As a seasoned researcher with a knack for deciphering market trends, I must admit that MicroStrategy’s Bitcoin strategy has been nothing short of captivating. My years spent analyzing stock markets have led me to observe numerous companies, but none have dared to be as bold as MicroStrategy in their approach towards cryptocurrencies.

MicroStrategy’s bold approach towards purchasing large amounts of Bitcoin has played a major role in pushing the company’s stock price to its highest point ever. Since the company consistently buys considerable amounts of this digital currency, the increasing value of Bitcoin directly advantages its shareholders.

There’s growing optimism among investors about MicroStrategy’s strategy to integrate Bitcoin into its financial holdings, as demonstrated by the impressive surge in the company’s stock price, particularly over the past year. It’s worth mentioning that following MicroStrategy’s purchase of Bitcoin, its stock prices started climbing significantly after remaining relatively stable for years.

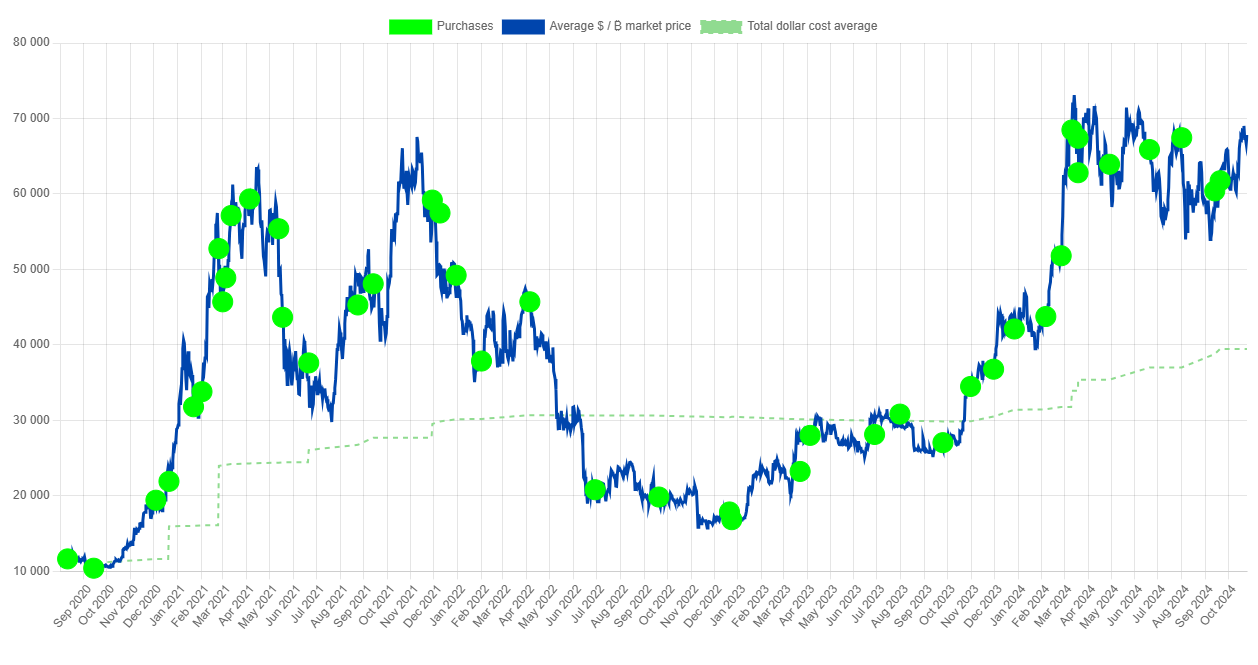

Once again, we see Bitcoin‘s value increasing and MicroStrategy benefiting from this trend due to its substantial holdings. Michael Saylor, CEO of MicroStrategy, has consistently bought Bitcoin and has repeatedly expressed the company’s dedication to it. According to the company’s portfolio tracker, MicroStrategy has purchased over $17 billion worth of Bitcoin at an average price of approximately $39,000 per coin.

Using Bitcoin, this investment strategy has yielded impressive results, boosting the portfolio by more than 72% at present, given that its current value surpasses $67,000. Evidence of this is seen in MicroStrategy’s acquisitions, including over 74,000 Bitcoins bought on September 20, 2024, for an average price of $61,750 per Bitcoin – a clear indication of the company’s aggressive buying pattern. The surge in the stock can be attributed to this well-thought-out decision.

Over the last several months, it’s evident that MicroStrategy’s Bitcoin holdings have been steadily increasing, as shown by portfolio data and on-chain information. This growth supports Michael Saylor’s long-held belief that Bitcoin functions as a reliable asset for storing value and serves as a protective measure against inflation.

In summary, MicroStrategy’s aggressive Bitcoin purchases have pushed their stock to a new peak record. As the value of Bitcoin remains steady or increases, it is likely that MicroStrategy’s stock will continue to climb, solidifying their role as a pioneer in corporate Bitcoin integration.

Read More

- FIS PREDICTION. FIS cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- LUNC PREDICTION. LUNC cryptocurrency

- EUR CAD PREDICTION

- Luma Island: All Mountain Offering Crystal Locations

- OSRS: Best Tasks to Block

- DCU: Who is Jason Momoa’s Lobo?

- XRP PREDICTION. XRP cryptocurrency

- How to Claim Entitlements In Freedom Wars Remastered

- Borderlands 4 Will Cut Back on ‘Toilet Humor’ Says Gearbox

2024-10-25 15:33