As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the recent surge in transaction volume for Litecoin. The graphical evidence suggests a growing user interest and network activity, which could potentially fuel volatility in its price. However, it’s important to remember that such trends don’t always translate into immediate gains or losses for investors.

Recent on-chain activity indicates that Litecoin‘s trading volume over the past week is at its peak since May 2023. This surge in activity might have implications for the asset’s future pricing.

Litecoin Transaction Volume Has Been Rising Recently

In a new post on X, Jay Milla, the director of marketing at Litecoin Foundation, has pointed out that the LTC network has witnessed a large amount of transaction volume during the past week. The “transaction volume” here refers to an on-chain metric that keeps track of the total amount of Litecoin that’s becoming involved in transactions on the network every day.

When the level of this particular indicator is significant, it suggests that users are actively transferring considerable sums within the blockchain network. This pattern indicates a heightened curiosity or demand for the asset from investors, as they are likely engaging in substantial trading activities.

In a nutshell, when the indicator is low, it suggests that the holders might not be very active or engaged with the cryptocurrency since they’re not conducting numerous transactions.

Here’s a graph illustrating the recent changes in Litecoin’s transaction volume:

The graph shows that the transaction volume for Litecoin has been increasing significantly, indicating more user activity. Over the last week, the network has handled approximately 512.8 million Litecoins, which equates to around $35.4 billion using today’s exchange rate. This translates to an average daily volume of over $5 billion.

In simpler terms, an increase in network activity often triggers price fluctuations for an asset because it supplies the momentum needed for significant price movements. This increased activity can cause either a rise or fall in the asset’s value. For instance, Litecoin has experienced a decrease in its price over the past few days, which may indicate that the recent surge in trading activity was driven by sellers rather than buyers.

A positive aspect is that the trend for this metric has been steadily increasing over time. This could imply that it’s not simply a temporary trend or fad, but rather an indication of genuine, organic growth.

Litecoin stands out due to its quick and affordable transactions, which historically have led to strong performance when measuring network activity. It seems that this trait continues to pique user curiosity.

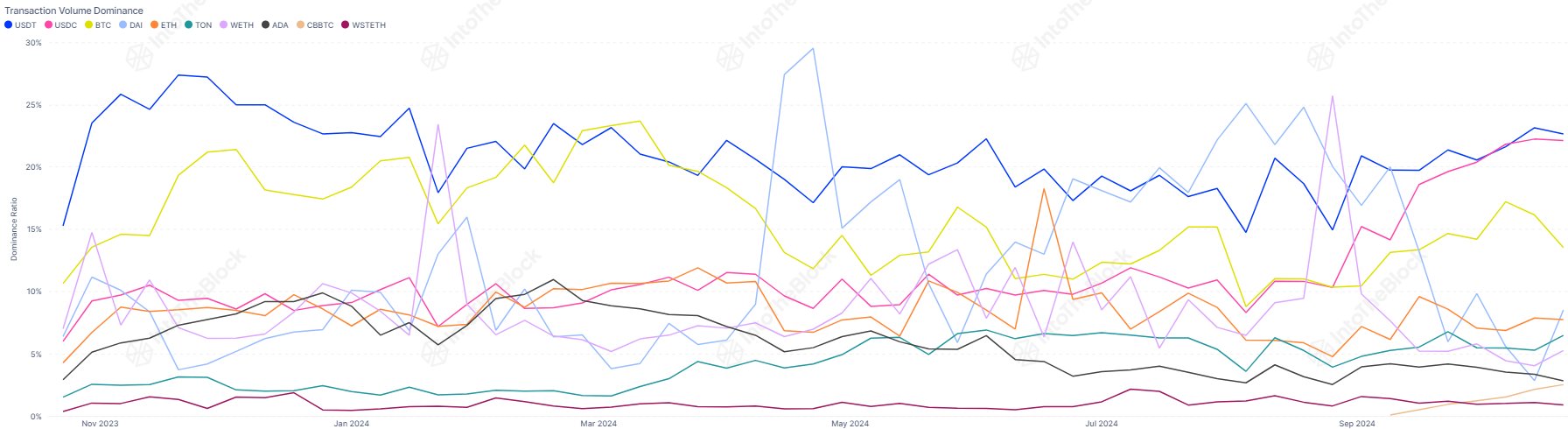

In terms of where LTC (Litecoin) sits within the broader context, the market intelligence platform IntoTheBlock has provided a graph showing the transaction volumes of the key coins in this field.

In recent times, the digital currencies USDT and USDC have led the pack with transaction values reaching approximately $29 billion and $28 billion respectively. Bitcoin trails slightly behind in third place, recording a volume of around $17 billion.

Consequently, although Litecoin has seen growth lately, it’s important to note that its trading volume remains significantly lower compared to Bitcoin, approximately one-third as much.

LTC Price

At the time of writing, Litecoin is trading around $69, down more than 2% over the past week.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- EUR CAD PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- EUR ARS PREDICTION

- OSRS: Best Tasks to Block

- Tips For Running A Gothic Horror Campaign In D&D

- ULTIMA PREDICTION. ULTIMA cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- INR RUB PREDICTION

2024-10-24 13:11