According to on-chain analysis, an unprecedented 62.5% of Litecoin investors now fall into the category of long-term holders.

There Are Now More Than Five Million Litecoin Long-Term Holders

Based on information from market analysis tool IntoTheBlock, the Long Tactics (LTC) network has achieved a new mark in the number of its long-term holders.

Long-term Bitcoin investors, referred to as LTHs here, are individuals who have owned their coins for over a year without making any transactions or selling them. Note that IntoTheBlock sets this benchmark; other analytics companies define LTHs as those holding onto their coins for anywhere between 5 and 6 months.

In statistical terms, as time passes, investors are less and less inclined to sell their assets. Consequently, those who hold onto their investments for extended periods are perceived as having strong determination.

In the past, Long-Term Holders (LTHs) seldom engage in selling, irrespective of market conditions. On the other hand, the unpredictable segment of investors with shorter holding periods is referred to as the Short-Term Holders (STHs).

It’s not unusual for large-scale token holders (STHs) to join in selling during market volatility, whether it’s a rally or a crash. However, sales by long-term holders (LTHs) can be particularly noteworthy.

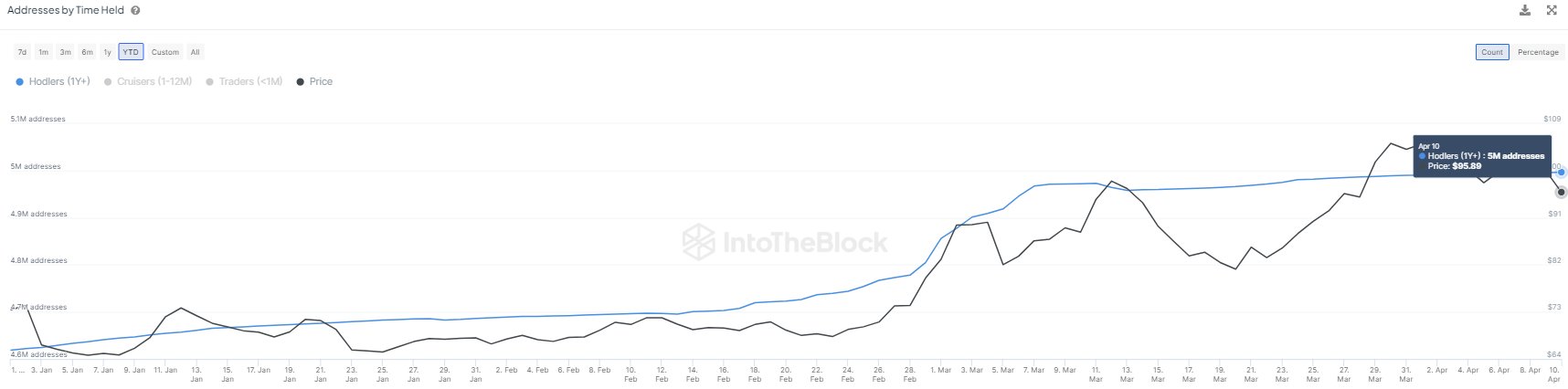

Keeping tabs on Litecoin’s Long-Term Holders (LTHs) can be achieved by monitoring the count of addresses holding the coins for an extended period. Here’s a chart from the analytics firm, showing the development of this indicator for Litecoin since the beginning of the year.

The graph above shows that the number of Litecoin (LTH) addresses has seen a large increase over the past few months and has recently surpassed the 5 million threshold.

Approximately 62.5% of the total LTC wallets, which currently hold some amount other than zero, have been inactive for over a year. Translated, this implies that more than five million such wallets haven’t initiated any transactions since then.

A large number of cryptocurrency holders have kept their coins stored, indicating strong interest in holding onto them for the long term. This locked supply could potentially boost prices due to the basic economic principle that less available supply in relation to demand can lead to increased values.

Any rise in the number of LTH (Large Holder) addresses for Litecoin doesn’t necessarily mean new purchases are being made by HODLers. Instead, it could indicate that some investors bought coins over a year ago and have only recently met the qualification requirements to be counted as large holders.

In simpler terms, there is a one-year lag between when the metric calculates coin accumulation and when it records a rise. However, selling does not come with this delay; investors who sell their coins on the network are right away removed from the group.

LTC Price

Lately, Litecoin’s price hovers near the $95 mark, bouncing back and forth within a limited range.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

- SEILOR PREDICTION. SEILOR cryptocurrency

- USD CLP PREDICTION

- Best JRPGs That Focus On Monster Hunting

- COW PREDICTION. COW cryptocurrency

2024-04-13 05:11