As a researcher with a keen eye for trends and patterns in the cryptocurrency market, I find myself continuously intrigued by the strategic moves of key players like Microstrategy. The recent acquisition of 15,350 BTC by this company, bringing their total holdings to an impressive 439,000 BTC, is a testament to Michael Saylor’s bold and visionary approach.

Just now, Michael Saylor’s company, MicroStrategy, made an announcement about purchasing more Bitcoin. This new acquisition boosted their total Bitcoin holdings to an impressive 439,000 units.

Microstrategy Has Bought Another 15,350 BTC

As a researcher, I’ve noticed that during this recent Bitcoin bull run, Microstrategy has been a significant player. The value of Bitcoin has been surging, and concurrently, Microstrategy has been steadily amassing cryptocurrency. Remarkably, even at these current high prices, the company appears unfazed, as they’ve announced another purchase, suggesting they are not yet done accumulating Bitcoin.

Over the span of those days from the 9th to the 15th of December, the company bought a grand total of 15,350 Bitcoins, spending around $1.5 billion at an average price of roughly $100,386 per token during this shopping period.

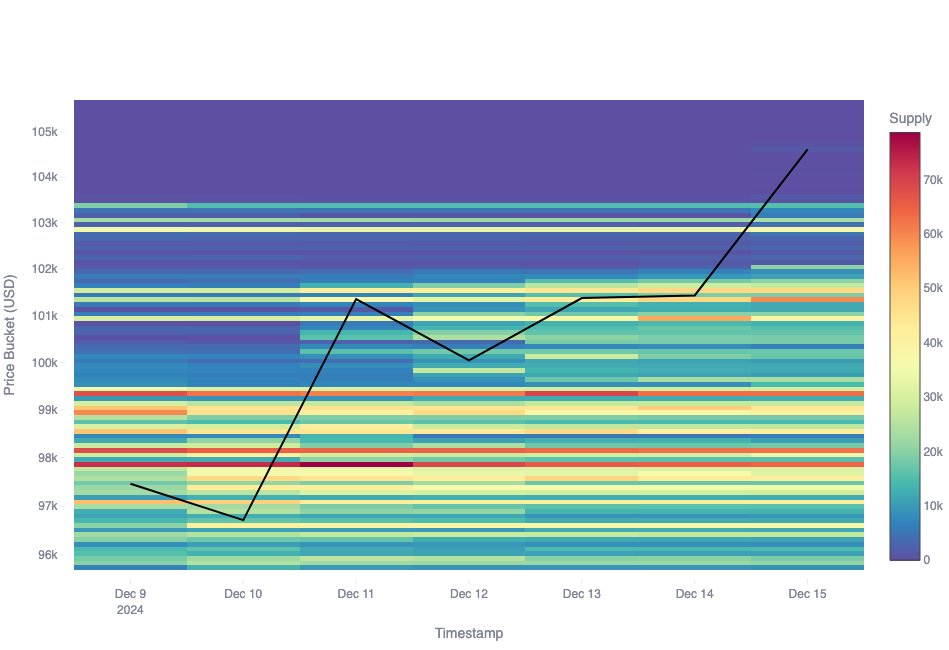

In their latest update on platform X, Maartunn from the CryptoQuant community has presented a graph illustrating the specific times when Microstrategy recently made its acquisitions over the past few months.

As a researcher analyzing my recent Bitcoin transactions, I’ve noticed an interesting pattern. While my most recent purchase holds the smallest value in Bitcoins, it surpasses the value of my earlier purchase this month when considering U.S. Dollars. This is due to the continuous appreciation of the asset’s price since the previous buy.

As depicted in the following chart, Microstrategy’s Bitcoin holdings have increased to a total of 439,000 Bitcoins.

Based on the graph, it appears that the company’s purchasing activity during this current bull market surge is significantly more intense compared to its actions during the 2021 rally. Consequently, this recent buying frenzy represents the most substantial investment period the firm has engaged in thus far.

Over time, the company has invested a total of approximately 27.1 billion dollars to acquire Bitcoin. On average, these purchases were made at around $61,725 per Bitcoin. Given this, it appears that Michael Saylor’s strategy has been successful, as his company currently holds profits exceeding 72% at the current market price.

Meanwhile, in other updates, Bitcoin surpassing a fresh record high ($106,000 and above) has sparked interest as Glassnode, a renowned blockchain analytics firm, provides insights into the accumulation process that led to this milestone using its Cost Basis Distribution (CBD) tool.

The CBD, or Cumulative Buy Base, gives us information about where and at what prices previous transactions for a particular cryptocurrency occurred, as it records the amount of the currency’s supply that was last bought at various price levels based on either the last transaction price or Realized Price of each token in circulation.

It’s clear from the graph that Bitcoin investors were actively buying and selling around the prices between $96,000 and $100,000. The range of $97,000 to $98,000, in particular, attracted a significant number of transactions, with roughly 500,000 Bitcoins having their purchase price set within this area.

Trade action persists beyond $100,000, but thus far, substantial accumulation points (or “supply clusters”) among investors have not materialized. Particularly noteworthy is the scarcity of coins at levels above $103,000, where activity remains sparse.

BTC Price

Currently, as I’m typing this, Bitcoin stands at approximately $106,400, marking an increase of over 8% in the past week.

Read More

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- How to Reach 80,000M in Dead Rails

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- REPO: All Guns & How To Get Them

- Top 5 Swords in Kingdom Come Deliverance 2

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- LUNC PREDICTION. LUNC cryptocurrency

- All Balatro Cheats (Developer Debug Menu)

- BTC PREDICTION. BTC cryptocurrency

2024-12-17 09:11