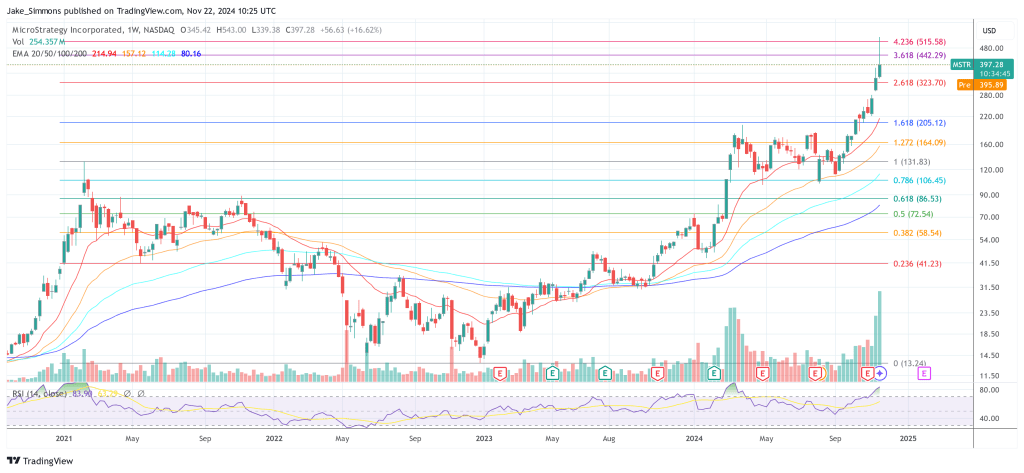

As a seasoned crypto investor with a knack for navigating the volatile world of digital assets, I find myself intrigued by the ongoing saga of MicroStrategy Inc. (MSTR). Yesterday’s steep decline, while unsettling, was not surprising given the unpredictable nature of the market. However, the stock’s drop occurred amidst Bitcoin’s surge to a new all-time high, which raises some eyebrows.

Yesterday saw a steep fall in MicroStrategy Inc.’s (MSTR) stock price, dropping more than 20% at its lowest point during the day’s trading, eventually ending with a decrease of 16.2%. This substantial drop took place even as Bitcoin (BTC) reached a fresh record high, flirting with the $100,000 mark. Despite this reversal, MSTR has still managed to climb an astounding 479% so far in 2021.

The decline in the stock’s price can be attributed to comments made by Andrew Left, founder of Citron Research, who raised doubts about MicroStrategy’s valuation compared to Bitcoin’s underlying value. In essence, Left suggested that the trading volume of MicroStrategy (MSTR) no longer reflects Bitcoin’s fundamental aspects due to the increased accessibility of Bitcoin investment through ETFs, COIN, and HOOD. Despite being optimistic about Bitcoin, Citron has taken a cautious stance by shorting MSTR. They hold great admiration for Michael Saylor, but even he should acknowledge that MicroStrategy is currently overvalued.

Is MicroStrategy Really Overvalued?

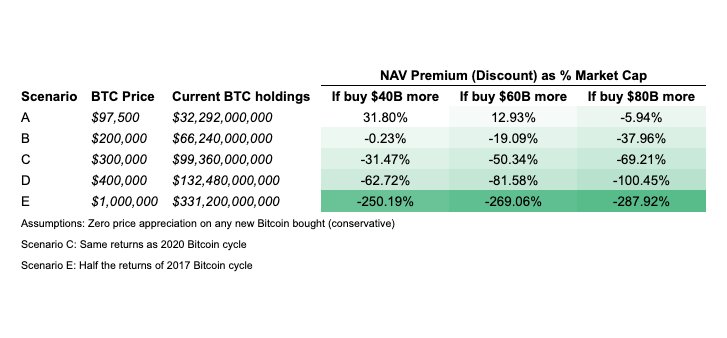

Instead of viewing MicroStrategy’s valuation pessimistically as some on the Left do, Charles Edwards, the founder and CEO of crypto hedge fund Capriole Investments, presented a strong argument supporting the company’s current market value. In an analysis he posted on X, Edwards contended that under specific circumstances, the firm’s market capitalization and surplus above its Bitcoin net asset value (NAV) can be considered reasonable.

According to Edwards, despite the widespread belief that MicroStrategy is overpriced, he believes otherwise. He posits that if the current Bitcoin market trend follows a pattern similar to the previous one, even under less favorable conditions, and if Saylor continues to actively purchase Bitcoin, then MicroStrategy has significant room for growth. Edwards further emphasized that for maximum potential, Saylor should increase his Bitcoin buying aggressively as the Net Asset Value (NAV) premium widens. He mentioned that the 21/21 plan is no longer enough, as the market has already factored it into MicroStrategy’s current valuation.

I recently underscored the magnitude of recent capital infusions, specifically pointing out how MicroStrategy managed to raise an impressive $9.6 billion in just nine days. Given Bitcoin’s potential market value surpassing the $2 trillion threshold, there exists a substantial cohort of bond traders who are currently barred from directly investing in Bitcoin due to their investment guidelines. As such, I posited that the U.S. bond market, valued at a staggering $50 trillion (over 25 times the size of Bitcoin), represents a vast untapped market for bond traders seeking exposure to Bitcoin. In this context, MicroStrategy serves as one of the few available avenues for these investors, as their bond offerings are consistently oversubscribed—an indication of the robust demand for MSTR stock.

In addressing doubts about his predictions, Edwards made clear that his calculations rely on particular hypotheses. Essentially, if MicroStrategy’s Saylor were to invest an additional $40 billion in Bitcoin, the price might be deemed “fair” over a short-term perspective under this assumption. However, he admitted that such a scenario would necessitate Saylor being more assertive than previously indicated in his Bitcoin purchases and emphasized that there are numerous potential risks involved.

Edwards advised investors to be mindful of the unpredictable fluctuations in MicroStrategy’s Net Asset Value (NAV) premium. He explained that the NAV premium for MSTR can vary significantly and rapidly, and it’s important to understand that it may not remain stable with Bitcoin. He emphasized that his analysis is meant for exploring various possible scenarios, but should not be used to forecast daily returns, particularly when considering speculative Bitcoin price predictions like $1 million.

As a crypto investor, I find myself drawn to MicroStrategy’s persistent Bitcoin acquisition strategy and its potential ripple effects on the market. Michael Saylor needs to be proactive in the coming year, securing substantial capital inflows. If he succeeds, there’s room for growth in MSTR equity. Regardless of the route taken, we have a significant Bitcoin purchaser on our hands, poised for an intense buying spree ahead.

At press time, MSTR traded at $395.89 pre-market.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- APU PREDICTION. APU cryptocurrency

- USD GEL PREDICTION

- JST PREDICTION. JST cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- GLMR PREDICTION. GLMR cryptocurrency

- EUR CAD PREDICTION

- OKB PREDICTION. OKB cryptocurrency

2024-11-23 01:41