As an experienced analyst, I believe that the recent large Litecoin transfer from Binance to an unknown wallet by a whale entity could potentially be bullish for the asset’s price. The reason being, such exchange outflows are often seen as signs of fresh buying or investors planning to hold for extended periods, which can lead to increased demand and potential price appreciation. However, it’s important to note that there is also a possibility that the whale could be selling through over-the-counter (OTC) deals instead, which could have bearish implications.

Recent on-chain information indicates that a significant Litecoin investor, holding approximately $20 million worth of LTC, has transferred this amount from Binance. This action might be a positive sign for the value of Litecoin.

Litecoin Whale Has Just Made A Large Outflow From Binance

As a researcher examining transactions on the Litecoin blockchain, I’ve come across noteworthy information from Whale Alert’s data: a significant transfer took place within the last 24 hours.

As a researcher studying transactions on the Litecoin network, I came across one that stood out due to its significant size. This particular transaction involved the transfer of 286,482 LTC, which equated to approximately $20.6 million at the time. Given the sheer magnitude of this movement, it’s plausible that a large entity, often referred to as a “whale,” was responsible for this action.

As a blockchain analyst, I would observe that whales carry significant weight within the digital economy given their substantial holdings. Consequently, monitoring their transactions becomes essential since their activities could potentially trigger shifts in the value of a particular asset.

The impact of a whale transaction on the market hinges upon the motive behind the transfer. While it’s often challenging to discern why such a large transaction was initiated, the recipient’s address may offer some clues.

Below are details for the latest transfer that may shed light on its context.

I notice from the information presented that the transfer of Litecoin was initiated from a Binance-connected wallet, while the destination address remains unknown and unidentified.

Unknown wallets, which haven’t been connected to any recognized centralized systems, are most probably the investing public’s personal addresses. Such transactions, originating from an exchange and moving to a self-custodial wallet, can be referred to as exchange withdrawals.

Transferring funds out of an asset could indicate new purchases in the market or a intent to keep the investment for a longer term. Consequently, such transactions might be considered as optimistic signals for the asset’s future price trend.

As a crypto investor, I can tell you that if a large whale has transferred a substantial amount of Litecoin from an exchange, there are two possible scenarios. In the first one, the whale might be accumulating more Litecoins for future use or long-term holding. This could potentially lead to positive price movements for Litecoin. However, it’s also plausible that the whale intends to sell their Litecoins through over-the-counter (OTC) deals instead. In this case, the selling pressure could negatively impact the Litecoin market.

As an analyst, I would assess that this development could potentially result in a downturn for the cryptocurrency. The impact of the recent large-scale transaction by the Litecoin whale on its price remains uncertain.

Recently, Long Term Coin (LTC) has remained the busiest blockchain globally based on news article activity. This information was disclosed through a post featuring the coin’s official symbol, X.

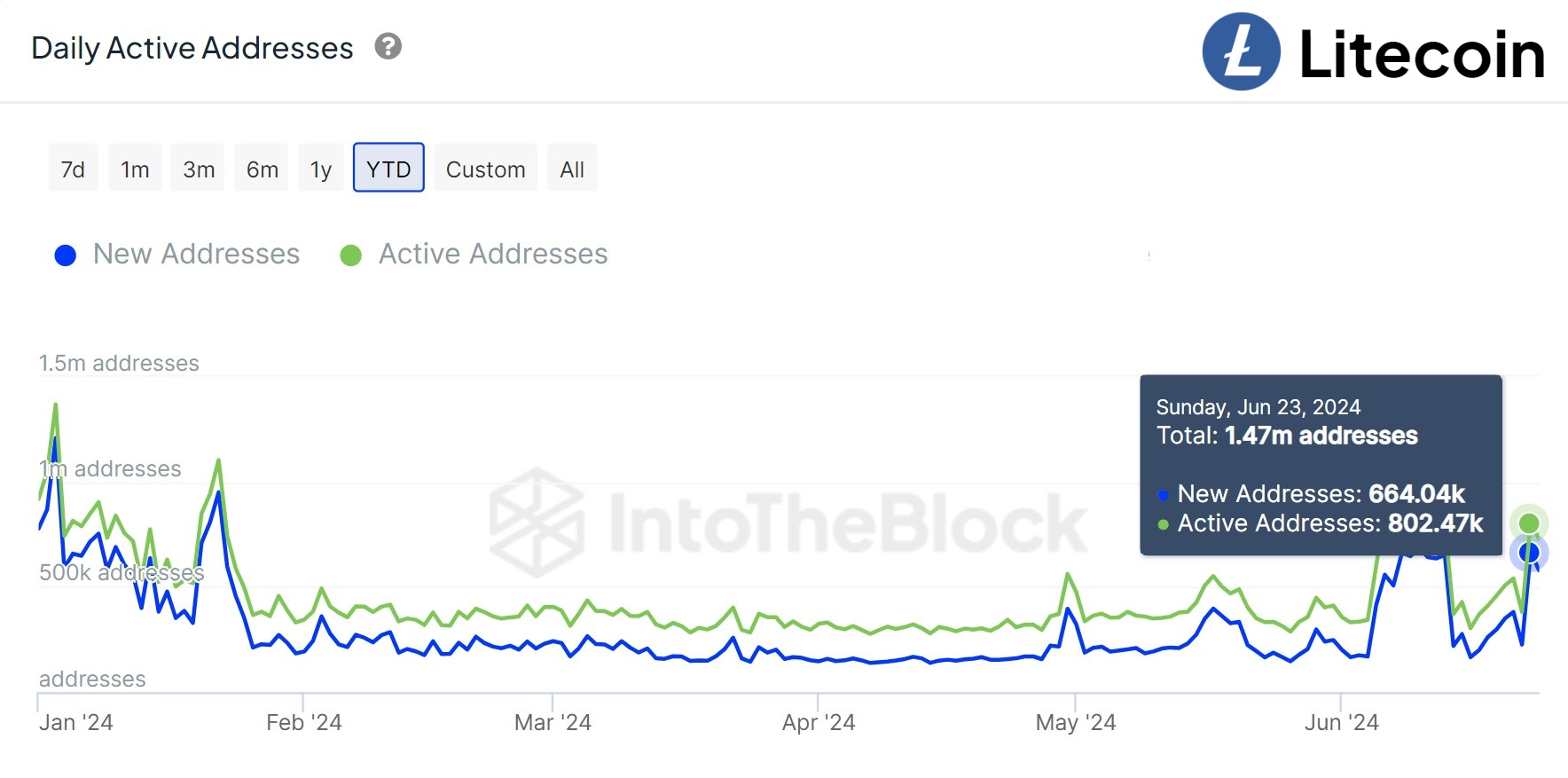

In the provided chart, you can see that the number of daily active Litecoin addresses has noticeably increased and currently reaches 802,470. These figures represent the number of addresses engaging in any kind of transaction on the network each day.

As a crypto investor, I’ve noticed an intriguing trend in the number of active addresses on the Litecoin (LTC) network. Surprisingly, this figure is currently greater than that of Bitcoin (BTC) and Ethereum (ETH) networks. Thus, the bustling activity on Litecoin suggests a higher level of engagement and transaction volume on its chain compared to these two prominent cryptocurrencies.

LTC Price

At the time of writing, Litecoin is trading at around $71, down more than 4% over the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- USD COP PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- IQ PREDICTION. IQ cryptocurrency

- TROY PREDICTION. TROY cryptocurrency

- SHI PREDICTION. SHI cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

2024-06-27 10:14