before the noses of the financial rabble. 🥕

The Great Accumulation: Chainlink Holders Play Keep-Away

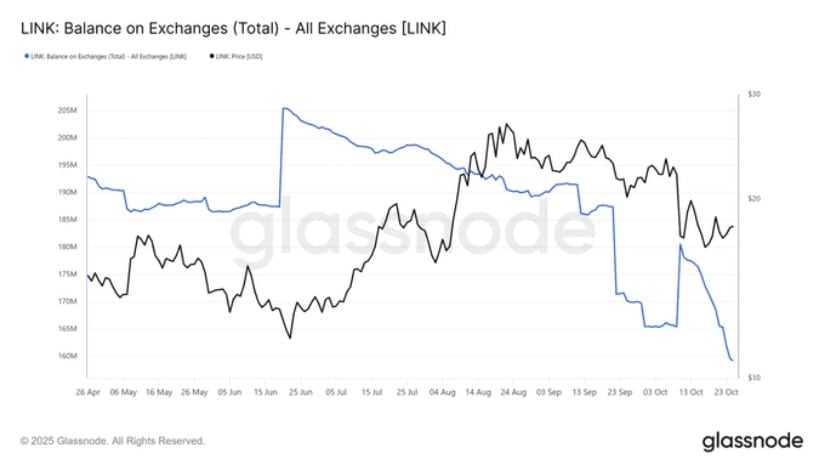

On the twittering grounds of X, one Tom Tucker-a fellow of dubious distinction but undeniable charts-has proclaimed a trend so robust it could only be described as a hoarding frenzy. The blue line on the Glassnode chart, a thing of beauty and terror, plunges like a socialite’s morale at a bad review. Holders, it seems, are spiritedly withdrawing their tokens into the icy embrace of cold storage, leaving exchanges as bereft as a Waugh novel’s protagonist. ❄️

Tucker’s musings reveal a Holder Accumulation Ratio of 98.9%, a figure so absurdly high it suggests the entire populace has taken to stockpiling LINK like tinned goods before an apocalypse. History, that fickle mistress, reminds us that such greed has often preceded market euphoria. With exchange reserves thinner than a society matron’s patience, a supply squeeze looms, promising price surges as dramatic as a Bright Young Thing’s scandal. Tucker, ever the optimist, foresees a climb to $46-a sum that would make even the most stoic investor giggle with glee. 😂

Chainlink: Steady as a Butler’s Hand at $18.50

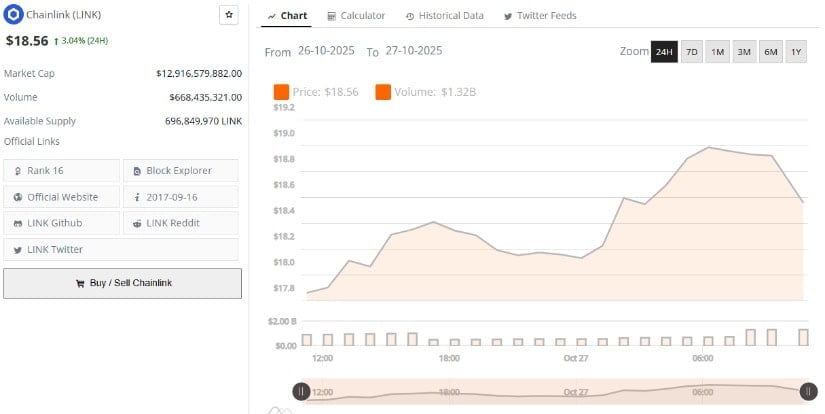

According to the oracles at BraveNewCoin, LINK currently resides at $18.56, a modest 3.04% rise in the last 24 hours. Its market capitalization, a staggering $12.91 billion, and trading volume of $668.4 million, confirm its place among the crypto aristocracy. With 696.8 million tokens in circulation, it remains a darling of the top 20, its liquidity as robust as a country squire’s port collection. 🍷

This price resilience coincides with a shift in on-chain dynamics, as subtle as a trumpet at a tea party. The asset, now comfortably above $18, eyes the $19.50-$20 resistance zone with the determination of a socialite climbing the ladder of respectability. Should it breach this barrier, the bullish thesis will be as undeniable as a Waugh protagonist’s disdain for the middle class. The path to $25, and perhaps even $46, would then be as clear as a country estate’s view. 🏞️

Technical Indicators: The Tea Leaves of the Financial Set

As of October 27, TradingView reports LINK/USDT at $18.88, a 1.78% daily uptick. The daily chart, a thing of intricate beauty, identifies $19.53 as the resistance level-a barrier as formidable as a dowager’s disapproval. Support at $18.20-$18.40 remains critical, lest the trend collapse like a poorly constructed soufflé. 🥧

The RSI, at 48.64, lingers in the neutral zone like a guest at a party neither enjoying nor leaving. Its moving average of 40.80 hints at a recovery from oversold despair, a bullish shift as subtle as a raised eyebrow. The MACD, with its crossover and positive histogram, confirms short-term buying momentum, though the broader trend remains as stable as a Waugh marriage. Sustained closes above $19.50 would herald a breakout, propelling LINK toward $22-$25, a forecast as grand as a society wedding. 💍

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- TRX PREDICTION. TRX cryptocurrency

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Xbox Game Pass September Wave 1 Revealed

- INR RUB PREDICTION

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

2025-10-27 18:36