So, Movement Network (MOVE) is making headlines again. Big surprise. 🙄 They announced a $38 million buyback because, apparently, a Binance market maker was up to no good. Classic. Despite the drama, MOVE is still up over 13% in the last week. Not bad, but let’s not throw a parade just yet.

Key indicators like RSI and DMI are hinting that the bullish momentum is cooling off. But hey, depending on how the market feels, a new trend could still pop up. Because, you know, the market is as predictable as my ex’s mood swings.

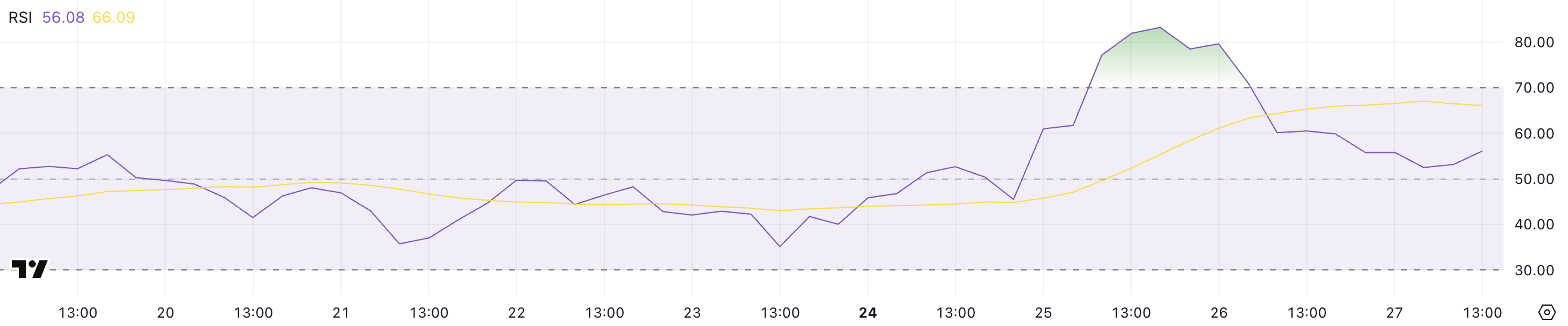

Is MOVE Overbought? Let’s Ask the RSI

MOVE’s Relative Strength Index (RSI) is currently at 56, down from 83 just two days ago. That spike happened after the company announced the buyback. The RSI measures price movements on a scale from 0 to 100. Above 70? Overbought. Below 30? Oversold. Between 30 and 70? Neutral. So, 56 is like the Goldilocks zone—just right, but leaning slightly bullish. 🐻📈

Before the recent surge, MOVE’s RSI was chilling in the neutral zone for 23 days straight. Talk about a snooze fest. The spike pushed it into overbought territory, but now it’s back to 56. So, the extreme bullish momentum is cooling off. But hey, there’s still room to push higher without being technically overbought. 🚀

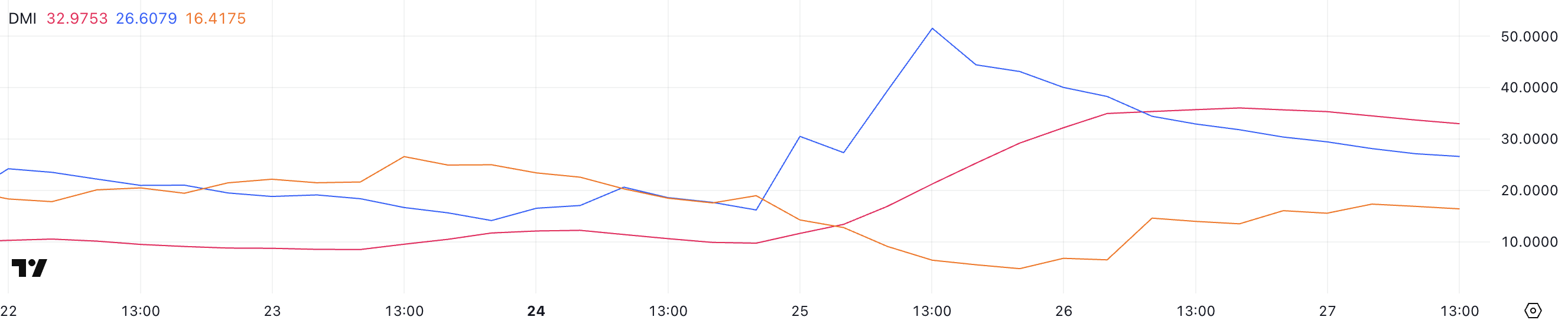

DMI: Buyers Might Be Losing Their Grip

MOVE’s DMI chart shows that its Average Directional Index (ADX) is at 32.97, holding steady since yesterday. The ADX measures trend strength on a scale from 0 to 100. Below 20? Weak trend. Between 20 and 25? Trend might be forming. Above 25? Strong trend. So, 32.97? That’s a solid trend. But wait, there’s more. The +DI (Positive Directional Indicator) is at 26.6, down from 51 two days ago. The -DI (Negative Directional Indicator) is at 16.41, up from 6.43. So, bullish momentum is cooling off, and bearish pressure is creeping in. 🐂➡️🐻

This means the trend might be weakening or transitioning. So, MOVE could enter a period of consolidation or face a pullback unless new buying pressure shows up. Because, you know, the market loves a good plot twist. 🎭

Will MOVE Drop Below $0.40 in April? Let’s Speculate

After a sharp 30% price surge on March 25, MOVE is now in a corrective phase. It’s trading 11% below its recent peak. This kind of pullback is normal after such a move. Traders take profits, momentum cools off, and everyone takes a breather. The ongoing correction is focusing on key support levels—$0.479 is the first. If that fails, MOVE could drop to $0.433, $0.409, or even $0.37 if bearish momentum continues into April. 📉

But if sentiment around MOVE improves, the pullback could be short-lived. A rebound could see MOVE retest the resistance at $0.539. A successful breakout above that could open the path to $0.55 and even $0.60. So, will MOVE drop below $0.40 in April? Maybe. Maybe not. The market is as predictable as a coin flip. 🤷♂️

Read More

- Devil May Cry Netflix: Season 1 Episodes Ranked

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Jujutsu Kaisen Shocker: The Real Reason Gojo Fell to Sukuna Revealed by Gege Akutami!

- You’re Going to Lose It When You See the Next Love and Deepspace Banner!

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nine Sols: 6 Best Jin Farming Methods

- How to Reach 80,000M in Dead Rails

- Get Ready for ‘Displacement’: The Brutal New Horror Game That Will Haunt Your Dreams!

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- How to Get the Cataclysm Armor & Weapons in Oblivion Remastered Deluxe Edition

2025-03-28 00:41