Well, folks, grab your popcorn because Metaplanet’s stock has taken a nosedive that would make even the most seasoned skydiver queasy. Yes, you heard it right! The stock price has crashed and entered a bear market, which, if you ask me, sounds like a terrible theme park ride. 🎢

- Metaplanet’s share price has plummeted by a staggering 55% from its year-to-date high. Talk about a dramatic fall from grace!

- The stock has dropped faster than my willpower at an all-you-can-eat buffet as Bitcoin treasury companies dive headfirst into the abyss.

- Technical analysis suggests that more downside is on the horizon. Great, just what we needed-more bad news!

As of now, Metaplanet shares are worth a measly ¥910 ($6.18), which is the lowest level since May 23. That’s a 55% drop from this year’s peak, which is like watching your favorite TV show get canceled after one season. The company’s market cap has plummeted from ¥1.14 trillion to ¥638 billion. Ouch!

Why the Metaplanet Stock Price Has Crashed

So, why has Metaplanet’s share price taken a dive? Well, let’s break it down, shall we? First off, there are signs that demand for Bitcoin treasury stocks is weakening. It’s like finding out your favorite band is just a cover group. For instance, Strategy, the largest Bitcoin accumulator, has dropped by 30% from its all-time high. Other companies like MARA Holdings and Trump Media are also experiencing double-digit declines. It’s a veritable stock market pity party!

Secondly, some investors have decided to cash in their chips. At its peak in June, the stock was up more than 15,000% from its lowest level in 2024. I mean, who wouldn’t want to take a little profit after that kind of rollercoaster ride?

It’s not unusual for stocks to pull back after a massive rally. From a technical analysis perspective, it seems the stock has entered the distribution or markdown phase of the Wyckoff Theory. Sounds fancy, doesn’t it? But really, it just means things are looking grim.

Thirdly, there are ongoing concerns about Metaplanet’s valuation. Despite the 55% drop, its net asset value (NAV) multiple stands at 2, which is higher than other Bitcoin treasury companies. Strategy has a NAV multiple of 1.47, while MARA is at 1. It’s like being the tallest kid in kindergarten-great, but not exactly a high bar to clear.

And let’s not forget the looming specter of dilution. Last week, the company announced plans to raise an additional $3.7 billion to buy more Bitcoin. This move would increase dilution, as its outstanding shares have surged from 114 million in January last year to 460 million. It’s like trying to make a cake and realizing you’ve run out of flour-good luck with that!

Metaplanet Share Price Technical Analysis

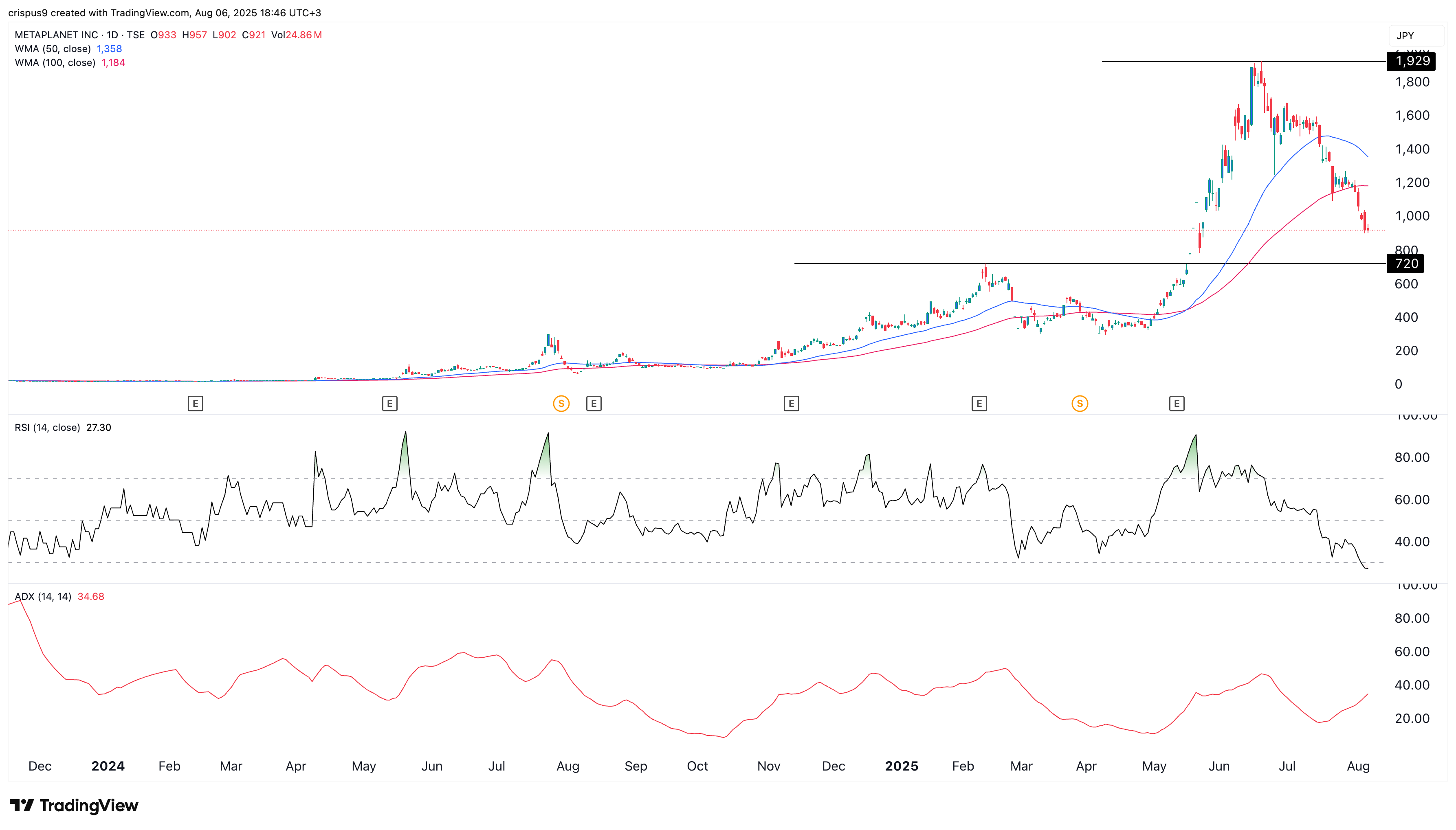

The daily chart shows that Metaplanet’s stock price has been on a strong bearish trend over the past few months, falling from a high of ¥1,929 in June to ¥920. It’s like watching a slow-motion train wreck, and you can’t look away.

It has dropped below the 50-day and 100-day Weighted Moving Averages. Meanwhile, the Relative Strength Index has fallen to 27, and the Average Directional Index has risen to 35. These momentum indicators suggest that the bearish trend is strengthening. In layman’s terms, it’s not looking good, folks.

So, brace yourselves, because the path of least resistance for the Metaplanet share price is downwards, with the next target being ¥720, its highest point in February. If you’re still holding onto those shares, you might want to consider investing in a good pair of roller skates instead. At least then, you can glide away from the chaos! 🛼

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-08-06 20:36