In the wake of a turbulent tempest that shook the digital shores of Bitcoin, the astute analysts at Glassnode took up their quills and began to pen the tale of loss and capitulation. Who amongst the vast sea of Bitcoin investors has floundered the hardest in these stormy waters? Well, grab your life jackets, dear reader, for we are about to dive into the depths of desperation.

Recent Bitcoin Buyers Have Combined Realized $2.16 Billion In Loss Recently

Picture this: the wild-eyed investors, in their fervent pursuit of riches, braved the market only to find themselves navigating the treacherous waves of financial despair. Glassnode, in a flurry of hashtags on X, revealed the heart-wrenching saga of the peckish price crash and its unfortunate victims. The narrative revolves around a number aptly named “Realized Loss,” a stern reminder of the harsh reality waiting in the shadows of the blockchain.

Now, this “Realized Loss” measures, with a cold and calculating air, the total amount of despair that our dear investors are experiencing as they clutch their wallets. It sifts through the shifting sands of coin transfers, comparing their noble selling prices against the devastating realities of today’s rates. If a coin is sold for less than its previous glory, it’s a tale of misery well told.

Thus, the calculation bears fruit—the total losses amassed by frayed nerves and trembling hands amounts to a staggering $2.16 billion from those fresh-faced investors who leapt into the Bitcoin maelstrom from the 25th to the 27th of February. Oh, how the mighty have fallen! 💸

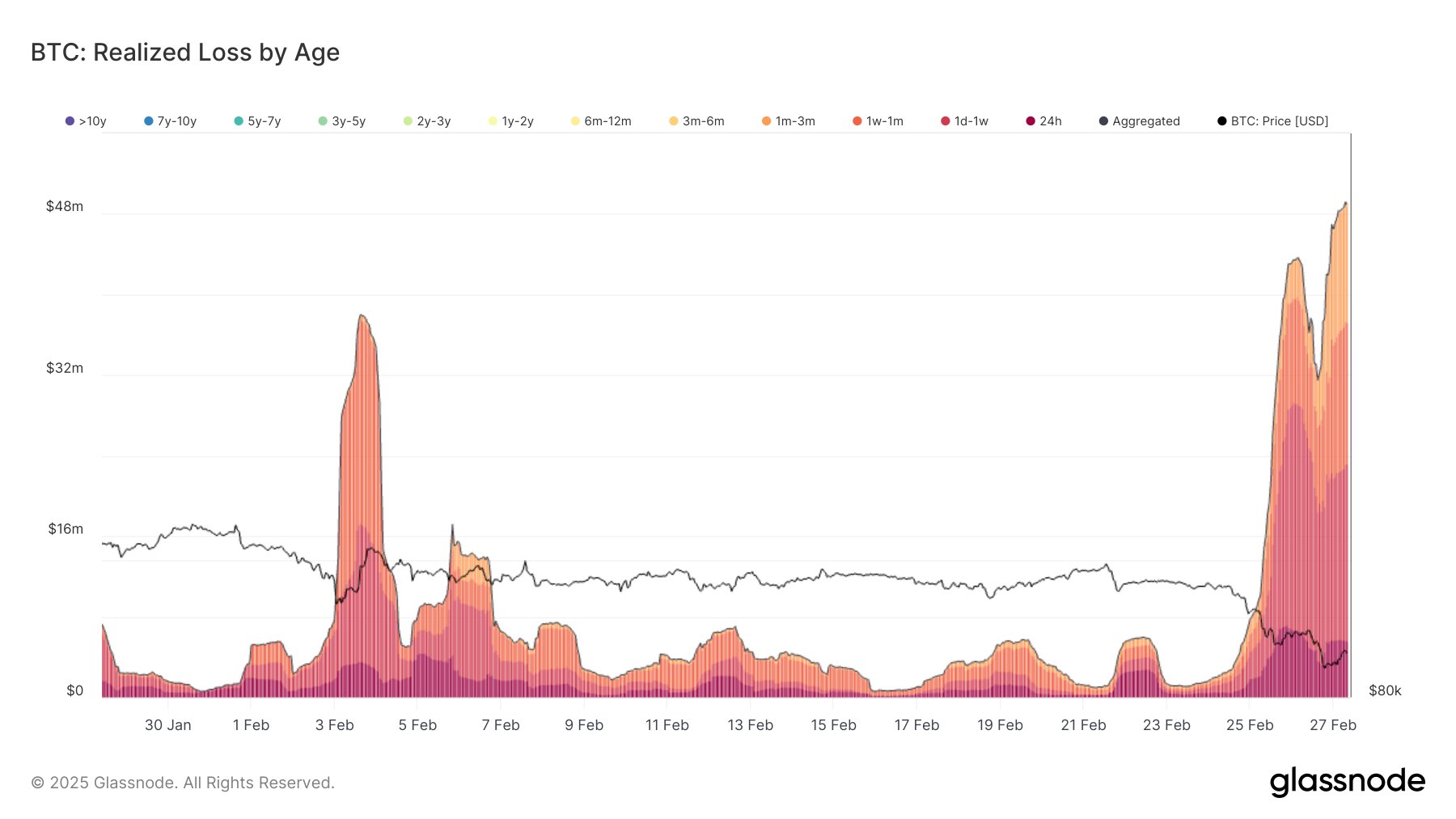

Behold the chart presented by Glassnode, a humble testimony to the chronicled decline of Bitcoin’s fortunes among the many cohorts over the past moon’s cycle.

As the chart unfurls, one might observe that the seasoned Bitcoin voyagers have steadfastly refused to take the bait of loss-taking; their minds are clear as the storm passes. Why? Because even after the crash that sent many to tears, the older generation of Bitcoin is still sailing in waters they once considered safe.

But for the greenhorns who dared to dance with fate, the accounts of their losses dance like shadows against the wall: a staggering $322 million lost in a single day, $927 million in just a week, and, in a tragic twist of irony, a whopping $257 million drifting away in the following months.

Ah, but the cohort of those new to the trade—those who hopped on the Bitcoin bandwagon just days before the thunderous crash—accounted for more than 42% of the tragedy. A lesson learned too late, their exuberance drowned beneath a deluge of misfortune.

Now, allow us to widen the lens and reflect on the broader canvas of loss throughout the annals of Bitcoin history. Here’s the grand historical chart, revealing the ebb and flow of our once-beloved coin:

BTC Price

As the winds howl and the markets tremble, Bitcoin, our beleaguered friend, lingers around the $86,200 mark, down, mind you, almost 12% just this past week. Alas, such is the life in the digital wild west.

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- USD ILS PREDICTION

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Gold Rate Forecast

- How to Get 100% Chameleon in Oblivion Remastered

- Invincible’s Strongest Female Characters

2025-02-28 10:14