As a seasoned analyst with over two decades of trading experience under my belt, I must admit that the current Bitcoin rally has piqued my interest. The recent “golden cross” formation, combined with the surge above key resistance levels, paints an optimistic picture for the world’s largest cryptocurrency.

Bitcoin is continuing to build on its recent gains, as indicated by its price movements over the last few trading sessions. Currently, buyers seem particularly eager and are not only looking to solidify the two-day rally but also to push prices above the March 2024 highs of approximately $74,000.

Bitcoin “Golden Cross” Forms

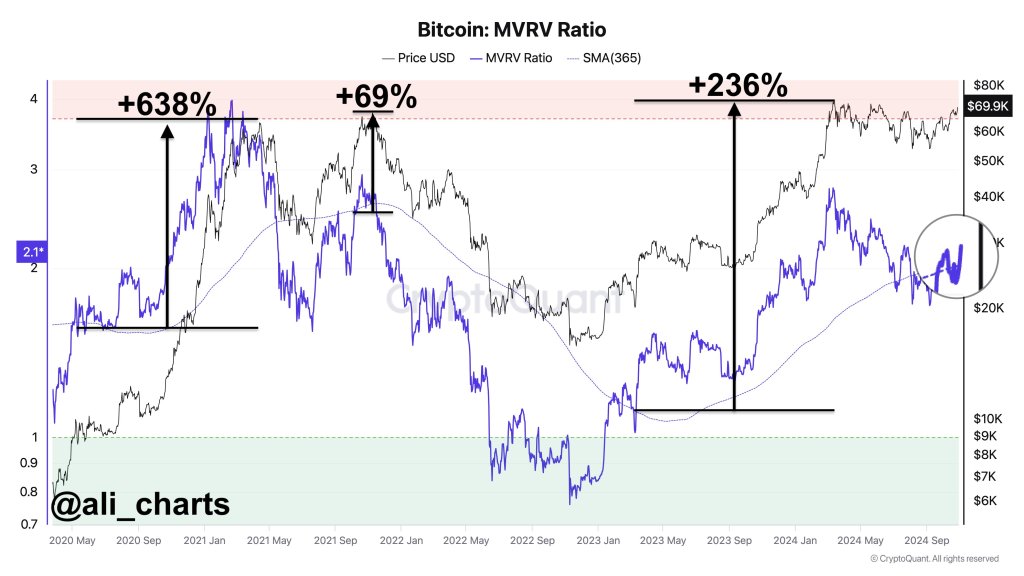

The optimism has been confirmed on-chain. On X, one analyst notes that the market value to realized value (MVRV) ratio has exceeded the 365-day moving average.

The MVRT ratio is a tool that on-chain experts employ to determine the typical profit (or loss) of Bitcoin holders at various prices. If the MVRT ratio surpasses its 365-day moving average, it’s often referred to as a “golden cross,” and this occurrence has typically been followed by significant price increases.

If the ongoing development continues in its current trajectory, it’s likely that Bitcoin will surpass and close above significant resistance levels around $74,000. The recent surge beyond $72,000 to reach as high as $73,000 on October 29 might indicate a strong foundation, suggesting that bulls are gearing up for another surge in demand.

As the bulls approach the $74,000 mark, the speed at which they surpass this level and eventually break through $86,000 will be crucial. In a recent post on X, an on-chain analyst suggested that a move above $86,200 could dictate the “outcome” or “direction” of the bulls. Once this hurdle is cleared, they’ll require “strong, sustained upward pressure.” After surmounting this barrier, prices are expected to develop as everyone has been anticipating.

Over the last several months, and more so since Bitcoin reached almost $74,000 in March 2024, investors have anticipated significant price increases, pushing the value closer to $100,000.

Based on my short-term analysis and risk assessment using the charting tools provided by CryptoQuant, if Bitcoin manages to break above the current resistance at $86,200, it’s quite plausible that its price could surge towards $100,000.

Market Forces Will Determine The Pace Of Growth

The speed at which Bitcoin reaches $100,000 will be influenced by various elements, with investments from institutions playing a key role. Positively, the interest in Bitcoin is growing, particularly among those who are considering launching spot Bitcoin ETFs. For instance, as per SosoValue’s data on October 29, over $870 million worth of shares were purchased by these potential ETF issuers.

Independent of formal institutions, market analysis indicates that retail traders are opening leveraged long positions on continuous trading platforms like Binance, while simultaneously buying in the spot market. Contrastingly, on Coinbase’s platform, the spot market shows a trend of selling as the price increases.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- PlayStation and Capcom Checked Another Big Item Off Players’ Wish Lists

- EUR CAD PREDICTION

- XDC PREDICTION. XDC cryptocurrency

- Black Ops 6 Zombies Actors Quit Over Lack Of AI Protection, It’s Claimed

- POL PREDICTION. POL cryptocurrency

- SEI PREDICTION. SEI cryptocurrency

- APU PREDICTION. APU cryptocurrency

- JST PREDICTION. JST cryptocurrency

2024-10-31 11:41