As a seasoned investor with over two decades of experience under my belt, I have learned that timing the market is more of an art than a science. Even institutional heavyweights like MicroStrategy can make missteps, as their recent Bitcoin purchase demonstrates.

Among the highly recognized institutional investors dealing with Bitcoin, MicroStrategy stands out. However, predicting market trends remains challenging, even for experienced investors. This is evident in their latest Bitcoin acquisition, which, at present, appears to be a loss.

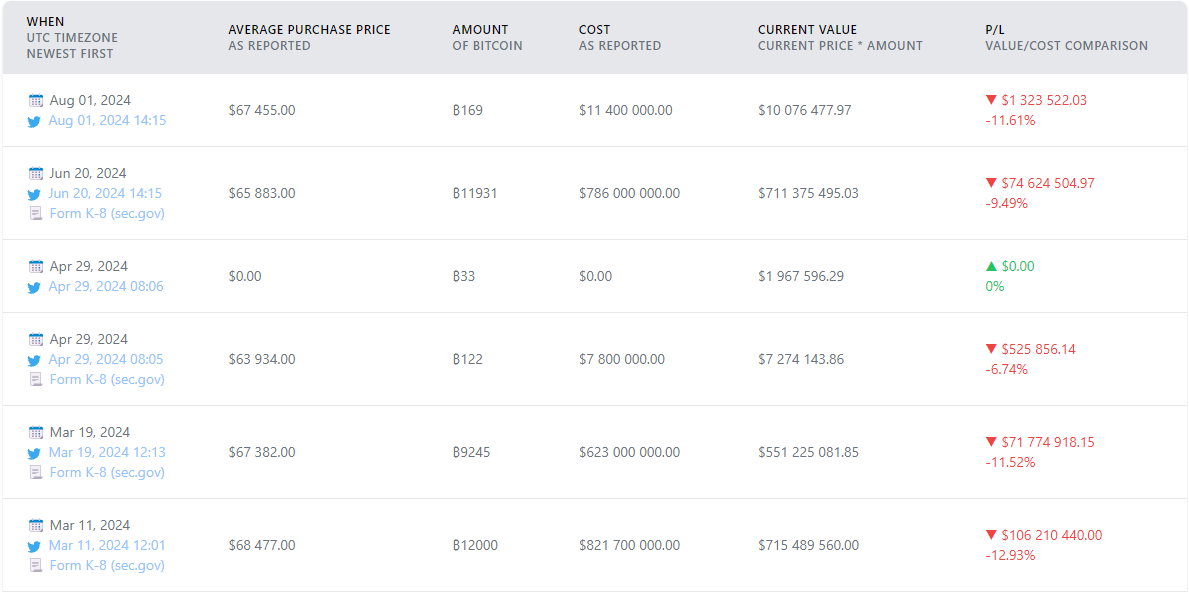

Currently, MicroStrategy purchased 8,169 Bitcoins in August 2024 for an average price of $67,455 per Bitcoin, which is now showing a loss of approximately $1.3 million. This represents an 11.61% decrease in value. Although MicroStrategy’s Bitcoin holdings usually generate profits over time, this recent underperformance deserves attention since the company has historically earned around a 61.45% return or $5.1 billion and owns more than 811,000 BTC in total.

Still, even for institutional investors with long-term investment horizons, the recent purchase underscores the volatility and risks involved with Bitcoin. The price of Bitcoin has been erratic lately. Bitcoin is currently trading at about $59,738 on the given chart, which is slightly less than the crucial $60,000 threshold.

By March 2024, the value of this asset has been trending downwards in a descending channel and is currently near the lower limit of this pattern. For long-term investors, it’s significant to note that the price is struggling to stay above the 200-day moving average, which serves as a key level of resistance.

During this time, Bitcoin’s behavior could be uncertain, as it might oscillate between trying to reach greater heights or dipping below its downward trend, depending on market opinions and external factors such as economic trends worldwide.

High levels of Bitcoin accumulation come with their own set of risks, as demonstrated by MicroStrategy’s latest Bitcoin purchase showing underperformance. Yet, the company has a well-thought-out long-term strategy and has reaped substantial benefits in the past. This recent dip is merely a temporary hurdle that MicroStrategy can manage without any trouble, thanks to its ample liquidity reserves.

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- LBT PREDICTION. LBT cryptocurrency

- GAMMA PREDICTION. GAMMA cryptocurrency

- Best Turn-Based Dungeon-Crawlers

2024-08-29 15:54