As a seasoned investor with over two decades of experience under my belt, I’ve seen my fair share of market fluctuations and trends. Jim Cramer’s recent commentary on the interplay between cryptocurrency, China, and global financial markets has piqued my interest.

CNBC host and TV expert Jim Cramer has released a new commentary on the financial markets, with a special focus on cryptocurrency and China.

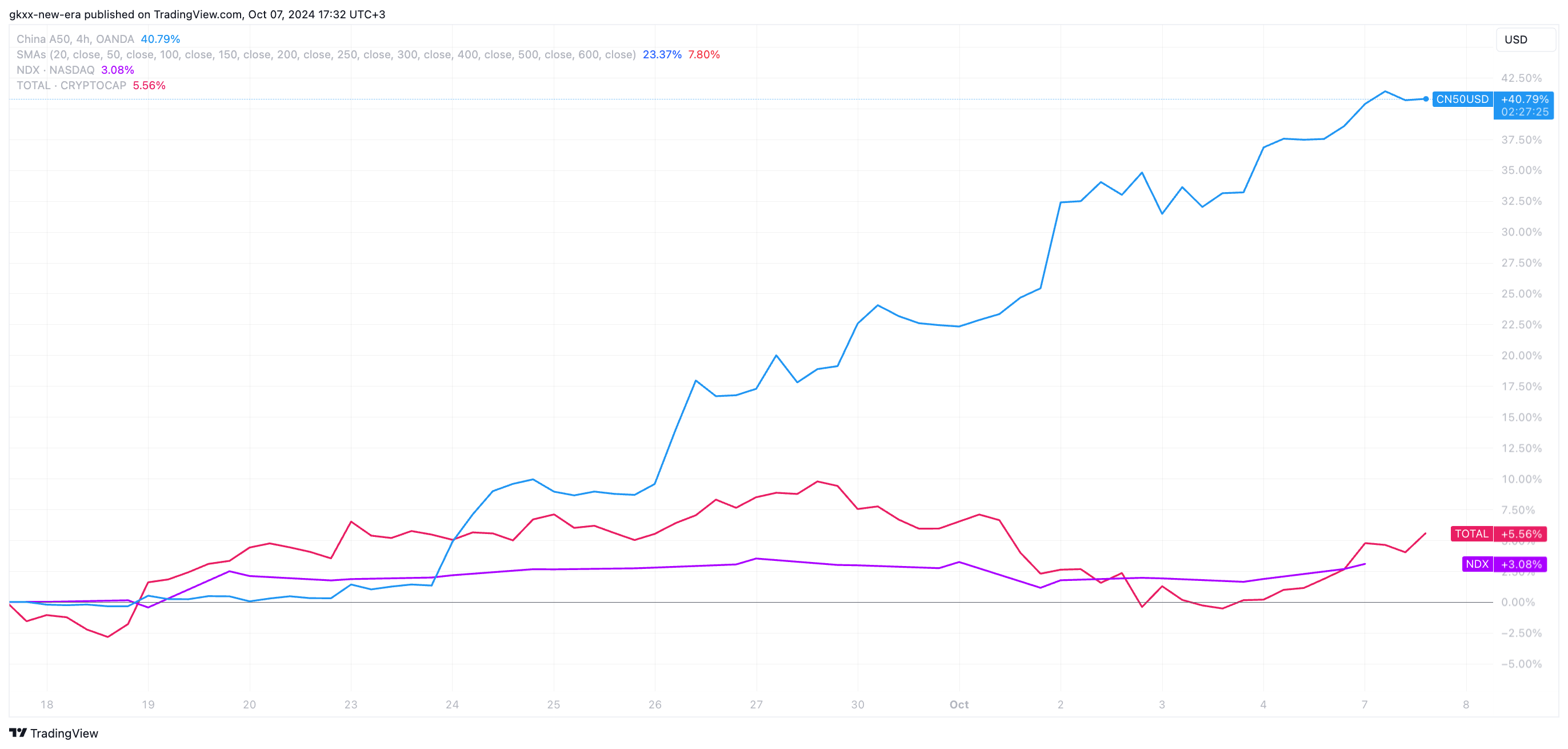

It’s common knowledge that Chinese stocks have experienced an unprecedented surge in the past few days following the People’s Bank of China’s decision to loosen monetary policy and reduce interest rates. This action sparked an immediate response, as illustrated by the China A50 index, a significant benchmark for the Chinese stock market, which has surged more than 41% since September 18.

Such an epic anomaly would not have gone unnoticed, and many pundits began analyzing and projecting how such a turnaround would further impact the global financial markets. This is when Cramer weighed in with a rather bold statement.

In-n-out, but it is crypto and stocks

In my analysis, the host of Mad Money asserted that just as China appears to be drawing out capital, presumably of a speculative kind, from the technology sector and directing it towards China, an equally significant influx of speculative capital seems to be moving from the cryptocurrency market into China.

The hot money out of tech into China is rivaled only by the hot money out of crypto into China

— Jim Cramer (@jimcramer) October 6, 2024

Essentially, Cramer implies that China is quickly emerging as a prime destination for both traders and investors. Previously focused on tech stocks and cryptocurrencies, many are expected to divert their investments towards China.

While such a correlation is something to look into, the argument can be made that crypto and NASDAQ as the main index for tech stocks are still on the rise since mid-September.

It seems that the rate at which money is flowing into these markets might have decreased slightly, given the increased interest in the Chinese fund market. However, it’s worth noting that the crypto market and U.S. tech stocks managed to grow by 8.67% and 3.08%, respectively.

Read More

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- PlayStation and Capcom Checked Another Big Item Off Players’ Wish Lists

- EUR CAD PREDICTION

- XDC PREDICTION. XDC cryptocurrency

- EUR INR PREDICTION

- Black Ops 6 Zombies Actors Quit Over Lack Of AI Protection, It’s Claimed

- CTXC PREDICTION. CTXC cryptocurrency

- APU PREDICTION. APU cryptocurrency

- POL PREDICTION. POL cryptocurrency

2024-10-07 18:35