As a seasoned researcher with years of experience in the cryptocurrency market, I find it fascinating to observe the resilience and patience of Litecoin HODLers, especially in times of market volatility such as this recent plunge. The data clearly shows that these long-term investors control the majority of the LTC supply, with an average holding time of 2.4 years per token.

Recently, the pattern of holding onto Litecoin (LTC) has remained robust on the network, even though its value has experienced a significant drop.

Litecoin HODLers Currently Control The Majority Of Supply

As a researcher delving into the latest updates from X, I’ve noticed that Litecoin’s official account has shed light on the current distribution of their asset supply across various investor groups, categorized by holding duration.

Here are three groups significant for this discussion: Investors, Explorers, and Long-Term Holders. The initial group, the Investors, consists of individuals who have purchased their coins within the last month. This group encompasses both newcomers to the market and those who engage in short-term trading, meaning that the supply they hold is frequently changing or fluid.

Individuals who have been members for over a month will be categorized in the “Cruisers” group. This group symbolizes the portion of our community that shows promise towards becoming a steadfast barrier.

As a researcher studying cryptocurrency behavior, I find it intriguing when investors choose to keep their digital assets for over a year without any trades. Such individuals can be considered as having realized the potential of their investments, thus falling into the category of long-term holders or HODLers.

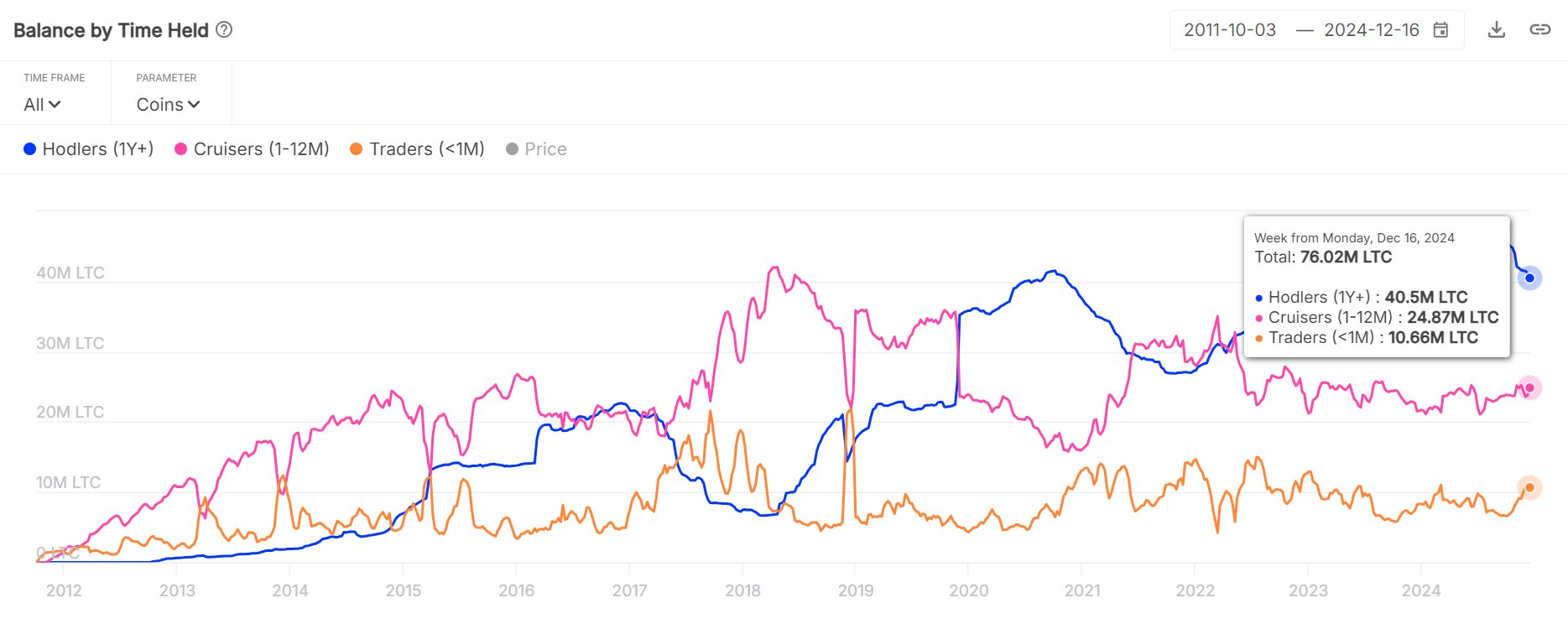

The following chart, originally posted by the Litecoin X account from the market intelligence platform IntoTheBlock, illustrates how the distribution of coins among the three main groups has evolved throughout Litecoin’s history.

According to the graph, there’s been a recent rise in the amount of Litecoin held by traders, indicating that older groups of holders may be becoming active again after a period of inactivity.

Additionally, it’s clear that the Cruisers have seen their supplies staying steady horizontally, suggesting that the coins being transferred are over a year old. In other words, there might have been some selling activity among the HODLers.

As a crypto investor, I’ve learned to stay resilient amid market fluctuations, but it’s common for me to seize opportunities during bull runs by taking profits. So far, the reduction in supply hasn’t been drastic. Most significantly, even with the recent crash in Litecoin’s price, I haven’t felt compelled to sell in a panic.

Following the reduction, Holders presently possess approximately 40.5 million Litecoins in their wallets, which represents nearly 54% of the entire Litecoin supply. A significant portion of this stockpile is also older than a year, as data from the cryptocurrency’s handle indicates an average holding period of about 2.4 years per token on the network.

It’s important to understand that when something is sold, it shows up straight away on the supply graphs for older groups. However, buying doesn’t work the same way. When we see an increase in supply among Cruisers or HODLers, this doesn’t necessarily mean they are currently accumulating, but rather that they bought something a month or a year ago.

This is naturally due to the fact that coins have to age up sufficiently first in order to be counted among these cohorts. In contrast, transactions instantly reset back their age to zero, which is why selling is immediate.

LTC Price

At the time of writing, Litecoin is trading around $102, down 15% over the last week.

Read More

- March 2025 PS Plus Dream Lineup: Hogwarts Legacy, Assassin’s Creed Mirage, Atomic Heart & More!

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Top 5 Swords in Kingdom Come Deliverance 2

- XRD PREDICTION. XRD cryptocurrency

- Unlock the Secret of Dylan and Corey’s Love Lock in Lost Records: Bloom & Rage

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Reverse: 1999 – Don’t Miss These Rare Character Banners and Future Upcoming Updates!

- JTO PREDICTION. JTO cryptocurrency

2024-12-24 00:41